Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Pullbacks are part of the fabric of the market

- Investors should avoid trying to time the market

- The fundamentals reaffirm our positive equity market outlook

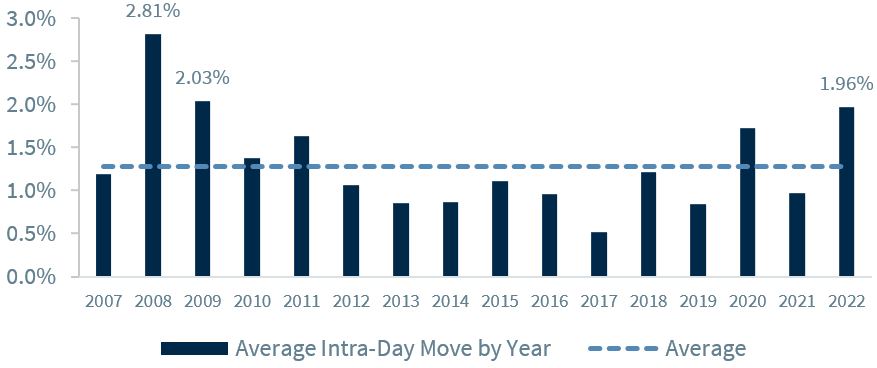

It has not been a seamless start to the year for the equity market. The S&P 500 has experienced an average intra-day move year-to-date of nearly 2%—the highest swings since 2009 and higher than the pandemic-induced 2020 volatility—and is on pace for its worst month since March 2020. While there are many catalysts contributing to the weakness, the Fed trying to ‘thread the needle’ to avoid a monetary policy error has been at the forefront of investors’ minds. But while it feels like this bull market is about to ‘burst at the seams,’ remember that pullbacks are part of the market’s tapestry. As we put this recent selloff into perspective, we will focus on the investment principles that have stood the test of time and discourage emotionally-driven decisions.

- Equity Investors Are Not In Stitches | The recent uptick in volatility has been uncomfortable for most investors, especially given the steadiness of the S&P 500 last year—only one 5%+ decline (versus three to four historically) and the second smallest intra-year decline since 1995. The drivers of this year’s volatility include the Fed’s unwinding of its ultra-accommodative policy, an earnings season that is less impressive than those previous, the worst pandemic surge of new cases, and still stubbornly high inflation. But another reason could simply be time, as this is the S&P 500’s fourth longest run without a 10% pullback (~22 months vs. ~one per year). In addition, we are approaching the two-year anniversary of this bull market where, historically, returns become more muted, volatility increases and investors become more discerning (e.g., selectivity becomes critical). With volatility increasing, it is important that investors revisit the following long-standing investment principles.

- Volatility Can Push Buttons | Weakness in the equity market can make investors question their overall strategy and risk tolerance and cause knee-jerk portfolio moves. Emotionally-driven decisions to exit the market are one of the reasons that equity fund investors could underperform the broad market. In fact, the biggest equity market outflow over the last three years coincided with the S&P 500 reaching its pandemic-induced low the week of March 25, 2020, suggesting that the masses sold at the worst possible time and missed the beginning of the strongest bull market in history.

- It Is Hard To Pin Down The Market’s Highs & Lows | Perhaps even more detrimental, is attempting to time the equity market—exiting during perceived troubled times with the expectation of returning at a more opportune moment. Unfortunately, that is a herculean task that few have been successful at. A more effective strategy is understanding the risk associated with the equity market, remaining disciplined, and riding out the volatility. Case in point: the annualized price return for the S&P 500 over the last 20 years is ~7.3%. Investors who missed the top ten best trading days (of the total 5,033 trading days) would have cut their average annualized return in half to 3.2%. Even worse, investors who missed the top 20 best trading days would have seen their performance reduced to a mere 0.6% annually. While it can be challenging to exercise patience during pullbacks, it is worth noting that these ‘best days’ are typically clustered around the worst days.

- Complacency Was Sewn Into The Market | At the start of the year, our Investment Strategy Quarterly Sentiment Survey revealed that ~80% of respondents anticipated equities being the top performing asset class in 2022, with 90% expecting positive performance. While we do not disagree with that potential outcome, we become cautious with such elevated levels of optimism surrounding equity market returns. And that is one reason why we expected a period of temporary, elevated volatility to shake some of this complacent optimism. Already we have seen this sentiment change as the percentage of bearish investors (~53%) has risen to the highest level since 2013. These now elevated bearish levels are historically a contrarian indicator, with the S&P 500 up ~10%, on average, in the 12 months following these instances.

- The Economy Isn’t Hanging By A Thread | Despite the near 10% pullback in the S&P 500, we reiterate our year-end target of 5,053 for the S&P 500 (~17% upside from the current level) on strong fundamentals that include a robust economy, above- average earnings growth, and attractive valuations. The good news is that when the market has incurred a 10%+ pullback, a recovery of those losses has typically taken five months assuming there is no recession. And, given resilient consumer spending, continued capital expenditures, and the rebuilding of inventories, our forecast is that economic growth will remain healthy. We’d view a pullback of this magnitude differently and expect deeper losses if a recession were to materialize (low probability).

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.