Two Weeks in June, 1944

After my father, a Pearl Harbor survivor, died in 2011, we found a shoebox. It contained items that belonged to my Uncle Bill (my mother’s brother), who had also served in WWII. There was Bill’s birth certificate and baptism record, an address book, and some pages that looked like they were torn out of a diary. From the address book, we learned that Bill had served on the U.S.S. Carmick (DD-493) and saw action in the Atlantic and the Pacific. It’s unclear whether Bill wrote the pages. The following is what was written (G.Q. is General Quarters or “battle stations”):

June 1 – Well, we got off easy last night. No alarm. We found out the reason this a.m. Plymouth was bombed. They say we can expect it tonight. It’s a perfect night out for a raid, so that ought to raise our chances of getting it. The time is now 12:30 coming. We shall see.

June 2 – Another peaceful night last night – another drawn out day waiting. Everyone is starting to tire of this. Just hanging around. I know I’ve had my fill. From the looks of things I should say the invasion is in the near future.

June 3 – We left Weymouth and went on sub patrol in the channel – out all day. Coming in tomorrow night.

June 4 – Entered port this p.m. and fueled up. Leaving tomorrow – this is what we have been waiting for. I have seen some sites since I left the States, but the fleet of landing barges, L.S.T.s, etc. that have passed us and are still passing is something I’ve never witnessed before. You can’t count them all.

June 5 – This is the Day. We got underway at exactly 11:05 a.m. and started. We are with two other destroyers and quite a few minesweepers. We are going first and clear the way for the rest.

June 6 – Early this a.m. about one or two. We neared our destination. Bombers have been coming and going overhead all night. The horizon of France seems to be all lit up. I can even see the bomb burst and the Germans . fire. The sky is full of tracers. We went in about 5:45 a.m. and started to do our job. From what the captain said to us before we left, we have certain targets on the beach to knock out. They happen to be shore batteries. They fired at us first with 6 inch guns. We had a couple of close ones, but from all reports we done our job well. We fired all day long. from our main battery. That’s a lot of shooting. Through the gun site you can see everything. I saw prisoners coming down the hill with their hands in the air. I saw landing ships hit by shells and saw some of our tanks on fire on the beach. The beach was covered with bodies. It was a site I shall never forget. The sea was full of landing craft. bout 5 miles out battleships and cruisers pounded the beach all day and night. We had no opposition from enemy aircraft.

June 7 – We remained around at G.Q. all day and left in the evening. We finally secured from G.Q. after 36 hours straight. tired. Upon entering the port of Plymouth England, they started to load ammunition and take on fuel and food. s soon as we were loaded we left for France again.

June 8 – Wespentthebiggestpartofthenightatseacomingback. Flankspeedalltheway. Wehungaroundatanchorwithnothingexcitinghappening.

June 9 – We went to G.Q. around 9:00 p.m. yesterday and was still at it until 6 a.m. today. There was an E-boat attack and some planes came over. One German plane went right over the ship but no bombs were dropped on us, although the beach took a heavy pounding. We saw five planes go down in flames from

June 10 – This is the day we have all been waiting for. We went to G.Q. yesterday night about 9 p.m. again. This time the enemy planes were pretty thick. We got a sub contact and dropped a couple of charges. Nothing happened – lost contact. The beach took another heavy pounding and we saw six planes go down this night. Then they announce we had a bomber coming in on us. We fired two shells – one from gun 2 – which missed and one from gun 1 which hit him right on the nose. He caught fire instantly, circled the ship in flames and crashed right off our fantail. Two men could be seen getting out. We picked up part of the wreckage, but one of the men drowned and the other was picked up by a P.C. boat which was in the area. The man was brought aboard our ship a few hours later. He could talk very good English and after coming out of conference with the officers, before he went back to the P.C. he was talking to some of the fellows. His name was Rosenbloom (sounded kind of Jewish for a German). Came from Hamburg, Germany. Said he was 26 years old and was married with six children. He also said he had relatives in Chicago. He was rear gunner of the plane which was by the way a Heinkel 177. He didn’t like the English. He said he was glad he was picked up by the he was OK. The plane carried a full crew of seven. He was the only one alive.

June 11 – Went to G.Q. again yesterday evening and remained there till early this a.m. Enemy planes and E-boats were in the area, but we were not attacked. Time now 5:00 p.m. and we are heading for England for minor repairs.

June 12 – rrived in Plymouth this a.m. and started work.

June 13 – Still in the navy yard.

