Weekly Headings

As the Friday early morning deadline (12:01 AM EST) expired, tariffs on an additional $200 billion of Chinese imports have technically gone into effect. However, as we go to press, negotiations are ongoing with the hope that a compromise can be brokered. However, rather than the “art of the deal” playing out, we are witnessing the “art of uncertainty.” The situation has grown more complex this week following President Trump’s Sunday tweet that not only threatened to raise tariffs from the existing 10% to 25% on $200 billion worth of Chinese goods but raised the stakes by potentially adding tariffs to an additional $325 billion dollars of Chinese imports at 25%. In total, that amounts to the potential of $575 billion in Chinese imports being taxed at 25% (~$144 billion or 0.7% of U.S. GDP). China’s threat to retaliate immediately with countermeasures (not yet specified) further clouds the situation. Admittedly, we have no additional insights other than what we have shared previously into what the endgame of these complex negotiations will be, however, we borrow a few points from “The Art of the Deal” to gain some additional insights:

- Think Big | In “The Art of the Deal,” Trump suggests “think big.” The negotiations between the U.S. and China impact the two largest economies in the world, representing ~40% of the global economy. With Europe and Japan next on the docket with the May 18 deadline for President Trump’s decision regarding tariffs on auto imports, that is an additional ~25% of the global economy. In total, we are dealing with approximately two thirds of the global economy when it comes to trade conflicts—that is big! As a result, an unfavorable outcome—a prolonged trade war—would place downward pressure on our global economic growth forecasts.

- Fight Back and Leverage | Trump’s belief that the U.S. has been treated unfairly and has been taken advantage of in regard to trade has led to his administration’s more aggressive stance. The U.S. is the largest, single most important and robust “goods” market in the world and access to it is critical for many companies around the world—a point brought up by U.S. negotiators. However, geopolitical and financial leverage is an important dynamic China has to play. China has supposedly been helpful with the North Korean nuclear discussions, has competing interests when it comes to Venezuela and Iran, and remains the second biggest holder of U.S. Treasury bonds (behind the Federal Reserve). A more cordial relationship between the two biggest economies in world could lead to a more collegial effort with many geopolitical hotspots in the world.

- Protect the Downside and the Upside Will Take Care of Itself | This may be the most important point of the book and the reason we believe a compromise will eventually be agreed upon to avoid significant trade disruption. The President needs a win to protect his downside, which is to keep the U.S. economy strong in order to bolster his re-election aspirations in 2020. Weakness in the economy, particularly from middle America (and farmers) would likely hurt his strong approval ratings on handling the economy. Similarly, China needs to maintain its momentum as the recent soft patch that they have experienced has not been viewed favorably by the government and its people. Both leaders have a strong desire to win and portray strength on a global stage and a compromise would allow both to do so.

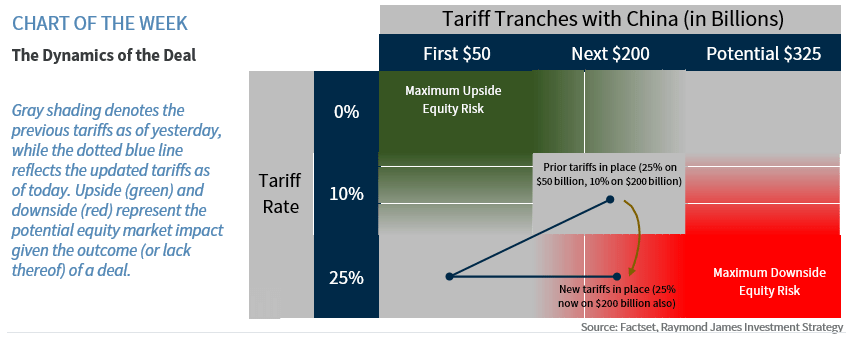

Will a Deal Be Struck? As we wrote yesterday, we remain optimistic a deal will eventually be struck (not necessarily today). However, with the uncertainty surrounding the outcome, we continue to believe the table below illustrates the likely direction of the equity market given various outcomes. The tariffs in place as of yesterday are represented in gray. An increase in tariffs, effective this morning as the $200 billion tariffed at 10% has gone up to 25%, are a headwind for the equity market and is likely to cause some downward pressure as long as they remain in effect. Should those tariffs be reversed or reduced, that could lead to upside pressure in the equity market whereas an increase in tariffs (the potential $325 billion tranche) could lead to further downside pressure. The timing and enforcement of these tariffs will similarly play a role in the market response. Regardless of the outcome, this topic is likely remain in the forefront for the foreseeable future as President Trump ramps up his re-election campaign.

