Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Labor market trends are not indicative of a recession

- Reduction in inventories weighed heavily on 2Q GDP

- U.S. economy should be stronger moving forward

Tomorrow is the final day of Shark Week! The series is a cultural phenomenon, with millions of viewers tuning in as researchers seek to unravel the mysteries of the ocean’s notorious predator. But as entertaining as the content may be, the true intent of the program is to educate viewers and correct misconceptions about sharks. As it relates to the financial markets, the release of the second quarter GDP report has become a phenomenon of its own. After two consecutive quarters of negative growth, investors are wondering if the economy is officially swimming in recessionary waters. Despite Chairman Powell confirming that the Fed was not taking this bait just a day prior at the July FOMC meeting, the concern is still top of mind for investors. Therefore, we’re looking to clear up the misconceptions and confirm why we don’t believe the economy is in the depths of a recession.

- The Economy Is Not In The Jaws Of A Recession | Last week’s Weekly Headings explained thedifference between a ‘technical’ and an ‘actual’ recession. While the economy’s 1Q and 2Q contraction meet the ‘technical’ definition, we doubt the official arbiter of recessions, the National Bureau of Economic Research (NBER) will declare the economy is in a recession for two reasons:

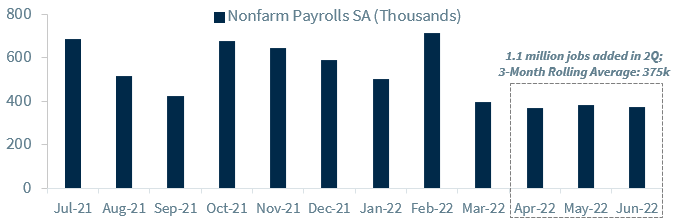

- A Habitat Fit For Survival | We believe investors would be mistaken to only look at the GDP report when determining whether the economy is in a recession. When it comes to our rationale as to why we are not, we’re in agreement with the Fed— look at the labor market! The three-month moving average of job gains is ~375,000, nearly 4.5x the historical average of ~80,000 jobs added at the start of a recession. The unemployment rate of 3.6% would be the lowest at the start of a recession since 1969 and the third lowest in the post-World War II era. There are other factors to consider as well. For example, industrial production is rising more than 4% year-over-year, and durable orders just notched the largest month-over-month increase since January. So, despite a negative 2Q GDP, there is evidence that the economy remains strong beneath the surface.

- Inventories Took A Bite Out Of GDP | To echo Chairman Powell’s more positive view, there are “too many areas of the economy that are performing too well” and although growth is slowing, it is “for reasons that we understand.” For the second quarter, a reduction in inventories alone caused a 2.0% detraction to growth. Is this such a bad thing? Inventories being worked down to more normal levels is a sign that consumers are still buying. Government spending retreating from record levels during COVID should not be a surprise and is likely to become less of a drag as we move further away from the fiscal stimulus programs.

- Economy Will Break Out Of The Negative Growth Cage | Our economist and consensus estimates indicate a growth bounce in both 3Q and 4Q, with our forecasts at 0.9% and 0.4% respectively. Below trend forecasts are unsurprising as Chair Powell suggested that the economy would be in a period of sub-trend (not recessionary) growth to help normalize inflationary pressures. However, with a slow growth trajectory, the economy does become more vulnerable to recession risks. But with nearly one third of 3Q complete, early signs suggest continued strength and improvement across several indicators:

- Services Spending Is Not A Drop In The Ocean | Services spending was additive to GDP in the second quarter, but key summer months for traveling, July and August, will shift the majority of travel spend to the third quarter. Payment processors continue to emphasis the surge they have seen in travel-related expenses.

- Goods Spending Is Still Making Waves | Amazon’s Prime Day is historically held in June, but this year it was hosted in July. Therefore, the nearly $12 billion in spending will benefit third quarter GDP. During the two-day event, consumers purchased over 300 million goods and at one point, over 100,000 goods per minute! Given that Amazon wasn’t the only retailer to host a deal day, we anticipate the sales holidays and the back-to-school shopping season to bolster consumer spending in 3Q22. In addition, there should be tailwinds from industries that have yet to return to pre-pandemic supply levels (e.g., auto sales).

- Lower Gas Prices May Shift The Tide On Sentiment | Gas prices have fallen ~$0.75 per gallon from the peak. Higher fuel expenses limit other consumer discretionary purchases and have a negative impact on consumer sentiment. As we hope to avoid a self-fulfilling prophecy, the recent decline in gas prices should benefit consumers’ view of the economy. A bounce back in financial markets could also stimulate spending as consumers feel wealthier and more inclined to spend.

- Earnings Not Tanking | Despite dour projections, 2Q earnings season has been better than feared with top line revenue and earnings growth at 11.6% and 6.8% respectively. While there have been some notable disappointments from the one-time pandemic beneficiaries (i.e., streaming companies, mass retailers, and at-home services), the earnings and guidance of major technology, e-commerce, financials, industrial and healthcare companies remain solid.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.