Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Global economy to notch its best year of growth since 1973

- Earnings, not P/E expansion, have led to new record highs

- Tech sector on pace for its eighth year of outperformance

As the end of 2021 draws near, investors are pleased with the impressive performance posted by most asset classes, but we are still awaiting the transition to the endemic state of the virus. As your Investment Strategy Team, the ability to look ahead and anticipate material developments that could alter our economic and financial market outlook is critical. We do not look back often, but sometimes reflecting on the past can be prudent as it presents us with the opportunity to reassess and critique our views and analysis. Therefore, as we prepare to release our Ten Themes for 2022 in just two weeks time, we must first look back to evaluate and grade our themes for the current year. In hindsight, the guidance our team of economists, strategists, and portfolio managers gave for 2021 was prescient, as ~85% of our ten leading investment views proved to be accurate. Below is our scorecard for 2021, with insights into which views did and did not come to fruition:

- Global Synchronized Recovery – Rowing In The Same Direction | After the worst year of global economic growth since World War II in 2020, we expected the sharp contraction would be followed by a strong rebound. Some countries grew faster than others, but world GDP rose at the fastest pace since 1973 and notched the largest turnaround in economic growth between two years as a result of the vaccine rollout, the reopening of economies, and supportive monetary and fiscal policies.

- US Economic Recovery Taking On A Triathlon | We anticipated that the pace of the economic recovery would coincide with the availability of vaccines, as certain sectors and industries would remain challenged until a full reopening was realized. Overall, US economic growth recovered all lost economic activity by the second quarter (the fastest recovery on record!) and grew at the fastest pace since 1984 given robust consumer spending and increased capex once the inoculation count increased.

- Keeping Portfolios En Garde Despite Low Yields | We saw upside for yields given growth expectations, but thought elevated foreign demand and an accommodative Fed would limit the move higher. We encouraged investors to let “bonds be bonds,” taking risk in the equity market rather than with credit, and not looking to fixed income for total return. The 10-year Treasury yield has risen ~50 basis points, and overall returns have been muted with the S&P 500 outperforming credit (+26% versus -1.2%).

- Earnings Will Do The Heavy Lifting | We believed earnings rather than multiple expansion would move equities higher, and in light of the reopening, we favored the cyclical sectors. Driven by record earnings (+48%), the S&P 500 has notched 67 record highs – the second largest number on record – and has risen ~26%. As earnings outpaced appreciation, we saw a modest P/E contraction, and select cyclical sectors outperformed led by Energy, Financials, and Technology.

- Hitting The Bullseye Of Our Tech Target | Between earnings growth expectations, a history of earnings beats, sizable business investment, and its increased involvement in a number of other sectors (e.g., Industrials, Health Care, Consumer Discretionary, Communication Services) we forecasted that the Tech sector would continue to outperform in 2021. Year-to-date, the sector has rallied +31% and is on pace to outperform the S&P 500 for the 8th consecutive year, as we all continue to adapt to the digital age.

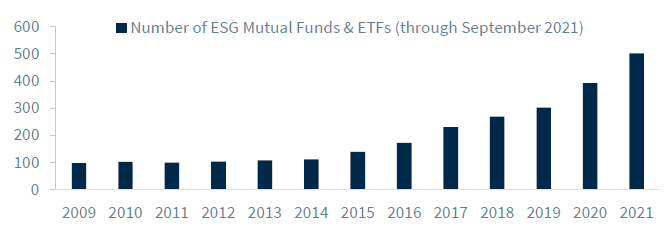

- Wave Of Socially Responsible Investment Now About To Break | Between President Biden’s stance on climate change and increased investor awareness of company actions, we believed increased interest in sustainable investing would be met with increased regulation. The number of ESG mutual funds and ETFs now exceeds 500 for the first time; the SEC created a Climate and ESG Task Force to crack down on greenwashing, and the Nasdaq established reporting standards related to board diversity.

- Exposure Abroad Will Be A Balancing Act | We favored domestic equities due to stronger earnings growth, sector compositions, and profitability ratios, and identified Asian emerging markets as an opportunity when considering exposure abroad. The S&P 500 outpaced the developed markets (MSCI EAFE) by ~16%, but our call for Asian emerging markets was mistimed, as concerns emanating from China (e.g., strict COVID stance, property crisis) and a stronger dollar hampered returns in the region.

- US Dollar Will Not Have The Inside Track | We assumed improving global growth, widening US deficits, and easing trade restrictions would cause the dollar to weaken. However, it has rallied 6.8% and is on pace for its strongest annual appreciation since 2015 as additional COVID surges and social distancing measures weighed on global growth relative to the US.

- Oil Demand To Catch The Crosswind Of Economic Activity | With the global reopening intuitively restoring demand, we anticipated oil prices would rise north of $60 per barrel and that commodity sectors would receive a boost. On the back of the strongest annual demand growth since the 1970s, crude oil is posting its strongest annual price return (+49%) since 2009.

- Keeping Asset Allocation Parameters On The Fairway | After the tumultuous year the markets experienced in 2020, volatility was bound to be more muted in comparison. The average volatility, as measured by the VIX, declined from 29 to 20 in 2021, with the S&P 500 experiencing only one 5% pullback, versus its typical three.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.