The Opposite of Pump Priming?

During an economic slowdown, the government often employs fiscal stimulus to “prime the pump.” In such cases a burst in aggregate demand boosts income, which adds to consumer spending, which adds to income, and so on. This process can work in reverse. A shock to aggregate demand hits income, which reduces consumer spending, further reducing income, and so on. The self-inflicted wounds of misguided trade policy and the impasse on the federal budget could lead to broader economic weakness, but it depends on how long they last.

The near-term economic outlook remains positive, based largely on robust expectations for consumer spending growth (which accounts for 68% of Gross Domestic Product). Strong job growth and a pickup in wage growth should have boosted personal income into the new year (we won’t get December personal income and spending data due to the government shutdown, but we can get a good idea from the December Employment Report). Lower gasoline prices have added to consumer purchasing power (inflation-adjusted wage growth has improved). Confidence should remain relatively high by historical standards, although below peak, reflecting the negative press on the economy and Washington.

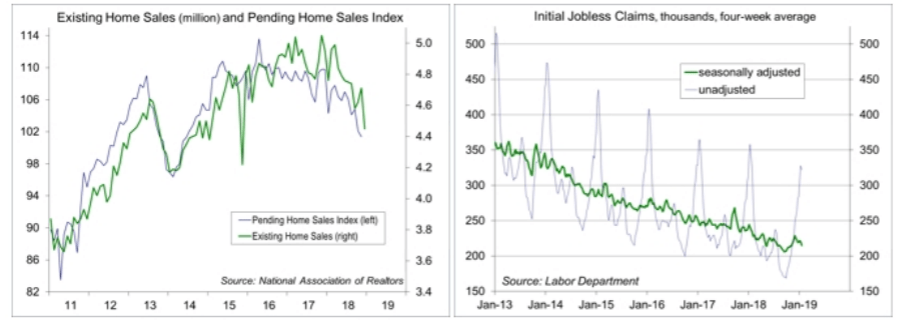

Residential fixed investment accounts for a little less than 4% of GDP, but the housing sector is often seen as the canary in the coal mine, weakening as the economy enters a recession. However, the recent softening in home sales doesn’t appear to be due to weak demand for housing. Job growth and wage gains are supportive. The National Association of Realtors has noted a high degree of sensitivity to mortgage rates, which peaked in mid-November (Freddie Mac 30-year commitment rate at 4.94%). Rates have since decreased (4.45% more recently), which should help, although the bigger test for the housing market comes in the spring. The one missing element of the housing recovery has been a rebound at the low end. Higher construction costs have decreased incentives for firms to build starter homes and price increases have reduced affordability. There is a growing mismatch between demand at the low end and the supply of homes for sale at the high end.

Business fixed investment made up 13.6% of nominal GDP in 3Q18, but this accounts for most of the swing in the business cycle. Less than half of that (6.0% of GDP) is equipment. The rest is structures (including energy extraction) and intellectual property products. Much of the strength in business investment in the last two years has reflected the rebound in oil and gas well drilling. The tax cut doesn’t appear to have significantly boosted spending on equipment – most has gone to share buybacks and increases in dividends. Moreover, the global economic slowdown and trade policy uncertainty have been negative factors. The Conference Board’s CEO Confidence Index fell to 42 in 4Q18, down from 55 in 3Q18.

Last week, the partial government shutdown generated two newsworthy themes. One is that the economic impact was growing more widespread, creating hardships for federal employees, government contractors, and their families. There has been an increased negative effect on a variety of routine government functions, including mortgage approval, tax return processing, and air-traffic control (which in turn, led airports to restrict flights). The second major theme was a demonstrated lack of understanding from White House officials, who suggested that federal employees simply work it out with their grocery store or borrow money from a bank. Kevin Hassett, Chair of the President’s Council of Economic Advisors, said that the shutdown would likely reduce 1Q19 GDP growth to 0% if it lasts through March. The Senate had sat out most of January, only voting on bills to end the shutdown on Thursday (and failing).

Kicking the can down the road should have been simple, and leaders finally appeared to come to their senses on Friday. We now have an agreement to fund the government through February 15. That will reduce the near-term damage of the shutdown. It doesn’t eliminate the uncertainty, but the White House will be less inclined to force another shutdown.

