Weekly Investment Strategy

Key Takeaways

- Virus should not ‘hold down’ global economy for long

- Strong equity market fundamentals are not a ‘lie’

- ‘Reality’ of delegate projections starting to set in

Jiminy Cricket! It’s been 80 years since the release of Walt Disney’s Pinocchio, an animated film about a puppet brought to life by a fairy so that he can prove himself worthy of becoming a real boy. One of the key values Pinocchio must possess to succeed (and to keep his nose from growing) is truthfulness. Truth is the cornerstone of our outlook, even if it means expressing pessimistic rather than optimistic views. Overall, we remain constructive on the US economy and asset classes like equities, but with a degree of caution as risk is still relevant (e.g., coronavirus, dollar strength, complacency, etc.) and since the fast start to the year has led some markets to approach our year-end targets (i.e., S&P 500: 3,400) earlier than expected. As we celebrate the iconic film’s anniversary, we borrow several of its songs and themes to help summarize our insights for this week.

- US Economy Has ‘No Strings To Hold It Down’ | Pinocchio famously sings that he has “no strings to hold him down, make him fret, or make him frown.” Given the health of the labor market, resiliency of consumer spending, and other signals of strength from our preferred leading economic indicators, there isn’t much to ‘frown’ at when discussing the US economy. But it is important to constantly evaluate the factors that could ‘hold down’ this record run. The potential contagion effect of the coronavirus appears to be the most credible threat, causing investors to ‘fret’ about global and US growth expectations, especially when Chinese government actions have been questioned and a few US companies lowered their Q120 earnings guidance. We remain confident that the Trump Administration and various public health agencies have and will react proactively to mitigate any major spreading of the disease in the US. But until the virus is contained in China, it will remain difficult to quantify the resulting impact to the Chinese and global economy. While interest rate cuts and liquidity injections from the People’s Bank of China will cushion any impact, evaluating the situation across the globe ~100 days after the start of the outbreak (by early April) will help determine whether or not the coronavirus will significantly harm economic growth beyond the first quarter. Assuming that more than 80% of Chinese production capacity is reactivated and the number of reported new virus cases is on a consistent downtrend within this timeframe, our expectation is that the virus will only be a short-term disruption, and not a ‘string’ that will negatively ‘manipulate’ the forward path of the US economy.

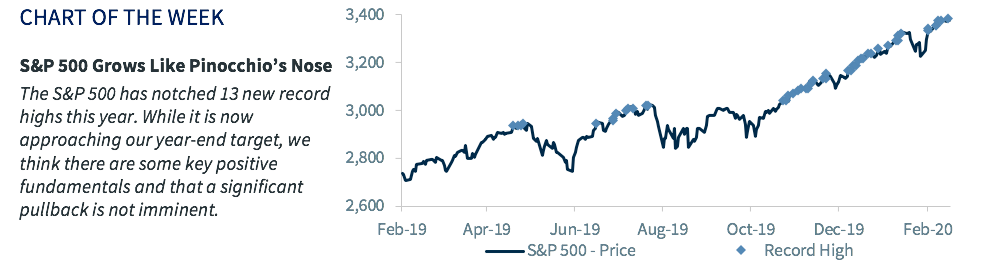

- ‘Truths’ About The Equity Market | The fairy that brings Pinocchio to life tells him that “a lie keeps growing and growing until it is as plain as the nose on your face,” but we think there are a few obvious ‘truths’ about the current state of the equity market. Although the S&P 500 has notched 13 new record highs this year (five occurring over the last two weeks) and is quickly approaching our year-end target, key fundamentals should provide support moving forward and mitigate the potential of a significant near-term pullback. First, the S&P 500’s expected earnings growth for the fourth quarter has now reached 1.6%, much improved from the -1.6% figure at the start of earnings season, and growth expectations for 2020 are a healthy 8%. Second, dividend growth expectations (~6-7% in both 2020 and 2021) should be a positive for equities, especially given the current low interest rate environment. But of course, when the market rallies and valuations become more stretched, selectivity becomes increasingly critical. We continue to favor more cyclical sectors such as Technology and Communication Services, which exhibit the best combination of attractive valuations and robust earnings growth prospects.

- Election ‘Wishes’ And ‘Realities’ | The Democratic Party’s ‘wish’ for a ‘star’ frontrunner has yet to ‘come true.’ With only ten days to go before Super Tuesday, the probability of a brokered convention has risen (53% according to PredictIt) as the ‘reality’ of the delegate projections begins to set in. Based on our post Super Tuesday projections, Sanders would need ~60% of all remaining delegates while other candidates would need over 70% to capture the nomination outright—a very tall order! This appears to be a re-election ‘wish come true’ not only for President Trump, but for a financial market hoping that the 14% 2018 corporate tax cut will not be rolled back as it would likely reduce earnings growth and serve as a headwind for equities.

- Always Let Your Asset Allocation ‘Be Your Guide’ | Pinocchio is told to “always let his conscious be his guide” but he also has help from his friend Jiminy who is quick to step in whenever he thinks Pinocchio is about to make a mistake. For investors, your asset allocation should be your guide, supplemented by ongoing discussions with your financial advisor. Having a plan for more volatile periods in the market will lessen inopportune emotionally-driven decisions from being made.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.