Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Shift to services occurring at a rapid pace

- Positive returns often follow depressed sentiment

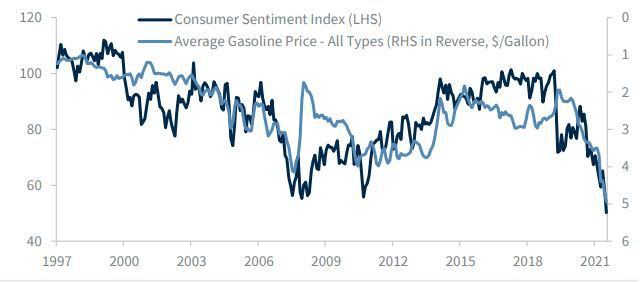

- Strong correlation- between gas prices & sentiment

It’s been over 200 years since the discovery of the Rosetta Stone. The 2,000 year-old carving enabled the decipherment of the Egyptian hieroglyphics that had puzzled the world for centuries, unlocking the mysteries of Egypt’s past in the process. The duration of the Ukraine crisis, China’s zero-tolerance COVID policy, and elevated inflation have caused a great deal of mystery in the markets, all of which has resulted in the worst start to a year in decades for both equity and fixed income investors. Although we don’t quite have a Rosetta Stone to predict the market’s perplexing future, we do have clues that can help us crack the code of what’s to come for the economy and various asset classes. As we enter the second half of 2022, we’ll borrow from ancient Egyptian history as we set forth our economic and financial market views for the remainder of the year and beyond.

- Reading The Economy From Left To Right & Top To Bottom | Entering the year, the economy appeared to be an easy read. In the aggregate, consumers were well positioned due to strong job growth, wage gains, and abundant savings, and the only question was how quickly consumers would shift spending from goods to services. The answer turned out to be immediately, as consumers have returned to pre-pandemic activities near or at record speeds. For example, TSA screenings are at a post-COVID high, 2.5 million weddings are expected this year which is the most since 1984, and over 70 million concert tickets have been sold year to date—36% above 2019 levels! In our view, pictures of resorts, restaurants, airports, and venues are worth a thousand words, and strongly suggest that the US economy is not currently in the midst of a However, persisting inflation is a risk to the downside. Metrics such as normalizing money supply growth, bloated inventory levels, and peaking or falling prices for freight routes, semiconductors, and fertilizer suggest that inflation is decelerating and that the Fed may not have to raise interest rates as aggressively. But with business and consumer confidence falling and the Fed on the path of taking interest rates into ‘restrictive’ territory (at least temporarily), the probability for a recession in 2023 is rising. If a recession does occur, our economist currently forecasts it to be the shallowest contraction in the post-World War II era.

- Dry Times Bring Us Back To Equity Market Basics | As much as the equity market has evolved, volatile times inspire us to get back to the basics. After the S&P 500’s worst start to a year since 1970 and the end of the shortest bull market on record, we encourage investors to focus on the basics: valuations, earnings growth, and corporate shareholder actions.* As we mentioned above, our economist projects that if a recession occurs it will be mild in nature. Historical dynamics suggest that the equity market has priced this in. Timing the market’s bottom is no easy feat but investing in equities following a selloff of the magnitude we experienced over the last few months has historically paid off. In fact, since 1950, the S&P 500 has rallied about 15% on average and is positive 70% of the time after a 20% drop in the index. The historical performance following depressed sentiment is favorable as well. But ultimately, it is attractive valuations, mid-single digit earnings growth, increased dividends, and robust buybacks that supports our year-end and 12-month S&P 500 forecasts of 4,180 and 4,400, respectively.

- Oil Prices Could Be The Straw That Breaks The Global Economy’s Back | With gas prices just below $5 per gallon, drivers have dreaded seeing the fuel light appear on the dashboard. History reveals a strong correlation between gas prices and consumer sentiment, and with current prices translating to an additional $600-$850 expense for the average driver it’s no wonder sentiment has trended lower. And if consumer and business confidence sink simultaneously, spending could retreat and create a self- fulfilling prophecy recession.* With his approval rating tied to overall economic sentiment, President Biden and his administration continue to look for ways to ease price pressures at the pump—but a viable solution remains elusive. In the meantime, OPEC and the US are keeping pace to make up for the lost production from Russia. But in order for prices to move sustainably back below $100 per barrel, we’d likely need abundantly more output and/or an end to the war in

For a more in-depth explanation of the Investment Strategy Committee’s views, please read the third quarter release of the Investment Strategy Quarterly: https://go.rjf.com/3Q22ISQ. The publication includes a letter titled “Deciphering the Market’s Difficult Message” from our Chief Investment Officer Larry Adam, which provides additional insights into the above topics and more.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.