Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Inflation poses a downside risk to the economy

- The Fed will maintain its flexible approach

- Economic fallout may put pressure on Putin

President Biden delivered his first State of the Union address Tuesday night. In accordance with the US Constitution, the president has the responsibility to update Congress on measures deemed “necessary and expedient.” As the American people expected, there was no shortage of topics to discuss on both the international and domestic fronts. However, President Biden was not the only one to address Congress this week, as Chairman Powell had his semi-annual testimony. His comments come just two weeks ahead of the Fed’s March meeting, where the committee is expected to tighten monetary policy. And now we’ll share our ‘address’, as we communicate our views on the state of the economy, the direction of monetary policy, and the Ukraine-Russia crisis.

- The State Of The Economy | Coming off the best year of economic growth since 1984, there were a number of positive economic updates for President Biden to share, yet inflation took center stage. With nearly 60% of consumers viewing the economy as getting worse and the same percentage stating that they are “very concerned” about inflation, many of the growth catalysts (e.g., surging withholding taxes, inventory rebuilding, elevated capital expenditures) are being overshadowed by inflation fears. Case in point, the strongest wage gains in four decades have been overtaken by rising pricing pressures. The conflict in commodity-rich Russia and Ukraine has only intensified these concerns—with oil prices soaring to ~$110/barrel and wheat prices moving to the highest level in 14 years. The longer prices stay elevated and ‘tax’ consumer spending, the higher the potential for downside risk to economic growth. The good news though is that supply chain disruptions are starting to moderate which should alleviate some inflationary pressures; these sentiments are consistent with commentary from major shipping companies such as Maersk and reaffirmed by actions such as the $450 million federal investment in US ports.

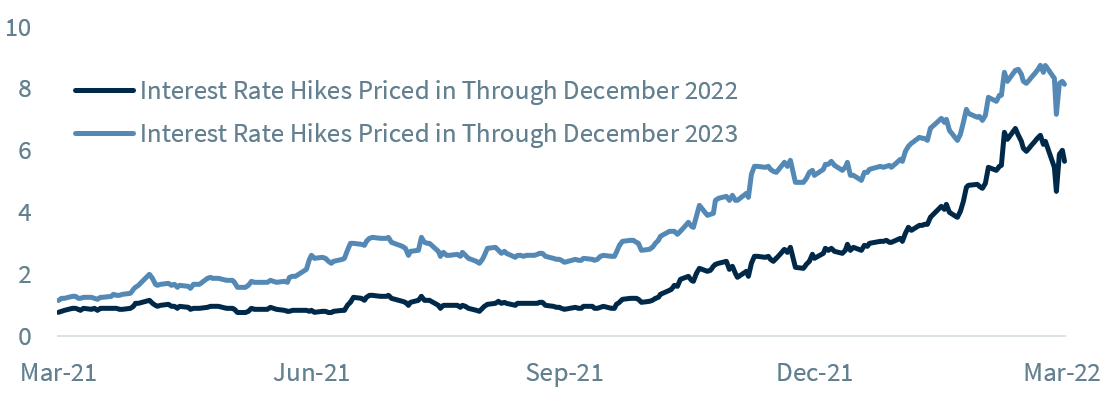

- The State Of Monetary Policy | The escalation of the Russia-Ukraine conflict had already reduced the market’s expectation of the Fed’s tightening cycle beginning with a 50 basis point hike in March, but it was Chairman Powell’s comments this week that seemingly removed that option from the table. In fact, the futures market has completely priced out the chance of a 50 basis point liftoff, compared to over a 90% likelihood just a few weeks ago. He also eased the anticipation of the Fed’s balance sheet reduction plan, stating that it would not be finalized at the March meeting. While Powell acknowledged that the labor market is well-positioned (over 1.1 million jobs added in the last two months) and that the Fed must intervene with inflation at a 40-year high, he also acknowledged that the situation in the Ukraine is “highly uncertain” and that the Fed is “never on autopilot.” With the duration of the conflict uncertain and with oil prices at the highest level in a decade, it is too soon to deduce the impact these tensions will have on the US economy. With some Fed governors advocating for a more aggressive approach to inflation, the emergence of this geopolitical crisis has almost gifted the Fed the opportunity to be more patient. With the Fed granted more time to see how this crisis unfolds and to monitor if supply chain disruptions ease sooner rather than later, we remain confident in our expectation for four rate hikes in 2022, and the market seems to be edging closer to our view. In fact, the futures market currently expects five to six interest rate hikes for the year, compared to at least seven just a few weeks ago.

- The State Of The Russia-Ukraine Crisis | There are many facets of the Ukraine-Russia conflict that make it unique, including the level of transparency in Russia’s moves thanks to the US Defense Intelligence. But perhaps one of the most remarkable ones, has been the coordinated response around the globe. Political leaders from Sweden, Switzerland, and Germany have stepped away from their traditionally more neutral stance, and even Hungary, which has typically had a positive rapport with Russia, is backing away from its perceived alliance. For instance, Sweden is sending is weapons to a country in armed conflict for the first time since 1939 (when the Soviet Union invaded Finland). Even beyond military aid, countries across the globe have coordinated stringent financial repercussions in an attempt to harm Russia’s economy. But government officials are not the only ones taking action. Companies such as Airbnb are offering housing to refugees, Nike and Apple are no longer selling their products to Russia, Meta and Google have blocked ad revenue, major British and US oil companies have divested from partnerships with Russian energy conglomerates, and airlines such as United are suspending activity in Russia. Add in the worldwide anti-war protests, even amongst Russian citizens, and there is a clear dissent for the militant actions Putin has taken. While this collective effort may not immediately stop President Putin from pursuing his agenda, it’s cumulative devastating impact on the economy (and wealth of his closest advisors) may steer him toward a more diplomatic route.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.