Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Consumer, business, & investor sentiment have declined

- The macroeconomic backdrop may turn more favorable

- Mistiming the market can be detrimental to a portfolio

The equity market was on cruise control, but now headline congestion has the S&P 500 down more than 17% year-to-date—its worst start to a year in at least 25 years.* The initial volatility in January was not quite as worrisome, as the market had withstood two years without a 10% pullback. However, Russia’s invasion of Ukraine became a major roadblock, with oil prices, inflation, and expectations of Fed rate hikes surging. Add in fears of China’s zero-COVID policy worsening supply constraints and slowing global growth, and investors questioned if the economy and the equity market were no longer on a positive route. But before investors head for the exit ramp, we encourage them to assess the underlying fundamentals, put the recent pullback into perspective, and understand just how headline driven the market has become.

- Will The Market Keep Slamming On The Brakes? | With the daily dose of worrisome headlines from around the world, it is no surprise that consumer, business, and investor sentiment has plunged. For example, 70% of consumers believe that the economy is on the wrong track, the net percentage of small businesses that expect conditions to improve over the next six months declined to -50% last month (a record low), and the percentage of bullish investors continues to trend below 20%. If there is a silver lining with this pessimism, it is that much of the negativity is already priced into the market. Below is our assessment of the risks weighing on the equity market and how they may shape the course for equities moving forward.

- Fears The Economy Has Speed Bumps Ahead | We do not agree with the calls for a recession, as neither our long-term nor our short-term indicators suggest that is the case. Over the longer term, the Leading Economic Indicators Index has historically peaked ~13 months, on average, before each of the last nine recessions. It just reached a new record high last month. Over the shorter term, there is no better gauge for the economy’s health than the labor market, and withholding taxes continue to surge to new levels. In addition, the reopening should continue to serve as a tailwind for growth.

- Buckling Up For A Potential Hard Landing By The Fed | In just one year’s time, the market’s expectations for Fed tightening have increased from 20 to 275 basis points!* As the ‘soft versus hard landing’ debate continues, we believe the Fed has reached ‘peak hawkishness,’ and that the Fed’s actual path will not be as aggressive as currently priced into the market. Several Fed members have recently expressed confidence that it is not behind the curve, and that the neutral policy rate is likely between 2.0-2.5% rather than the feared 3.0%+. If inflation trends decelerate and more jobs are added in the months ahead (both of which we expect), the macroeconomic backdrop could turn more favorable for equities.

- COVID Forces China To Make A U-Turn | China’s closure of key cities such as Beijing and Shanghai to stop the spread of COVID has led to a decline in growth forecasts. Since the lockdowns are not a story isolated to China given its position as one of the largest exporters in the world, the fears of worsening global supply chains (and the accompanying rise in inflation) may be eased now that China’s cases have declined ~45% from the recent peak. If this trend continues, lockdowns could be rolled back, and supply chains could start to normalize.

- Russia & Ukraine Crisis Is The Blind Spot | As we’ve said before, the longer the conflict lasts the worse it will be for the global economy and markets. With warnings that Putin is preparing for a prolonged war, with Ukraine refusing to forfeit territory, Western nations continuing to supply advanced military aid, and with historically neutral Finland and Sweden discussing a bid to join NATO, this risk is arguably the biggest and most unpredictable wildcard for the markets.

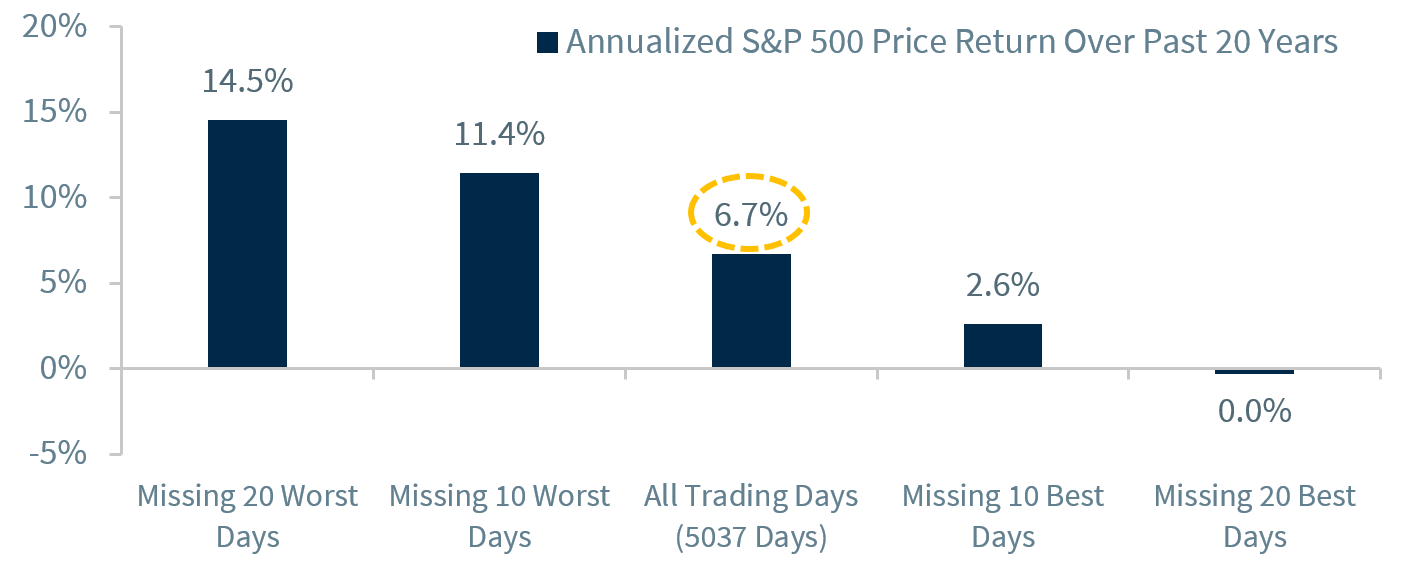

- Should Investors Temporarily Pull Into The Emergency Lane? | Given the unprecedented decline in the fixed income market and equity market (both off to their worst start to a year in +25 years), our most recent webinar on Thursday May 12 (see link above) addresses the question ‘Should You Stay or Should You Go?’, meaning should you stay invested or sell? While that is a challenging question, for most long-term investors, we suggest ‘staying.’ Why? Because market timing is difficult if not impossible—you have to be correct with not only when to sell but also when to buy back into the market. And just missing a few of the ‘best’ days can have a big impact. For example, the average return of the S&P 500 over the last twenty years is 6.7%; but if you missed just the 20 best days, the average return is essentially flat. Given our expectation that a recession is unlikely, valuations are not expensive, and a significant amount of bad news has been priced into the market, our view is that equities and corporate bonds represent attractive risk/reward profiles for long-term investors at current levels.*

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.