Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- A diplomatic resolution remains our base case

- Higher oil prices would impact the global economy

- Energy prices could force the Fed to be more aggressive

A picture is worth a thousand words. And the satellite images and social media posts revealing the scale and sudden intensity of Russia’s military deployments and equipment miles from Ukraine’s border speak volumes. Russia is amassing troops as it demands that Ukraine never become a NATO member and that NATO’s presence in Eastern Europe be reduced to 1997 levels. With the US unwilling to concede to this proposal, the diplomatic talks between Russia and the US and its allies have lacked a clear path forward, and the uncertainty is causing volatility in the equity markets. While President Biden has vowed to give “diplomacy every chance to succeed” to defuse the tensions with Russia, we discuss the economic and financial market consequences should the situation escalate.

- Impact Of Geopolitical Events Is Typically Limited | Over the last three decades, the equity market has witnessed its fair share of geopolitical events. From terrorist bombings (e.g., Manchester Arena Bombing) to missile crises (e.g., North Korea’s first intercontinental ballistic missile (ICBM) testing) to the beginning of wars (e.g., War in Iraq), these historic moments have sadly resulted in tragic deaths and destruction. But as horrifying as some of these events have been, the equity market seems to have a short memory. In fact, despite near-term volatility, the S&P 500 has rallied 4.6%, on average, in the six months following such crises dating back to 1990 and is positive ~81% of the time. In general, Fed policy and economic conditions tend be the more long-term drivers of the economy and financial markets rather than isolated geopolitical events. However, given that it could have economic and market ramifications, we caution a Russian decision to conduct a significant military operation may pose a near-term downside risk to the global economy and cause market volatility to persist.

- Higher Energy Prices A Potential Risk | While we remain optimistic that a diplomatic resolution and/or de-escalation (base case) will ultimately result, this is not a certainty with tensions high. A favorable outcome would reduce the current geopolitical risk premium built into oil prices (at least $5-$10) and return oil closer to our year-end target of $80. But President Biden remains adamant that Ukraine will be defended, and that sanctions such as blocking energy sales will be deployed as a counter to Russia’s militant action. With oil prices already at multi-year highs due to misaligned supply/demand dynamics, further tension could place further upside risk potential (north of $100) that could negatively impact both the US and global economy.

- The Fed’s Focus On Inflation | The Fed’s next meeting is less than a month away, and the release of the January minutes confirmed what investors already knew to be true: inflation has been persistent longer than anticipated. And with the combination of inflation at forty-year highs and recent economic data surprising to the upside (e.g., jobs report, industrial production, retail sales), the Fed will begin raising rates at the March 15-16 FOMC meeting. But if energy prices surge from already elevated levels, it could delay the peak in inflation and force the Fed to raise interest rates more aggressively.

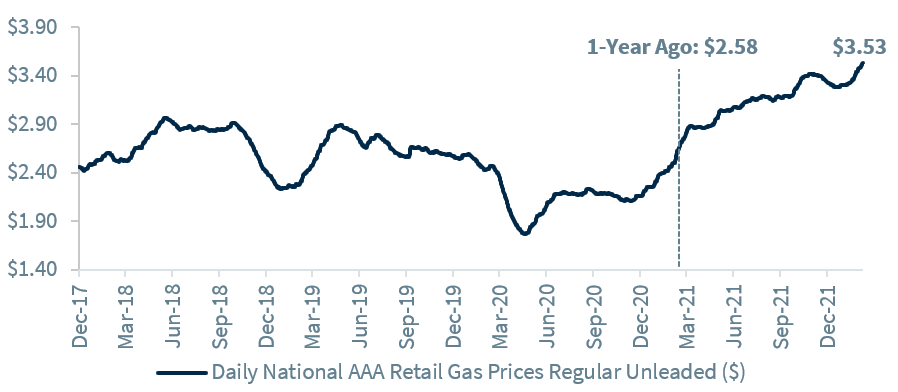

- Downside Risk To Consumer Spending | Tight labor market conditions have led nominal average hourly earnings to rise at the fastest pace in decades (+5.7% year-over-year), but not so much in real, inflation-adjusted terms (-1.7% year-over-year). Case in point, the average price per gallon of regular gasoline has risen by ~$1 over the last twelve months ($3.53 vs $2.58). On an annualized basis, that translates to almost $180 billion deduction in discretionary consumer spending. While gasoline expenditures are a small portion of overall household spending, the aggregate increase is significant and will disproportionately impact low-income earners. Since consumer spending is a leading catalyst for economic growth, any strains could pose a downside risk. In fact, oil prices have risen ~50% on average ahead of the last five recessions exclusive of the COVID-induced recession, signaling a strong correlation between the commodity’s price and economic output.

- Europe’s Exposure To Russia’s Energy Exports | While the US can rely on its own companies for drilling, Europe is heavily dependent upon Russia as its energy source. In fact, half of Russia’s oil and ~75% of Russia’s natural gas are imported to the European market (mainly Germany). The euro zone economy is already more fragile than that of the US, growing only 0.3% (quarter-over-quarter) in 4Q21, so any additional spike in energy prices could be even more detrimental to consumer spending and to the economy as a whole. This is another factor in our preference for US equities over European equities.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.