Weekly Headings

Key Takeaways

- Like Batman, investors cannot resort to superhuman powers when investing. Instead, knowledge, analytical skills and ingenuity are paramount for success.

- Asset allocation, diversification and risk management are essential dynamics to consider as volatility moves higher.

“I’m Batman!” Well, not really, but on the thirty-year anniversary of the re-birth of this superhero on the big screen (Batman played by Michael Keaton), I am reminded that investors should have a little Batman in them.

No Superhuman Powers Needed. Batman was unlike any other superhero in that he did not have any superhuman powers. He was not the strongest (Superman), the fastest (The Flash), and did not have an early warning “Spidey Sense.” Instead, he used his knowledge, analytical skills and ingenuity to solve problems and keep Gotham City safe. Batman’s attributes are similar to those of successful investors:

Knowledge, or a keen awareness of history, can help investors gain an edge. Our expectation is that a proactive Federal Reserve (Fed) will make two insurance cuts this year (in July and October), which will likely extend this current longest expansion in the history of the U.S. for at least the next twelve months, if not longer. Upon studying other time periods when the Fed orchestrated insurance cuts (1984, 1987, 1995 and 1998), the result was positive for economic growth (i.e., no recession). These insurance cuts provided a positive backdrop for equities, and interest rates rose slightly. This is consistent with our outlook going forward.

Analytical Skills in the form of fundamental and technical analysis provides insights. As an example, current valuations for the S&P 500 make us cautious on the equity market until we see a pullback or an acceleration in earnings growth. In fact, last week, with equity markets at all-time highs and near our year-end S&P 500 target (2946), we cautioned against inflated optimism as the market was priced to perfection regarding progress with a China trade deal and expectations of multiple future Fed rate cuts. With the potential for underwhelming progress (likely, just a near-term ceasefire) at the upcoming G20 meeting and the possibility for the Fed not being quite as aggressive as the market was expecting (three cuts this year), we offered a more cautious tone on the market. Additionally, technical indicators (RSI, moving averages, breadth, sentiment indicators, etc.) that helped us identify buying opportunities in late April had turned more cautious, affirming our view.

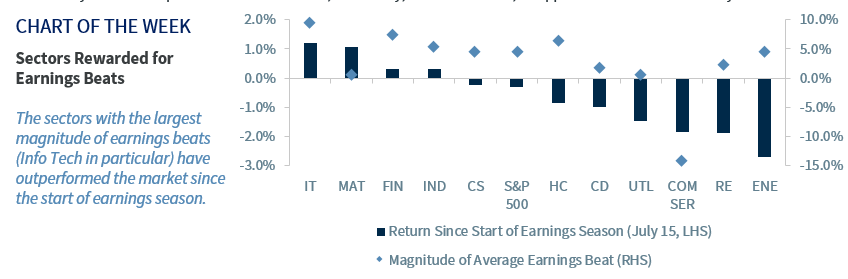

Ingenuity in the form of selectivity is critical given elevated valuations in both the equity and fixed income markets. With earnings growth expected to be at a premium, we favor cyclical sectors such as Technology, Consumer Discretionary and Communication Services. Our favorite defensive sector is Health Care, where we believe the political cloud of “Medicare for All” (unlikely to pass according to Ed Mills, our Washington Policy Analyst) has weighed on the sector. From a capitalization perspective, we favor large cap over small cap. In the fixed income asset class, we favor investment grade over high yield, as the potential for a modest uptick in corporate defaults will hamper the high-yield space.

Training, Planning and Risk-Taking. Batman never used a gun because of the gut-wrenching memories he had of his parents being shot. Instead, to protect himself and fight the forces of evil, he enhanced his athletic prowess by working out and learning defensive skills through martial arts. Detailed, well-thought out plans to foil his enemies were paramount and helped him avoid unnecessary risks. Similarly, investors should not take “shot-gun,” undisciplined risks with their portfolio. It is more prudent to build a diversified portfolio that matches an investor’s risk tolerance, so he can remain committed in both good and bad times. Diversification can also mitigate risk in times of heightened volatility. As an example, the recent downside volatility in the equity market in May was alleviated by exposure to Treasury bonds, which rallied.

Beware of Villains. Batman was hypervigilant to potential threats from his nemeses. This is no different for investors as they need to be cognizant of market risks and, more importantly, their potential impact to portfolios. From trade to politics to economic data, the list over the next several months will continue to grow. However, it is important to differentiate noise from fundamental changes in the economy or financial markets. Let us be your Alfred Pennyworth, Batman’s butler, as we assist you in navigating through what will be a more challenging market environment going forward.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.