June 14 – Left the yard to go back to France about 12:45 p.m. Was back in France in about eight hours flank speed all the way. next a.m.

June 15 – Just hung around all day going to G.Q. again tonight and every night that we are over here. June 16 – Was at G.Q. all night again saw the shore take a beating as it always does and a lot of fire. June 17 –- Same story as before. This G.Q. is one big strain.

Bill had stayed with us briefly when I was growing up. I wasn’t aware of it at the time, but I suspect he had difficulties adjusting when he came back – problems with alcohol. As with most men who served in WWII, he was proud to have served, but like my dad, he never talked about it.

Data Recap – Once again, trade tensions dominated, overshadowing the economic data reports. Consumer confidence remained elevated in May, but it also appears the surveys failed to capture the full impact of tariffs. The GDP picture for 1Q19 was little changed. April personal income and spending figures suggested a moderate trend for growth in the near term. Stocks fell and yields on long-term Treasuries tumbled.

Trump’s Trade War continued to expand beyond simple tit-for-tat tariffs. China threatened to restrict access to rare earth minerals (which are used in the production of technology goods, and China controls about 80% of the global market). Trump tweeted that he would impose a 5% tariff on goods from Mexico, beginning on June 10, rising 5% per month until Mexico works to reduce illegal border crossings.

Fed Vice-Chair Clarida said that “the economy is in a very good place.” However, “if the incoming data were to show a persistent shortfall in inflation below our 2 percent objective or were it to indicate that global economic and financial developments present a material downside risk to our baseline outlook, then these are developments that the Committee would take into account in assessing the appropriate stance for monetary policy.”

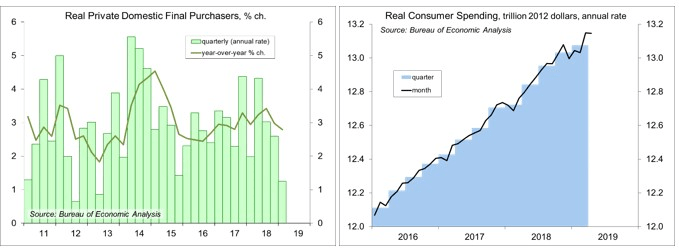

Real GDP rose at a 3.1% annual rate in the 2nd estimate from 1Q19 (+3.2% y/y), vs. 3.2% in the advance estimate. The story remained the same. Faster inventory growth added 0.6 percentage point to the headline growth figure, while net exports (a narrower trade deficit) added 1.0 percentage point. Real Private Domestic Final Purchases, the preferred measure of underling domestic demand, rose at a 1.3% annual rate, same as in the advance estimate. Consumer spending rose at a 1.3% pace (vs. +1.2% in the advance estimate), while business fixed investment rose 2.3% (vs. 2.7%). Corporate profits fell by $65.4 billion (-2.8%), up 3.1% from a year earlier. Profits for domestic nonfinancial corporations fell $62.1 billion (-4.4%), up 7.0% from 1Q18.

Personal Income rose 0.5% (+3.9% y/y) in April, although previous levels were revised down. Wage and salary income rose 0.3% (+3.6% y/y). Personal Spending rose 0.3% (+4.3% y/y), partly reflecting higher gasoline prices. Adjusted for inflation, consumer spending was flat (+2.7% y/ y). The PCE Price Index rose 0.3% (+1.5% y/y), up 0.2% ex-food & energy (+1.6% y/y, reflecting pickups in transportation services and financial services.

The Conference Board’s Consumer Confidence Index rose to 134.1 in the initial estimate for May, vs. 129.1 in April. Evaluations of current job availability strengthened further. However, as the timing of the report focuses on the first half of the month (the cut-off date was May 16), the survey likely failed to fully capture the impact of the May 10 increase in tariffs.

The University of Michigan’s Consumer Sentiment Index rose to 100.0 in May, vs. 97.2 in April, but down from 102.4 at mid-month. The report noted a late-month decline reflecting “unfavorable references to tariffs.” Buying conditions for appliances and other large household durables fell to the lowest level in four years. “Consumers now judge economic security more important than a faster pace of growth in their personal incomes or household wealth.”

The Chicago Business Barometer rose to 54.2 in May, vs. 52.6 in April, but the report cautioned “despite the pick-up in sentiment, the survey points to softness in business activity.” The three-month average hit a two-year low. Orders picked up, but not enough to offset the drop in April. Order backlogs declined, a poor sign. Demand for labor weakened.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.