Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Easing supply chains could allow for a more patient Fed

- Omicron doesn’t stop economy from adding jobs

- Higher gas prices a downside risk to our economic outlook

Punxsutawney Phil—the most famous groundhog—saw his shadow! So for those of us braving colder temperatures, we may have six more weeks of winter to go. Fortunately, historic weather data doesn’t give this furry forecaster much predictive power. But if there is one thing investors can count on over the next six weeks, it is that the Fed will be underground assessing the economic outlook ahead of the critical March Federal Open Market Committee Meeting (March 15-16). With Chair Powell’s latest commentary causing market volatility to come out of hibernation, the upcoming economic data releases will be all the more critical in discerning how the Fed’s economic forecasts and policy adjustments may shift. Below is a list of developments that will be on our radar without a shadow of doubt:

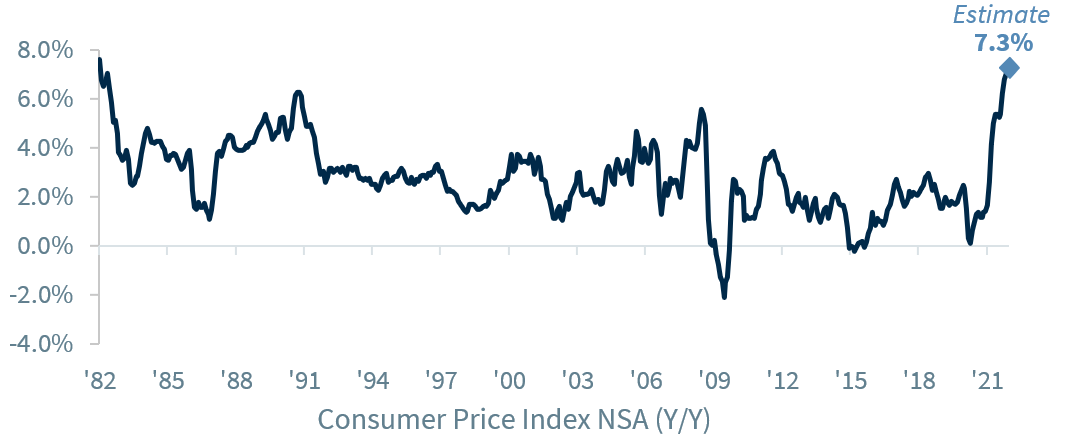

- Inflation May Spring Higher | The January and February readings for the Consumer Price Index and Producer Price Index will be released before the Fed’s next meeting, and the minutes from the previous meeting may give investors further insights to how the results may frame the policy discussions come March. The consensus estimates for top-line inflation (January’s Consumer Price Index released next Thursday, February 10) reflect that we may not have reached the peak just yet (+7.3% year-over-year versus +7.0% in December), and whether you listen to the nightly news or have seen headlines from company earnings reports, the supply chain disruptions are front and center. But despite the broad-based grievances on staffing shortages, input availability, and transportation costs, there are signs that inflation pressures may be starting to ease. In looking at the various subcomponents of the ISM Manufacturing Index, backlogs are down in five of the last six months, new orders fell for the second straight month and delivery times declined for a third consecutive month. It is also worth noting that General Motors expects “ongoing semiconductor availability improvements throughout 2022” and new car prices saw their first decline in ten months. While it will take time for these supply chains to unfreeze, any noticeable improvement over the next several months could allow the Fed to be more patient in tightening monetary policy as we progress into the year.

- Omicron Doesn’t Cast A Shadow On The Labor Market | Despite concerns that the rampant spread of the Omicron variant would temporarily weaken job growth (e.g., sickness-induced absenteeism and businesses postponing hiring), the jobs market remained robust (467k jobs created in January). As COVID-19 cases recede further, job creation should remain healthy. First, the percentage of businesses that plan to increase employment remains near the highest level on record. And second, the combination of higher prices and depleting stimulus reserves will compel people to go back to work sooner rather than later. With the labor market remaining strong, the Fed will keep a singular focus on inflation and begin to raise rates in March.

- Can’t Let Economic Momentum Go Back Into Its Burrow | With the more COVID-sensitive businesses once again affected by a case surge, the Atlanta FED GDP Now forecast for the first quarter is nearly flat. If our nation’s case path continues to follow the South Africa experience, there is reason to believe economic momentum should revive thanks to resilient demand. While Omicron poses downside risk to our initial 3.5% economic growth forecast for 2022, our base case remains that growth will rebound once we move past this surge, and that there is still a very low probability of a recession on the horizon.

- Retailer Earnings Set To Emerge | With the mega-cap tech-oriented companies having reported, we now await the results from some of the largest retailers. With the former only adding to recent market volatility last week, the retailer results will be all the more critical. Earnings for 2022 have been revised up slightly since the start of earnings season, and any additional boost would reinforce our expectation of ~15% earnings growth this year.

- Consumers Weathering Higher Prices At The Pump | The surge in oil prices must be monitored as it could negatively impact consumer spending. Despite oil rallying to $90+ per barrel, gasoline prices have remained fairly contained at $3.42. If gas prices spike closer to $4 per gallon, it could pose a risk to our economic forecasts as it dampens consumer spending power.

- Fed Tightening Cycles: Den There, Done That | As the market’s focus transitions from earnings season to macroeconomic data, the uncertainty surrounding inflation, growth, and the trajectory of monetary policy is likely to lead to a choppy equity market leading up to the Fed’s March meeting. But with the benefit of knowing that, historically, a tightening cycle is not synonymous with a halt in economic growth nor the end of an equity bull market, we’d encourage long-term investors to utilize any further pullbacks as a buying opportunity.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.