Weekly Headings

Congratulations to the defending World Cup champion U.S. Women’s National Soccer Team for an impressive opening game victory in this year’s tournament in France. By defeating Thailand 13-0 this past Tuesday, they set the largest margin of victory in Women’s World Cup history. Despite the strong start, we implore the team to remain focused and not become complacent. Upsets are a part of sports as witnessed by Buster Douglas knocking out Mike Tyson, UMBC beating Virginia in the basketball tournament last year, and of course, the Miracle on Ice of the U.S. men’s hockey team. Guarding against overconfidence is paramount not only in sports, but also in managing the economy and portfolios.

- Fed Finesse. As we expect the Women’s National Team to continue pushing for the World Cup, we expect the Federal Reserve (Fed) to take the necessary measures to extend the current record expansion. With the U.S. economy slowing from its robust 3.1% pace in Q1 due to trade headwinds, slowing global economic momentum and the yield curve inverting for the first time since 2008 (the 10-year and 3-month maturities), calls from the “vuvuzelas” to cut rates have grown louder. In fact, the futures market is now pricing in a 99%, 89%, and 56% probability of one, two, and three Fed rate hikes by year end. While the market is on a “break-away” path to multiple rate cuts, next week’s Federal Open Market Committee (FOMC) meeting looms large as market expectations may have gotten too far ahead of the Fed. That meeting includes an official statement on monetary policy, an update to the Fed’s economic forecasts (including the “dot” plot), and a press conference by Chair Powell. Even though recent Fed speeches have turned more “dovish,” the focus will be on whether the Fed’s new verbiage, forecasts, and dot plot match the aggressive downward path in interest rates that the market is anticipating. Unless the Fed markedly lowers its growth forecasts (because of global growth concerns) or changes its “transitory” low inflation expectations, the markets may very well be disappointed by the Fed being more patient and not matching the multiple rate cut expectations. The worst case scenario (unlikely) is that the Fed insinuates there are no interest rate cuts on the horizon.

- Pragmatic Game Plan. Regardless of the outcome at the Fed meeting, our economist believes the Fed will cut interest rates two times this year, likely in July and October. As a result, our game plan for the equity market remains consistent. As the S&P 500 moves above 2900, we become more cautious and as it falls below 2800, we nibble and get more aggressive as it approaches 2700. As a result, if the Fed finesses a perfect market-friendly message and the market rallies above 2900, we would fade the rally, and, if it falls, we would use it as a buying opportunity. From a historical longer-term perspective, the path of the equity market is dependent on the success or failure of the cuts and whether the economy enters a recession.

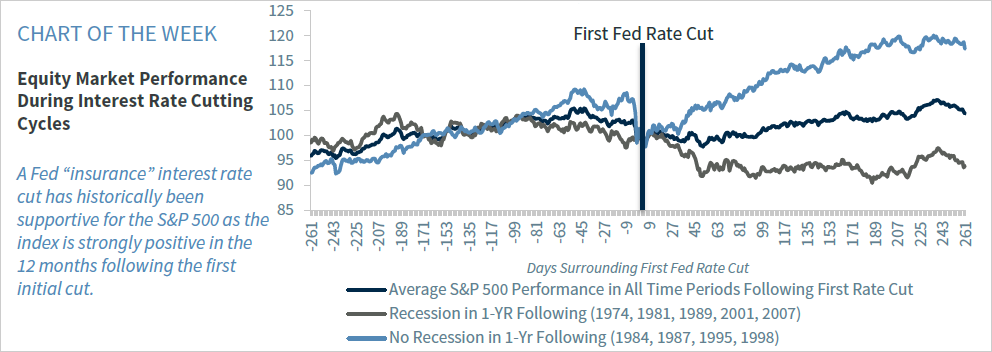

- Success: Insurance Policy. If the cuts act as an insurance policy to preserve and extend the expansion, the equity market is likely to continue to move higher. As an example, the Fed cut rates in slowing, yet non-recessionary environments in 1984, 1987, 1995, and 1998 and the economy continued to expand for a number of years. Given our view that U.S. economic fundamentals remain solid (e.g., activity levels are at record highs and consumer and business confidence remain near cyclical highs) with only a modest risk of recession over the next 12 months, our base case is that the current cycle will resemble these time periods. This assumption supports our more optimistic view on equities as it historically has led to an ~8% rally in the one month leading up to the initial cut and more than a 15% rally in the 12 months after the initial cut. Sectors that outperform in these periods are Info Tech, Communication Services, and Consumer Discretionary.

- Failure: Too little, Too Late. The risk factor is that the economy is already on the path to recession and that any interest rate cuts will prove too late or that the negative repercussions from trade frictions will overpower the Fed’s stimulative potential. In those instances where a recession was unavoidable, the equity market has struggled with the S&P 500 falling, on average, 10% in the 12 months following the initial cut. Cyclical sectors such as Info Tech, Financials, and Consumer Discretionary have been the hardest hit during these time periods.