Economy

- Despite on going attempts by the Trump administration to cut the trade deficit, it widened slightly in March to $50 billion from $49.3 billion in February. However, with China, the trade deficit narrowed to $20.7 billion, the lowest level since March 2014, which could bolster President Trump’s claim that tariffs work and reinforce his aggressive negotiating stance with China, Europe and Japan.

- Focus of the Week: Consumer sentiment (Fri) and retail sales (Wed) are critical indicators in assessing the strength of the consumer, who represents two thirds of the U.S. economy. With strong employment gains, confidence should remain elevated. Consumer spending rose softly in 1Q19, held down by the partial government shutdown, poor weather, and the late Easter holiday, therefore April retail sales figures should see a modest bounce.

U.S. Equities

- As a result of President Trump’s trade threat and increased uncertainty surrounding trade, the S&P 500 posted its largest drawdown year-to-date (YTD), falling ~3% from the all-time high set last week.

- Throughout this drawdown, it has been the cyclically-oriented sectors that have been the hardest hit, as Materials, Info Tech and Industrials have all underperformed the broad market since President Trump’s Sunday tweet.

- Given the underlying strength of the U.S. economy, positive future earnings growth, and our expectation that the

U.S. and China will ultimately come to a trade agreement, we continue to favor cyclicals over defensive sectors and would use any further period of weakness as a buying opportunity. - Turning to earnings, with ~90% of companies having reported during the 1Q19 earnings season, 74% of companies have beaten expectations (above the previous 16-quarter average of 72%) and earnings growth has crept up to 0.9% year-over-year (YoY) (well above the expected decline of 3% at the start of earnings season).

- Focus of the Week: Next week will mark the unofficial end of earnings season as Walmart reports on Thursday. With few economic and earnings releases, headlines surrounding trade will likely dictate any major moves.

International

- Trump’s Sunday tariff tweet created uncertainty across global markets, especially in higher beta regions, dragging down Emerging Markets (EM) by 5% since last Friday. EM has underperformed U.S. markets since the start of 2018 by 18.5%, with China alone trailing by 18.3%. However, if the U.S. and China compromise and come to a trade agreement, global equities, especially EM equities, are likely to move higher.

- Focus of the Week: International geopolitical risks continue to grow with North Korea (short-range missile launches), Iran (non-compliance with nuclear agreement) and Venezuela (gov’t crisis) intensifying. In addition to possible on-going China trade discussions, President Trump has until May 18 to make a decision on European and Japanese auto import tariffs. While a delay of six months is rumored, any definitive tariffs would be a negative.

Fixed Income

- Some major factors that influence bond pricing remain neutral: inflation (muted), central bank activity (still accommodative) and economic data (solid, but not overheating). As a result, some investors are turning to headline news which tends to initiate “knee jerk” reactions with short-term impact. Emphasis should be on disciplined long-term planning, leaving the speculative moves to other asset classes.

- Focus of the Week: U.S. Michigan inflation expectations (Fri) should show that consumer expectations of inflation over both the near term (next 12 months) and long term (5 to 10 years) remain at historically low levels. Also watch the spread levels of the high-yield market that have remained resilient despite the uptick in volatility.

Energy

- Sentiment on oil continues to improve due to a broadly supportive fundamental backdrop: larger U.S. producers are exhibiting restraint in capital allocation; OPEC and Russia’s production cuts are noticeably contributing to inventory draws, with OPEC supply at four-year lows; U.S. sanctions against Iran are about to become more impactful; the picture for global demand growth is broadly upbeat; and IMO 2020 is looming.

- Focus of the Week: Notwithstanding a trade war, tighter U.S. inventory levels and the approaching U.S. driving

season should place some near-term upward pressure on oil prices. Our year-end target remains $70/barrel.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.