Weekly Headings

Equities remain near all-time highs, as the S&P 500 closed at a record high two times this week and is now up 17.1% year-to-date, the best start to a year on a price return basis since 1987. Supporting factors for the equity market have been the reluctance of the Federal Reserve (Fed) to continue on the path of policy normalization (evidenced by the Fed leaving interest rates unchanged at the May Federal Open Market Committee (FOMC) meeting), rising optimism for a U.S./China trade deal (which is reported to take place as early as next week), still solid domestic fundamentals (highlighted by elevated productivity growth and the April employment report this morning that showed that the U.S. economy added 263k jobs in April) and a strong 1Q19 earnings season. With ~75% of S&P 500 companies having reported, below are some of the key takeaways thus far from the 1Q19 earnings season:

- Negative Earnings Growth Avoided | Fears of an earnings recession were elevated heading into the 1Q19 earnings season, as the 6% downward revision in the 12 weeks leading up to the end of the first quarter (the largest 12-week downward revision since 1Q16) brought the consensus 1Q19 earnings growth forecast to -2.9% Year-over-Year (YoY). These fears have subsided, as better than expected earnings has led the 1Q19 S&P 500 earnings forecast to be revised 3.9% higher since the start of earnings season, bringing the blended 1Q19 earnings growth forecast to +0.4% YoY. With 25% of companies yet to report, 1Q19 earnings growth is likely to trend higher and approach 1% by the time it is completed. Major companies reporting earnings next week are Disney and Bookings Holdings.

- Cyclicals Lead the Charge | While Health Care saw the strongest earnings growth (+10.0% Year-over-Year (YoY)) in the first quarter, it has been more cyclical sectors that have driven earnings as Consumer Discretionary (+7.7% YoY), Industrials (+6.7% YoY) and Financials (+5.8% YoY) have seen the strongest earnings growth. As cyclical sectors such as Financials, Consumer Discretionary and Industrials are also expected to see the strongest earnings growth throughout all of 2019, this reinforces our view of favoring cyclicals over defensives.

- Strong Earnings Beats | ~74% of companies have beaten earnings expectations, which is above the previous 16- quarter average of 72%. Cyclical sectors such as Information Technology and Consumer Discretionary have seen the largest percentage of companies beating estimates throughout the first quarter. The median S&P 500 company has beaten expectations by ~5.1%, which is the greatest amount over the past four quarters.

- Stabilization in Long-Term Earnings | After being revised 5.3% lower over the past six months, 2019 and longer-term earnings expectations have stabilized in recent weeks. In fact, the consensus now forecasts 4.2% YoY earnings growth in 2019 and an acceleration to +11.3% YoY in 2020. The upward trajectory of earnings remains a longer-term support for higher equity prices.

- Still Solid Sales | Similar to the bottom line, top-line sales growth has slowed from the robust pace experienced in 2018 but continues to remain solid. Following the full-year 2018 sales growth of 10.1%, 1Q19 sales growth is on pace to be the slowest (+6.2%YoY) since 3Q17 while the full year 2019 pace is expected to be 4.9%.

Economy

- Fed Chair Powell voiced the Fed’s commitment to holding rates steady, which dampened speculation that the Fed would consider a rate cut in 2019. Citing renewed confidence in global financial conditions and progress towards a U.S./China trade deal, Powell indicated that the Fed would exercise “continued patience” in setting policy. Our forecast remains that the Fed will not alter the federal funds rate for the remainder of the year.

- The April jobs report showed the U.S. economy added 263k jobs in April and the unemployment rate declined to the lowest level (3.6%) since 1969. As the U.S. labor market continues to tighten, this should support continued above trend economic growth and be supportive of consumer spending.

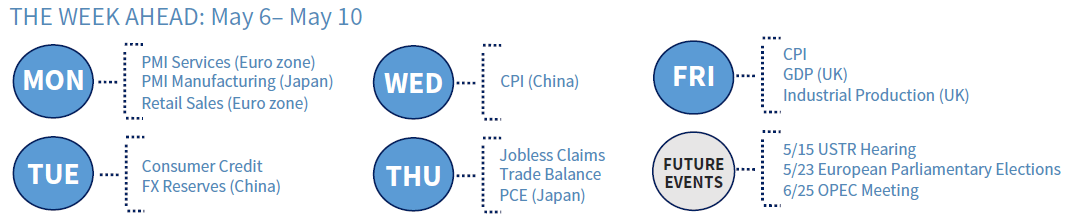

- Focus of the Week: While Chairman Powell suggested that muted inflation trends may be “transitory,” next Friday’s Consumer Price Index’s headline number is expected to reflect higher April gasoline prices, but core inflation is expected to remain low.

U.S. Equities

- With the S&P 500 nearing our year-end target of 2,946 (less than 1% away), the risk/return profile of equities is less attractive. With our expectation for a potential period of consolidation or pull-back, we would use weakness in the market as a buying opportunity as long-term fundamentals remain solid.

- Selectivity remains critical as dispersion at the individual and sector level grow. In fact, as the S&P 500 notched its first record high since September 2018, ~53% of individual S&P 500 constituents remain in negative territory over that time horizon with 30% of companies experiencing a decline of greater than 10%.

- From a sector perspective, seven of 11 S&P 500 sectors are positive since the last record high, with the best performing sector (Utilities) outperforming the worst performing sector (Energy) by ~25%.

- Focus of the Week: As the equity market remains near all-time highs and the possibility of a near-term consolidation has risen, selectivity remains critical over the coming months.

Fixed Income

- Amidst muted inflation and renewed commitment by the Fed to leave rates at their current levels, yields across the curve remained largely unchanged. The yield on the 10-year Treasury held steady at 2.53%, still off of its previous high of 3.24% achieved in November 2018.

- Focus of the Week: The Fed joined forces with the other major central banks around the world in declaring their need to do nothing. The lack of inflation was categorized as “transitory,” which put a damper on those clamoring for a rate cut and reducing forward implied probabilities for a September cut nearly in half (~29% as of 5/2). With the Fed on hold, this leaves us with one major interest rate driver: economic data. Outside of CPI next week, there are no major economic releases likely to significantly move the needle. Investors should stay the course.

International

- Chinese economic data published on May 8, 9, and 10 will provide important statistics on imports/exports, inflation and new yuan loan data. Focus will be on the influence of the trade tensions with the U.S., the impact of rising commodity prices on the inflation rate and the influence of government stimulus efforts on loan data. Our expectation is that the combination of fiscal and monetary stimulus should improve China’s growth prospects.

- After US. Trade negotiators went to China this week, Chinese negotiators come to Washington next week. With growing expectations of the framework of a trade deal being finalized as early as next week, any breakdowns in the discussions could lead to a negative market reaction.

- Focus of the Week: European and Asian composite PMI numbers will be published on Monday, May 6, which will include insights from the all-important services sector, the most dominant part of both regions’ economies.

Energy

- The Trump administration’s stated policy of eliminating Iranian oil exports altogether is not fully realistic. There are still buyers – notably China and Turkey – for Iranian oil, notwithstanding U.S. sanctions. In particular, Chinese oil companies have almost no assets under U.S. jurisdiction and therefore have little to fear from secondary U.S. sanctions. Short of a physical blockade, some limited amounts of Iranian oil exports will still continue to flow.

- Focus of the Week: As U.S. sanctions waivers expire, Iranian oil exports are set to fall further.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.