Meanwhile, we’re still looking at a mixed economic outlook. Most likely, consumer spending will carry us through, but there is some potential for a more substantial weakening in business investment. In the 2001 recession, consumer spending continued to advance, but a decline in business fixed investment pulled the overall economy down. However, that followed the dot-com bubble, where there was a clear misallocation of capital. That’s probably not the case currently.

Data Recap – The economic calendar was thin, especially as the partial government shutdown led to the postponement of December reports on durable goods orders and new home sales. Investor sentiment continued to bounce between fear and hope. The week began with continued concerns about the global economy (following reports of slower GDP growth in China and a less optimistic IMF), but ended with optimism on a deal to temporarily end the government shutdown (which comes amid reports of more widespread economic disruptions due to the impasse).

In its updated World Economic Outlook, the IMF reported that “the global expansion has weakened.” Global growth is expected at 3.7% for 2018 (vs. 3.8% in 2017), slowing to 3.5% in 2019. The outlook had already been revised lower in October (when 2019 growth was expected to be 3.7%, vs. a forecast of 3.9% in July). The IMF also cautioned that “risks to global growth tilt to the downside,” citing an escalation of trade tensions beyond those already incorporated in the forecast. A no-deal Brexit and a more pronounced slowing in Chinese growth were listed as potential triggers that “could spark a further deterioration in risks sentiment with adverse growth implications,” especially given the high levels of public and private debt.

The Conference Board’s Index of Leading Economic Indicators slipped 0.1% in December, down in two of the last three months. Positive contributions were led by jobless claims, the credit index, the yield curve (still positively sloped – 10-year Treasury note yield to federal funds), and consumer expectations. The stock market made a large negative contribution (barring a sharp drop in the next week, stocks will add to the January LEI). ISM new orders also subtracted. The Index of Coincident Economic Indicators rose modestly (note that two of the four components are estimated). The government shutdown resulted in the absence of some components (manufacturers’ new orders, building permits) and delayed annual benchmark revisions.

Existing Home Sales fell 6.4% in December, to a 4.99 million seasonally adjusted annual rate (-10.3% y/y). Unadjusted sales for 4Q18 were down 6.2% y/y (Northeast -3.4%, Midwest -4.3%, South -4.6%, West -12.8%). The number of home sales was up 6.2% from a year ago. The National Association of Realtors indicate that sales are very sensitive to mortgage rates. Increased inventories ought to lead to slower price appreciation, but the NAR noted a mismatch between “a lack of adequate inventory on the lower-priced points and too many in upper-priced points.”

Jobless Claims fell to 199,000 in the week ending January 19, the lowest since November 15, 1969. The four-week average was 215,000. Seasonal adjustment is large at the start of the year, so one should look at these figures somewhat skeptically. However, they are consistent with the anecdotal evidence suggesting a tight labor market. The “regular” total does not include claims from federal workers, which are reported with a lag (+25,419 in the week ending January 12, vs. 10,454 in the week ending January 5 and 1,658 a year ago). Note that jobless claims are a leading economic indicator.

This Week – The government shutdown means that we will miss the reports on 4Q18 GDP and December personal income/spending (and the PCE Price Index). The employment report will still be released. The partial government shutdown may have some impact, but there is also a huge amount of seasonal adjustment in January (we can expect to lose about 3 million jobs before adjustment, reflecting the end of the holiday shopping season) and annual benchmark revisions are due (although expected to be small). Normally, when released on the same day, the ISM manufacturing survey results get lost in the shadow of the jobs report, but this time ought to be different. The ISM figure fell sharply (from a very strong level) in December and market participants will likely be sensitive to a large move. Consumers don’t spend confidence, which typically peaks before a recession, but the Conference Board’s figure should remain supported by job market perceptions. The payroll survey covers the week of January 6-12. Furloughed federal employees who worked, but were not paid, are counted as employed. Furloughed employees who did not work at all that week are not included in the payroll count. The average weekly hours and average hourly earnings figures cover the private sector, but may pick up secondary effects of the shutdown.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.