Weekly Headings

Our second quarter outlook titled, “Reckoning with Records” proved prescient even outside the world of finance. From weather (record-high temperatures in May) to movies (unprecedented opening-weekend box office revenues for the “Avengers: Endgame”) to sports (a record 1,135 homeruns hit in Major League Baseball in May) to Jeopardy (James Holzhauer notching the ten largest paydays and narrowly missing the record for winnings), records are meant to be challenged and broken! The beautiful dynamic about records is that you can be a fan and continue to cheer existing ones (e.g., U.S. record economic expansion and record U.S. earnings) or once they end, new streaks (e.g., easing cycle, emerging market outperformance, and dollar weakness) can evolve that can garner your attention. For example:

- Dow Doldrums Disenchantment | Heading into this week, the Dow Jones Industrial Average (Dow) had declined for six consecutive weeks, the longest negative streak since 2011 and the second longest streak on record. If the Dow had declined this week, it would have tied the longest consecutive weekly decline (seven weeks) on record. Fortunately, that streak has ended with the equity market’s rising expectations for future Federal Reserve (Fed) accommodation as Jerome Powell and other Fed members highlighted their readiness to cut rates if necessary. Additionally, there are hints of trade de-escalation as China signaled that it was willing to open dialogue with the U.S., and members of the U.S. administration mentioned that the previously announced tariffs on Mexico may not need to go into effect. Finally, we saw a turnaround in stretched oversold technicals (as the 14-Day RSI fell into over sold territory and the put/call ratio rose two standard deviations above the long-term historical average). Turning away from the short-term nature of the market, we remain optimistic in the long term that the equity market will reach all-time highs on the back of record earnings for both 2019 ($166) and 2020 (current consensus $186). More importantly, this current bull market, the second longest in history, has a reasonable opportunity to set a record in June 2021.

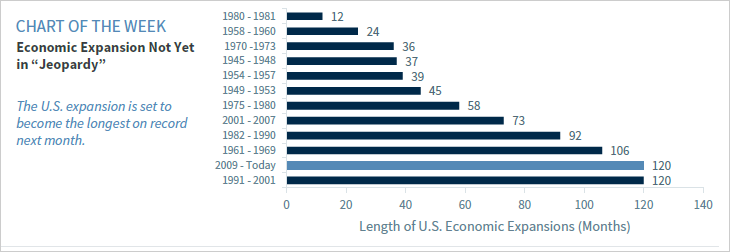

- Fed Will Not Put Economy in “Jeopardy” | As a result of recent trade uncertainty between the U.S. and China/Mexico, and the slowdown in global economic momentum, expectations for Fed rate cuts increased dramatically over recent weeks. In fact, the market is now pricing in a 98%, 85%, and 53% probability of one, two and three rate cuts before year-end, respectively. Notably, the futures market has almost fully priced in a rate cut (94%) at the September meeting. A Fed rate cut will mark an end to the current tightening cycle that became the longest on record this past April. This dovish shift by the Fed should ensure that the U.S. economic expansion will not only become the longest on record (which it is set to become next month) but also extend into the future. Strength of the labor market (as the U.S. economy added 75k jobs in May, a record 104 consecutive months of job growth), elevated business and consumer confidence, and a still stable manufacturing sector bolster our confidence in the longevity of this expansion. Additionally, while the further inversion in the yield curve between the 10-Year and 3-Month maturities has brought increased recessionary fears, we note that our preferred measure of the yield curve (10-Year and 2-Year) remains in positive territory and is currently at the steepest level (28 bps) in seven months.

The growing probability of the end of the Fed tightening cycle has led to some new streaks that may be beneficial to investors.

- EM Outperformance | Following the significant underperformance over the past 12 months, emerging market (EM) equities rallied for seven consecutive days to begin the week, marking the longest streak of positive consecutive days in over five years. Over that time period, EM outperformed U.S. equities by over 500 bps which is the second strongest five-day outperformance since 2014. A dovish Fed and lower-for-longer yields should be supportive for emerging markets.

- Dollar Direction Changing | The dollar has enjoyed a record-long bull market lasting eleven years. However, the combination of a more accommodative Fed and burgeoning trade and fiscal deficits suggests that the bullish dollar story is likely to be challenged. However, a weaker dollar will benefit the earnings of U.S. multi-nationals, support EM assets, and potentially serve as a catalyst to support commodities, particularly oil (our year-end target: $70/barrel).

