Weekly Headings

While the MSCI China Index has been the best performing country index year-to-date (YTD) (+23%), concerns that the rally in emerging market (EM) equities may be over is premature. First, YTD, broader EM (+14.0%) and Asia EM (+15.3%) have underperformed the S&P 500 (+16.4%)*. Second, over the last year, China, EM Asia, and EM broadly have underperformed the S&P 500 by 10%, 11% and 13%, respectively. As a result, there still appears to be some catch-up ability on behalf of EM equities. Emerging markets, particularly in Asia, remain one of our favored regions for several reasons including:

- Improving Macro Environment | With the U.S. economy growing above trend, the environment for risk assets should remain healthy. U.S. growth is important to China as the U.S. accounts for ~19% of China’s exports, outpacing exports to Europe (~17%) and the rest of the emerging Asian economies (~13%). In addition, China’s growth appears to be stabilizing from coordinated fiscal and monetary policy stimulus. The implementation of an April Value Added Tax (VAT) cut lowered the VAT in manufacturing from 16% to 13% and in transportation and construction from 10% to 9%. Monetarily, the People’s Bank of China (PBoC) is expected to cut the reserve requirements for banks three additional times this year, adding more capital creation to the system. This week’s better-than-expected 1Q19 GDP (+6.4%), retail sales, and industrial production figures suggest that these policy moves are gaining traction.

- Stabilization of the U.S. Dollar | EM currencies, in aggregate, have rebounded ~4.5% from their September 2018 lows but remain 4.5% from their record highs. With the Federal Reserve (Fed) likely on hold for the rest of the year, inflation remaining muted globally, and EM economies showing signs of improvement, EM currencies should slowly grind higher. Stable or appreciating currencies are a positive for EM equities as they have strong positive correlation.

- Budding Fund Flows | Starting this month, China’s yuan-denominated bonds are being added to the Bloomberg Barclays Global Aggregate Index. As a result, a total of 356 government and policy bank bonds (~$3.3 trillion) will be added to the index over the next 20 months, taking the exposure of Chinese bonds up to ~6% of the index after full inclusion. Similarly, major equity indices like MSCI and FTSE are increasing their weighting to Chinese equities significantly this year. Increased weightings in both fixed income and equity indices will drive cash flows into the Chinese markets, especially from passive index investors.

- Favorable Sector Composition | The three largest sectors within the MSCI EM Index should benefit from our expectations. Tech, our favorite global sector, represents more than 25% of the index. Financials should benefit from the lowering of required reserves and potentially lower interest rates. Consumer discretionary should benefit from the wealth creation driven by the expanding middle class.

- Trade Truce | We believe the U.S. and China will complete a trade deal in the next few weeks. Treasury Secretary Mnuchin remains optimistic, U.S. Trade Representative Lighthizer is under pressure to get a deal done, and President Trump is in re-election mode and wants no further trade-induced harm to the U.S. economy (or the equity markets). Final issues to resolve revolve around existing tariffs (whether the recent tariffs will get reversed), enforcement of the deal including intellectual property, and China’s currency management.

Economy

- The Fed’s Beige Book noted “slight-to-moderate” growth in most Fed districts, with some strengthening and that firms continued to exhibit mixed success in passing higher costs along. Similar to our economic growth and inflation outlook, these dynamics are consistent with the Fed keeping short-term rates on hold for the foreseeable future.

- After declining for two of the last three months, retail sales rebounded in March and posted the largest monthly gain (+1.6% MoM) since September 2017. Given elevated consumer confidence and tightening in the labor market, the strength in retail sales is consistent with a seasonal rebound in consumer spending in the spring/summer months.

- Jobless claims (+192k) declined for the sixth consecutive month to the lowest level since 1969. As jobless claims historically bottom ~15 months on average prior to the next recession, this suggests little U.S. recessionary risk.

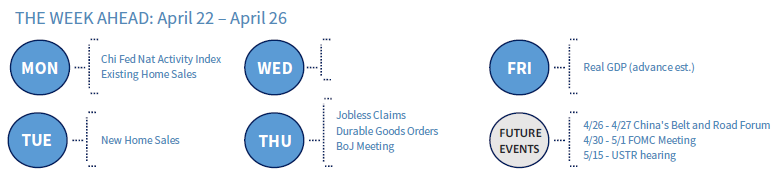

- Focus of the Week: With few major economic releases next week, the focus will be on Friday’s GDP report. Given the recent string of positive economic data, GDP is likely to come in above the consensus estimate of 1.6%. We expect this momentum to carry into 2Q and see little risk of recession over the next 12 months.

U.S. Equities

- While intermediate-term trends remain supportive, we believe the market is extended in the short term and would not be surprised to see some consolidation. Key levels of technical support include 2,812 (50 Day Moving Average) (DMA) and 2,766 (200 DMA). If the market incurs a short-term pullback, use it opportunistically to accumulate favored sectors and stocks.

- Focus of the Week: Over 35% of S&P 500 market cap reports earnings next week including Microsoft, Amazon, Facebook, Visa, Exxon Mobil, Procter & Gamble, Intel, Verizon and Boeing.

Fixed Income

- Next week, there is not any specific economic data which will potentially move the bond market with the possible outlier being the core Personal Consumption Expenditures Index (PCE) on Friday. However, our anticipation is that inflation remains subdued and the week is likely to see little volatility and a very tight trading range.

- Focus of the Week: Central banks remain in focus. Investor anticipation will be looking forward to May’s FOMC meeting and any critical changes in tone which is likely to help keep investors cautious and quiet next week. Two other central banks (PBoC and Bank of Japan on Thursday) have monetary policy decisions which could be impactful should there be a surprise change in their current accommodative stance.

International

- The recent stabilization in Chinese economic activity continued as 1Q19 GDP came in better than expected at +6.4% year-over-year (YoY) (vs. +6.3% YoY expected) and industrial output rose at the fastest pace (+8.5% YoY) in five years.

- Euro zone economic data continues to reflect slowing economic momentum in the region as the preliminary reading of Manufacturing Purchasing Managers’ Index (PMI) (47.8) remained in contraction territory for the third consecutive month.

- Focus of the Week: The incumbent centre-left government might face a backlash during Spain’s general election on April 28 from more patriotic political parties concerned that they are progressively shifting to a policy granting greater autonomy to regions such as Catalonia. This political build-up might spark separatist feelings.

Energy

- The energy industry’s capital spending recovery is slowing sharply after 15% growth last year. In 2018, initial budgets point to an increase of only 5% this year. Across the board, 2019 shows greater caution by management teams than the previous two years. This reflects a reaction to the year end 2018 oil sell-off, as well as the broader paradigm of growing shareholder pressure for capital discipline.

- Focus of the week: Watch energy company earnings over the next few weeks such as Haliburton (Mon) and Exxon Mobil and Chevron (Fri) for their capex guidance. Capital discipline, despite the recent rally in oil prices, is a positive for oil in 2020 and beyond, since a more disciplined approach to capital allocation will ultimately boost stability for what has historically been a textbook “boom and bust” industry. Our year-end target remains $70/barrel.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.