Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Indications that inflationary pressures are easing

- Retailers have inventory to offload with deal days

- Market reactions to earnings results will be magnified

Tuesday was the summer solstice, the longest day of the year and the beginning of the astronomical summer. The day is thought of as the perfect time of year as Americans get as many as eight additional hours of sunlight relative to the shortest day of the year in December, and temperatures are mild relative to the heat and humidity of July and August. The equity market is experiencing a summer solstice of its own, except this time period is anything but perfect for investors. Uncertainty remains elevated, therefore volatility does too. And as the financial markets await answers to their concerns over the state of the economy, Fed policy, and more, it may feel as though these are the longest days of the year for investors. While staying patient is easier said than done, the following developments and events in the weeks ahead should start to alleviate some of the uncertainty.

- Fed Commentary Will Be Hot Off The Press | The May inflation report was a game changer. When the peak in inflation remained elusive for yet another month, the market became intensely fearful that the Fed would need to pursue an aggressive path to tame it – even if it meant inducing a recession. The Fed acted as the market expected just days later, when it implemented a 0.75% hike for the first time since 1994 after suggesting rate hikes of that magnitude were off the table just weeks prior. However, the Fed will receive several inflation prints (Personal Consumption Expenditures on June 30, Consumer Price Index on July 13, and the Producer Price Index on July 14) before its next meeting (July 26-27) and there are several indications that inflationary pressures are easing. Transatlantic freight costs are falling, fertilizer costs are descending from the spike induced by the war in Ukraine, copper prices are falling, and the national average gas price is back below $5 per gallon – just to name a few. As many times as Chairman Powell has said the Fed is committed to fighting inflation, he has also stressed that the committee will remain flexible. While we are hopeful that the Fed can ease its hawkish rhetoric at the July meeting, the easing of price pressures could at least allow for a more patient stance come the September meeting – which will be welcomed by the markets.

- Goods Inflation No Longer On A Hot Streak | Another factor that could support our thesis of declining price pressures is the major retailer savings events spurred by Prime Day (July 12-13). Last year, Amazon’s 48-hour mega sale alone resulted in over $10 billion of sales, and that excludes the deal days hosted by other competitors such as Target, Walmart, Best Buy, and Lowe’s. With many larger retailers acknowledging substantial upticks in inventory levels – in some cases 20% to 30% above pre-pandemic levels – the expectation is that there will be significant deals to clear the decks of this bloated inventory. These lower prices would support our expectations that goods inflation is beyond its peak.

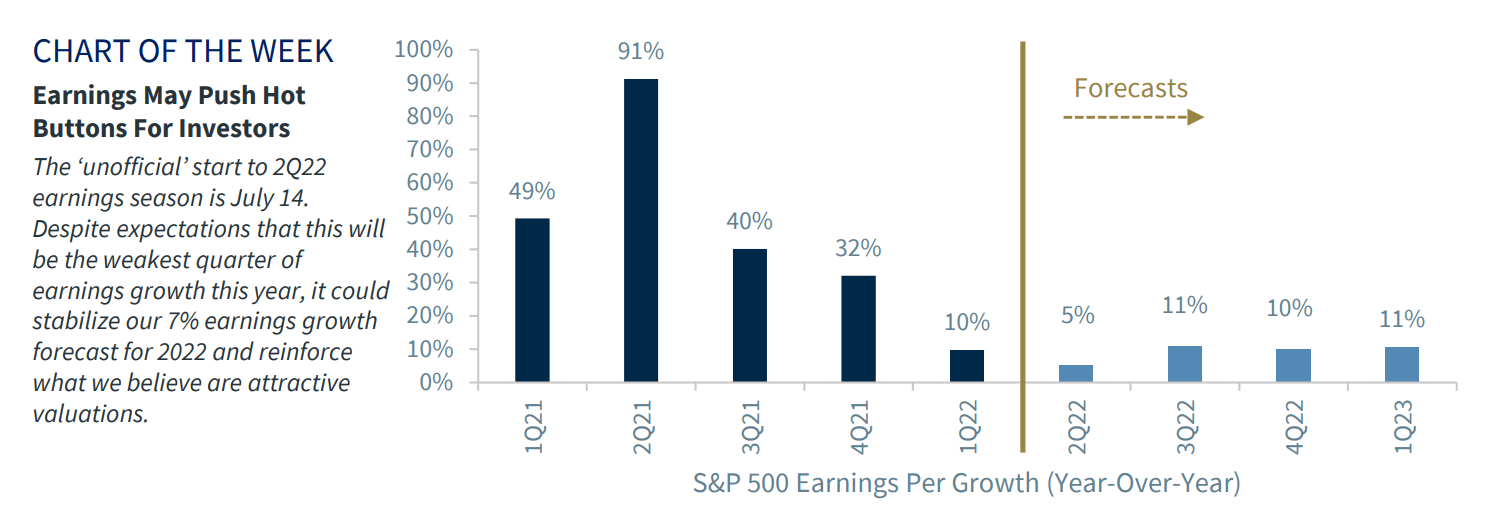

- Earnings May Push Hot Buttons For Investors | The bar for earnings expectations was set high last year, especially when the S&P 500 posted earnings growth of over 90% in 2Q21 as the global economy reopened from its pandemic-induced hibernation. But as the economy has been operating more fully, 2Q22 earnings growth will face tough comparisons on a year-over-year basis. In fact, it is expected to be the weakest quarter of earnings growth this year, albeit still positive at 5%. Perhaps even more important than the top and bottom line results will be CEO forward guidance. The first quarter earnings season rattled the markets when companies reported signs of slowing spending, elevated inventories, and isolated (but still persisting) supply chain challenges. With investor sentiment in a sensitive state, market reactions to earnings beats and misses will likely be magnified. If the small number of companies that have reported so far serve as a harbinger (80% have beat EPS and 88% have beat sales estimates), earnings growth estimates should remain stable and support our ~7% earnings growth forecast for 2022.

- Need Recessionary Talk to Simmer | Consumer spending accounts for ~70% of GDP, so it’s no wonder the markets focus intently on consumer spending patterns. In our view, the ability for consumers to spend, and the reason we do not see a recession this year, is supported by strong job growth, wage gains, and abundant savings. And strong activity during the summer – air traffic, hotels, restaurants, and resorts – support the view that consumers are willing to spend on services. Admittedly, 2023 could be different as our economist believes there is a 60% probability of recession unfolding in Q2 and Q3 next year. However, note that it is expected to be very mild with GDP declines of 0.1% and 0.2% respectively – which would be the weakest recession on record.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.