Economy

- May reports on retail sales and industrial production remained consistent with a moderate pace of growth in the overall economy. Consumer sentiment edged lower on tariff concerns.

- Ex-food & energy, CPI rose 0.1% in May (a bit less than the consensus expectation) leaving the year-over-year pace at 2.0%. While this is at the Fed’s target, the Fed’s preferred measure of inflation (PCE) remains well below (1.5%) the 2% target. Muted inflation pressures gives the Fed flexibility to reduce interest rates.

- Focus of the Week: Investor attention will be on the Fed as the FOMC holds its June meeting next week (Tuesday and Wednesday). While the FOMC is expected to leave interest rates unchanged at this meeting, the market is expecting Chair Powell to signal a rate cut at its next meeting in late July (federal funds futures are pricing in about a 27% chance of a rate cut at the June 19 meeting and about an 84% chance by the July 31 meeting).

U.S. Equity

- The S&P 500 has bounced from oversold levels and is back to ~2% from all-time highs. The 5% gain over a 5-day period was a two standard deviation move historically (happens less than 5% of the time). The catalyst for the move higher was liquidity-driven (investors remain addicted to loose monetary policy), as there is an 87% chance of a Fed rate cut at the July 31 FOMC meeting.

- Following such a sharp market gain, it is normal to have some consolidation as the market digests the move. Short-term indicators have gone from oversold to now overbought. Additionally, internals were not overly impressive during the rally, and we continue to believe that the market is too sanguine on trade with China.

- On the upside, we think the market will be hard-pressed to move to new highs without a trade resolution; on the downside, we think the market should not trade below the mid-2600s unless trade talks deteriorate. This leaves us with more of a cautious risk/reward set up for the short term. As such, we would be selective or patient with new purchases as there will likely be better buying opportunities, particularly if the market declines to the 2800 level and would get more aggressive around the 2700 level.

- Focus of the Week: While it is our belief that both sides do enough to soothe equity markets at the G20 meeting (i.e., agree to begin discussions again and/or delay the escalation of tariffs), it is far from certain at this point. Therefore, we have to be mindful of the potential negative consequences to the economy and equity markets if trade tensions escalate later this month.

Fixed Income

- Despite the sharp rally in risk assets over the past two weeks, the sovereign rate market is less optimistic as Treasury yields (10- year Treasury yield: 2.09%) remain near multi-year lows. While interest rates remain low, credit related sectors have rallied and high-yield spreads have declined almost 60 basis points (bps) over the past ten days.

- Focus of the Week: Rallying Treasuries are pushing yields lower. Resist the temptation to shorten duration with comparable yields between short and intermediate bonds. Fed cuts to short-term rates and/or a declining yield curve could create reinvestment issues going forward. The use of spread products (municipal bonds, corporate bonds, etc.), properly laddered, can mitigate interest-rate risk.

International

- In addition to the Fed, the Bank of England (BoE) will hold a monetary policy meeting next Thursday where they are expected to leave interest rates unchanged amidst continued Brexit uncertainty. Despite this, there has been a significant shift in recent weeks by other central banks to signal the potential for more aggressive easing if warranted. Bank of Japan (BoJ) Governor Kuroda signaled that the BoJ has plenty of ammunition to support the economy and European Central Bank (ECB) Chief Draghi highlighted that the ECB will act aggressively, if necessary.

- Focus of the Week: Central banks will be the key focus, as investors will monitor the forward guidance provided by the BoJ and BoE in each respective meeting. In addition, the deadline for submitting comments to the U.S. Trade Representative on the additional $325 billion in Chinese tariffs is Monday (June 17) and focus on the preliminary June PMI readings (June 21) given the recent slowing in global momentum.

Commodities

- Given the continued uncertainty surrounding trade, the sharp dovish shift from global central banks and the decline in global sovereign rates, gold has rallied in recent weeks and rose back above $1,350/oz for the first time since April 2018.

- Crude oil extended its losses this week, as the commodity declined for the fourth time in the past five weeks and is now down over 20% from its year-to-date highs in late April. Pushing crude oil prices lower has been concerns surrounding slowing global growth (therefore reducing future demand forecasts), an unexpected building in inventories, and a continued rise in U.S. production.

- Despite this, after declining 5% intra-week through Wednesday, crude oil moved higher on Thursday on the back of news regarding the second bombing of an oil tanker in the Straight of Hormuz in recent weeks. The U.S. was quick to blame Iran for the bombing, which raised concerns of a further escalation in already heightened tensions between the two nations.

- Focus of the Week: The sharp increase in geopolitical risk, potential action by OPEC to boost crude oil prices (through further supply cuts), and our view that concerns surrounding global growth are overdone support our year-end WTI forecast of $70/bbl.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.