Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

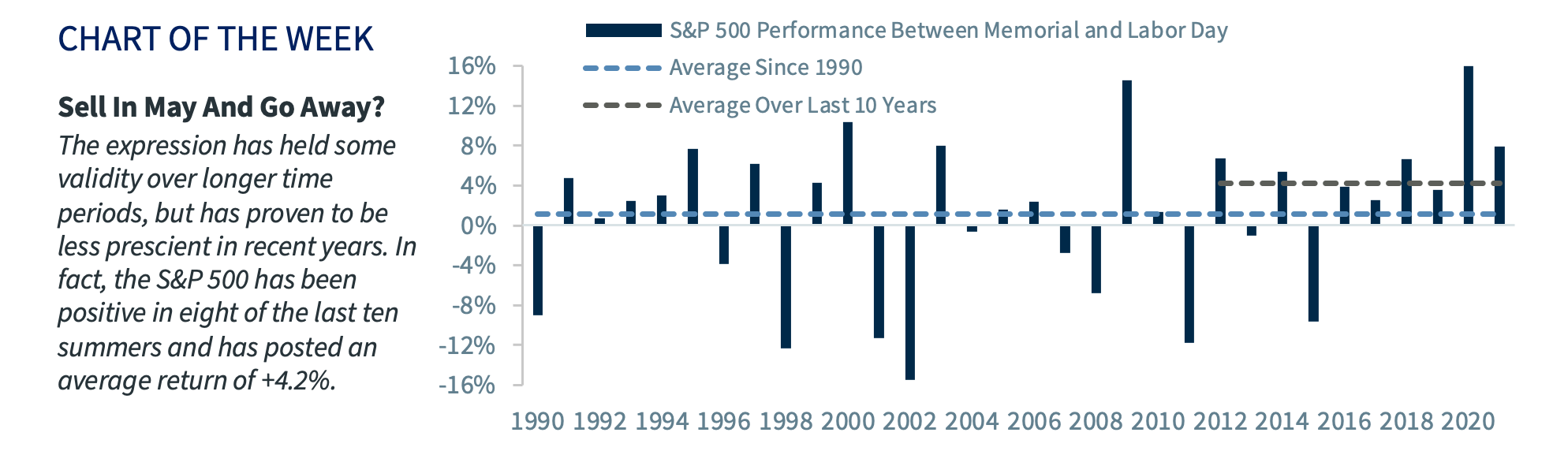

- Misconceptions with ‘sell in May, go away’ expression

- The S&P 500’s history of a summer slowdown

- Keeping an eye on a multitude of events this summer

As we prepare to celebrate the long Memorial Day Weekend, the Investment Strategy Group would like to remember, honor, and thank all of the members of our armed forces who bravely lost their lives in service of our country. After two years of restricted summer activity due to the pandemic, we hope everyone is able to spend quality time with loved ones and we wish you and your family a healthy and restful holiday! Memorial Day serves as the ‘unofficial’ start to summer as the temperature heats up, school ends, and vacation season begins. While the volume of miles driven has historically spiked between now and Labor Day (the ‘unofficial’ end of summer), pent-up demand and the ability to travel safely will likely lead to a vacation boom! But as more people put up an ‘out of office,’ sign do not lose focus on the markets as there are significant market-moving events in the offing.

Sell In May And Go Away? | As many investors prepare to take a long overdue vacation, some are questioning if their equity portfolios should do the same given the levels of volatility we have seen lately. While there are viable risks to weigh (e.g., Fed policy path, war in Ukraine, still elevated inflation, record gas prices), don’t let this old adage determine whether or not you take a hiatus from being invested in the equity market. The old expression of ‘sell in May and go away’ (defined as the S&P 500’s performance between Memorial Day and Labor Day) has held some truth over longer time periods, with the S&P 500 posting a paltry return of ~+1.3% since 1990; but it has proven to be less prescient in recent years as it has posted an average return of ~+4.2% over the last ten years. While the returns have been predominantly positive, volatility has tended to heat up as the S&P 500 has suffered an average drawdown of 8.4% since 1990 and at least a 5% pullback ~65% of the time at some point during the summer.* With the correction (e.g., a decline of 10%+) already experienced this year, it is hard to imagine a more volatile environment. If there is a silver lining to the negative volatility year-to-date, it is this: in the ten years since 1990 that the S&P 500 has entered Memorial Day with negative YTD performance, it has produced positive performance during the summer 70% of the time. The 30% of the time it was negative, it coincided with a recession or ‘excess’ valuations from the dot.com bubble. Given that a recession is not our base case, these are the five dynamics that could dictate market direction between now and Labor Day:

- 1. The Sun May Set On Inflation Fears | The war in Ukraine and reinstated COVID restrictions in China delayed the resolution of global supply chain issues. However, the Consumer Price Index reports (June 10, July 13, & August 10) should confirm that inflation has reached its peak and that pricing pressures have started to decelerate.

- 2. Job Reports Will Feel The Heat | Despite the unemployment rate falling to a post-pandemic low, the labor market still has ~700k jobs to recover as a result of the pandemic. Job report releases, one of which occurs just after the July 4 weekend, may weigh heavily on overall investor sentiment and economic prospects. This is especially true given that robust job gains and consistent wage growth have helped the consumer combat inflation. With the Fed unable to control certain aspects of inflation (e.g., gas and food prices), the economy needs job growth of ~300k to attain our 2.4% GDP estimate this year.

- 3. The Fed May Make Waves With Policy Shifts | Between the Federal Open Market Committee (FOMC) Meetings in June and July, and the Jackson Hole Summit in August, the Fed has many opportunities to adjust its rate hike plans as it receives more data. The Fed has the challenge of simultaneously taming inflation while avoiding a too aggressive approach that could stifle demand and tilt the economy into a recession. We expect the Fed to become less aggressive in the second half of the year.

- 4. 2Q21 Earnings To Shine A Light On The Consumer | This current earnings season (1Q22) has revealed an anticipated trend: a shift from goods to services spending. However, the magnitude at which consumers changed behavior caught retailers by surprise, leaving many with excess inventory. While we look for still strong earnings to power the equity market higher, we will also monitor CEO commentary as we expect this trend will be magnified in the months ahead.

- 5. Soaking Up A Slew Of Political Events | With the war in Ukraine still intense and fears that China’s ambitions to one day capture Taiwan are growing, a number of meetings amongst global leaders this summer (e.g., the 48th G7 Summit) could escalate or subdue these geopolitical hotspots. On the domestic front, a calendar packed with primaries will start to shape the political landscape ahead of the November midterm election.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.