Weekly Investment Strategy

Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

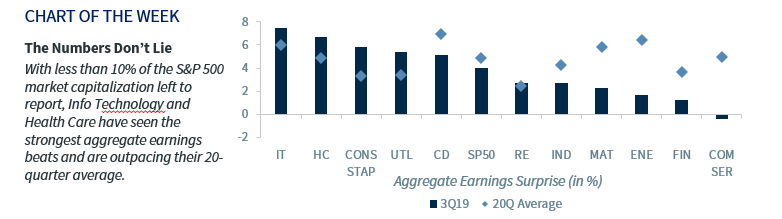

- Info ‘Technology’ Boasts the Strongest Aggregate Beats

- The ‘Art’ of Interpreting Earnings & Future Guidance

- Lower for Longer Yields Provide ‘STEAM’ for Equities

Today, November 8, we celebrate National S.T.E.A.M. (Science, Technology, Engineering, Art & Mathematics) Day. This date is appropriate as “NOV-8” is a play on the word ‘IN-NOV-ATE,’ an attribute necessary to maintain the competitive edge of the US economy. Many schools have adopted these areas of focus to instill the value of a well-balanced education in students. As your Investment Strategy team, it is our responsibility to be innovative and well balanced in how we conduct, construct and disseminate our market views. Admittedly, while there are clearly S.T.E.M aspects to analyzing historical numbers and trends, there is an ‘Art’ to how we convey our outlook. Consistent with our approach, we overlay the S.T.E.A.M. subjects to our assessment of the third quarter earnings season.

- Science Behind The Strength of Health Care | With less than 10% of the S&P 500 market capitalization left to report, the Health Care sector has been a standout with 85% of companies beating EPS estimates. The magnitude of beats has been impressive too, with companies topping estimates by 6.7% on average, well above the previous 20Q average of 4.9% and the S&P 500 average of 3.9%. These results arrived at an opportune time, as political risk associated with Medicare-For-All proposals have kept the sector ‘under the microscope.’ Health care costs will undoubtedly remain a top concern amongst both parties as we go further into the election cycle, but we think the sector’s underperformance is overdone. Health Care has trailed the S&P 500 by 8.8% over the last 12 months, and is trading at a significant discount (~15%) to the broader market. Favorable demographics, attractive valuations and earnings momentum lead us to remain constructive on Health Care.

- Technology At The Top | While technology is ever-changing, one thing has remained the same—the sector’s outperformance. Technology is up ~40% year to date, outpacing all other sectors by at least 10% and the broader market (S&P 500) by ~15%. Therefore, it is no surprise that the sector has had the strongest aggregate beats of any sector at 7.5%, topping its 20Q average of 6%. While trade tensions and a stronger dollar could weigh on the outlook, 2020 earnings are expected to rise 10% year-over-year. This estimate has been resilient throughout this earnings season, rising 0.5% and making it the only sector to see positive revisions. The Technology sector remains one of our favorite sectors due to the secular trend of rapid advancements across our entire economy, from artificial intelligence to robotics to medical enhancements to communications. In the near term, continued strong earnings, attractive valuations, buybacks and seasonality reinforce our positive view.

- Engineering Earnings | Share buybacks continue to support this bull market. From 2016 to 2018, S&P 500 companies bought back ~$650 billion in stock annually, on average. 2018 saw the largest amount of buybacks of the three years, with companies purchasing ~$830 billion of their own stock. These buybacks have not only boosted the attractiveness of equities for investors (~3.5% buyback yield), but have also financially ‘engineered’ earnings growth. Over this same time period, earnings growth outpaced net income growth by ~7-8%, which suggests that buybacks added ~2-3% to earnings growth on an annual basis.

- Art of Interpretation | While 3Q19 earnings growth is projected to decline 1.5% year-over-year, it is up to investors (and us) to interpret the results and guidance from management and ‘paint a rosy or dark picture.’ We choose a more optimistic view on earnings, because top line revenue growth remains healthy at ~5% (and it is rare to go into an earnings recession without negative sales growth), management guidance remains positive with little reference to a recession and global growth appears to be bottoming (especially if we get any truce in the trade war). As a result, we forecast 5-6% earnings growth in 2020, which will be necessary for the equity market to move higher as the 18.7x LTM P/E leaves little, if any, upside for multiple expansion.

- Mathematics of the Market | When we do the math, lower for longer interest rates should be supportive of equity valuations. Discounting dividends or earnings back to present value increases valuations the lower interest rates fall, especially with US Treasury yields near multi-year lows (10-year Treasury yield: 1.94%). Global negative yielding debt, currently accounting for ~22% of total outstanding global bonds, also makes equities attractive on a relative basis. As an example, ~50% of the S&P 500 constituents have a dividend yield above the 10-year Treasury yield. Given that low global yields could potentially stimulate the global economy and earnings growth, this should provide the ‘steam’ to power equity markets moving forward.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.