Economy

- Given the continued uncertainty surrounding trade and its potential negative impact on the economy, a number of Fed speakers this week suggested that they may need to adjust its current monetary policy stance, with Chair Powell highlighting that the Fed would “act as appropriate to sustain the expansion.” As a result, expectations of a rate cut rose dramatically as the market is now pricing in an 85% probability of two rate cuts before year end.

- Despite this, U.S. economic data continues to point to above-trend (albeit slowing) economic growth (2019 GDP forecast: 1.9%) with muted risk of a recession over the next 12 months. This is evident as the U.S. labor market remains healthy (lowest unemployment rate since 1969) and both ISM Manufacturing and Services Indices remain in expansion territory.

- Focus of the Week: We’ll get some important economic data in the lead-up to the June 18-19 FOMC meeting. The Consumer Price Index (CPI) (Wednesday) is expected to have risen moderately in May (both overall and ex-food & energy). Retail sales results (Friday) should be mixed, while industrial production (Friday) has been on a weakening trend in recent months.

U.S. Equity

- The 7% one-month pullback since President Trump’s tariff threat on May 5 created sharply oversold conditions for the S&P 500. The index bounced higher as a result this week, with more positive headlines on Fed policy and trade being the catalyst.

- The positive and negative forces battling it out in the short term revolve around trade negotiations and Fed policy. Trade negotiations with Mexico were ongoing this week, ahead of the 5% tariff level going into effect next Monday. With China, the first face-to-face meeting between the two sides is set to take place this weekend. Investors will be monitoring developments closely for hints on positive or negative momentum to negotiations. The Fed has continued to ease its stance, and has hinted at financial flexibility should trade negotiations continue to escalate.

- We would be selective with new purchases in the short term, due to the uncertainty revolving around trade policy. From a global perspective, we continue to favor U.S. large-cap growth. Moreover, global exposure is important to consider within your portfolios, and we would focus on U.S.-centric companies for investors when employing cash in the near term.

- We moved to an Equal Weight view for Industrials. Softening manufacturing trends globally and in the U.S., in addition to the risk presented by the U.S./China trade war, influenced our shift in opinion. The inability of the sector to post stronger relative performance during the rally off the December 24, 2018 low, when coupled with softening macro trends, further supports a more cautious stance.

- Focus of the Week: From a technical perspective, we would like to see a follow through rally within the next several days after this week’s strong rally. With the risk/reward balanced, we have a neutral stance for the near term.

Fixed Income

- Despite the sharp rally in risk assets and more favorable trade news (e.g., reports that the U.S. administration may delay tariffs on Mexico which are scheduled to go into effect on June 10), Treasury yields continued their recent decline as 10-Year Treasury yields have now declined for six of the past seven weeks (~50 bps over that time period) to the lowest level in two years.

- While the yield curve between the 10-Year and 3-Month maturities remained inverted for the seventh consecutive day, our preferred measure of the yield curve (10-Year to 2-Year) steepened to the highest level in seven months, suggesting that a potential recession is not yet on the horizon as this indicator typically inverts more than 12 months prior to the next recession.

- Going forward, we expect Treasury yields to move modestly higher into year end as above-trend domestic economic growth pushes yields higher. However, the rise in yields will likely be contained given the increasing likelihood of a 2019 Fed rate cut.

- Focus of the Week: As the market is now pricing in multiple rate hikes this year, monitor any additional news on trade and the CPI release as positive impacts could lead to a modest rise in yields off of depressed levels.

International

- Focus of the Week: Monitor comments from the weekend meeting of G20 finance ministers and central bank governors in Japan. Ongoing trade disputes and policy-making challenges will be the focus and inevitably any conclusions will be seen as a warm-up ahead of the equivalent meeting for the G20 political leaders at the end of the month.

Commodities

- Following the best start to a year since 1999 (38.9% through April 30), crude oil entered bear market territory this week (a decline of more than 20%) on the back of global growth concerns (due, in part, to trade uncertainty) and building crude oil inventories as the U.S. posted the largest weekly build in inventories (for both inventories and products) on record.

- Focus of the Week: Despite the recent decline in oil, we continue to believe the trajectory for crude oil prices is up over the next 12 months as a favorable global supply/demand imbalance should push oil prices higher.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.