Weekly investment strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The third quarter 2022 earnings season may be better than feared

- The consumer is healthy but becoming more discerning

- Strong earnings expected from the energy sector

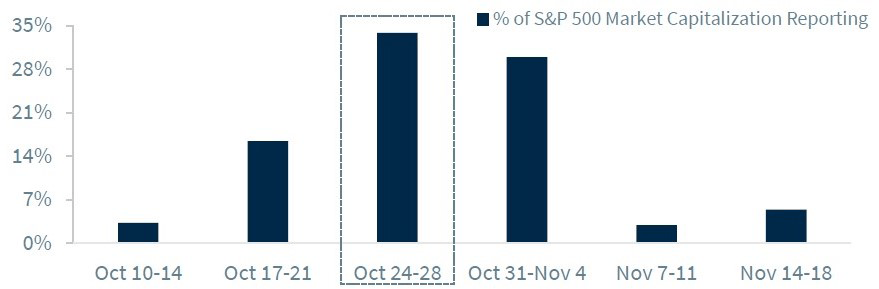

Yesterday was World Statistics Day! While it is only officially celebrated every five years, we can always appreciate the importance of statistics in our everyday lives. Whether it’s calculating the time it takes to get to the office, breaking down a monthly budget, or monitoring the weather, numbers are all around us. And over the next two weeks, when over 60% of the S&P 500’s market capitalization reports third quarter earnings, investors will have even more statistics to analyze. But as we’ve said before, it’s not just the results but the accompanying forward-looking commentary from CEOs that helps craft our outlook for the months ahead. Why? The results are backward looking, but the projections for the future give us real-time insights or ‘boots on the ground’ analysis.

- Beyond The Numbers Of The 3Q22 Earnings Season | The bar for earnings was set high last year, especially when the S&P 500 posted earnings growth of over 90% in 2Q21 as the global economy reopened from its pandemic-induced state. Fast forward to this year, and earnings are facing tougher comparisons on a year-over-year basis. Add in the elevated risk of a recession, still hot inflation, and an aggressive Fed tightening cycle, and it is of little surprise that the sentiment surrounding the current 3Q22 earnings season is cautious. We have reason to believe the 3Q22 earnings season will be better than feared and could become a positive catalyst for equities just as the 2Q22 results were. Here are our early takeaways and the trends we will be monitoring:

- Consumers Still Coming Out In Large Numbers | The consumer is the crux of the economy, and so far, banks see few signs of distress. For many, credit spending rose by double digits, savings were still healthy, and delinquency rates remained low. Credit card companies such as Visa report next week and may prove that the recession calls earlier this year were premature.

- Perspective On The Numbers We’re Crunching | Earnings results are backward looking. Do you remember the Fourth of July? Because that is one of the months included in the time period covered. Forward guidance will be key in the midst of recession fears, and overall, it remains resilient as the net percentage of companies raising rather than lowering their forward outlook is positive. For example, the ‘Summer of Revenge Travel’ was known to benefit the airlines, but commentary from United, American and Delta Airlines suggests demand remains strong for the months ahead and into 2023. Ultimately, the broader based and better the forward guidance, the higher the confidence in our $215 S&P 500 earnings target for 2023.

- Inflation Isn’t Just A Number | Consumers remain healthy, but it is clear that they have become more discerning. Therefore, spending growth may be driven by price increases while volumes are either flat or declining. Such was the case for Pepsi and Procter & Gamble. Consumers are balking at higher prices, with Lennar attributing the housing market pullback to affordability and CarMax noting a “market-wide decline in used auto sales” due to cost. These are just two of the many examples.

- A Number Of Supply Chain Improvements | While there may be a few pockets of constraints, supply chains are improving in the aggregate. Trucking and rail companies have noted that they are still handling growing volumes, retailers such as Nike acknowledged increasing inventories as both old and new orders are now being delivered, and semiconductor companies are likely to comment on improving supply after chip lead times just posted their largest monthly decline since early 2017.

- Days Of Higher Input Costs May Be Numbered | The prices for critical commodities have improved, but some time may still be needed before these still elevated costs stop weighing on aggregate margins. McCormick was one of the firms that acknowledged that easing pricing pressures won’t be beneficial until their existing long-term supplier contracts start to expire.

- A Numbers Game For Financials | Financials, particularly large money center banks, are one of the leading beneficiaries of higher interest rates, and yields are now at multi-year highs. As a result, of the companies that have reported thus far, net interest income has increased by ~$20 billion on a year-over-year basis – which is an impressive 30% increase over that time.

- The Dollar May Do A Number On Multinationals | A strong dollar has been a drag for even some unsuspecting companies such as Johnson & Johnson, Netflix and Levi’s, but it will especially be a headwind for multinationals. While the degree of the impact depends on the blend of costs versus sales overseas and how much of the currency risk is hedged, a stronger dollar typically impairs earnings. The ~13% appreciation of the trade-weighted dollar year-over-year is likely to be highlighted.

- The Force Of The Energy Sector’s Numbers | The Energy sector is expected to post both the strongest sales and earnings growth, much of which is attributable to the year-over-year gains in energy prices. For example, the average price of WTI crude was $70.64 in the third quarter of last year. This year it was $93.24 – an increase of over 30%!

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.