Weekly Investment Strategy

Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Expectations for Fed action ‘leap’ higher on virus fears

- Selectivity is critical should you ‘leap’ into equity market

- Yields fall to record lows as investors ‘leap’ to safety

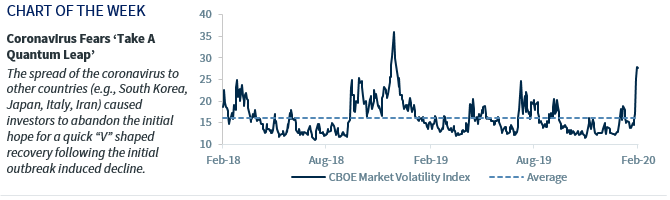

Leap days occur every four years to synchronize our calendar with the actual time it takes for Earth to orbit the sun—365.2421 days to be exact. The difference may seem small, but a quarter of a day annual imbalance adds up so leap days exist to ‘correct’ the timing of this rotation. Financial markets experienced their own ‘correction’ this week, as the spread of the coronavirus ‘adjusted’ prolonged depressed levels of market volatility and heightened levels of complacency. The removal of overly bullish sentiment is healthy for the equity market, but the escalation of the virus presents a unique near-term downside risk catalyst for risk assets. The spread of the coronavirus is accompanied by a multitude of fears (e.g., human fatalities, contagion fears, slowing global growth), so we ‘leap at the opportunity’ to incorporate our thoughts on the virus into our investment views.

- We Cannot ‘Leap To Conclusions’ About Future Fed Action | We have already seen accommodative monetary policies from China in the form of liquidity injections and interest rate cuts, and other central banks around the globe will likely follow suit should the economic situation in their country or region deteriorate. However, we believe that the markets may be underestimating the Fed’s data-dependent nature as expectations for a March interest rate cut spiked to 100% this week with growing expectations the Fed may cut as many as four times this year. At this time, we believe these elevated expectations are too aggressive given the continued strength in the labor market and consumer spending. While we have no doubt that the Fed will respond proactively if the economy weakens, we are seeing limited, if any, signs of domestic weakness thus far. We will keep a close eye on both consumer and business confidence as any weakness could serve as a harbinger of a more significant economic slowdown. One other potential policy tool at the President’s disposal is to incrementally cut/suspend Chinese tariffs in the near term to boost corporate and investor sentiment and support global trade. Our base case is that the US economy will not enter a recession in 2020 and that the substantial amount of monetary easing being put into the global economic pipeline by other foreign central banks will lead to a healthy rebound in growth during the second half of the year.

- ‘Look Before You Leap’ Into The Equity Market | When the initial outbreak of the coronavirus occurred in January, the financial markets were complacent, expecting a quick “V” shaped recovery similar to that of previous viral outbreaks. In fact, despite a rise in the number of coronavirus cases in China, the S&P 500 went on to notch new record highs (and approach our 3,400 year-end target), valuations swelled (LTM PE 20.5x) and the Volatility Index fell below 14.0. However, once the number of cases outside China moved sharply higher, sentiment changed and the S&P 500 experienced its first 10.0%+ correction since December, 2018 and the fastest 10% decline from record highs in history (six days!). In recent times, we viewed such pullbacks as buying opportunities, emphasizing solid fundamentals that remained supportive of the equity market (e.g., strong economic data, shareholder-friendly corporate actions and attractive valuations given low interest rates). We were particularly confident during last year’s trade-related pullbacks as we had an unwavering conviction that President Trump would secure a deal to avoid an economic slowdown and boost his re-election prospects. Unfortunately, the potential complications surrounding the coronavirus are more unpredictable and make us more cautious. Despite the low mortality rate for the virus (RJ estimate: 1%), the rise in the number of cases outside of China (e.g., Europe, South Korea, Iran, etc.) and the growing potential of an outbreak in the US (one in three odds) will continue to raise doubts about the resiliency of US economic and corporate earnings growth. While ~38% of S&P 500 companies have mentioned the coronavirus in their earnings transcripts, more time is needed to gauge the true impact, which will likely continue to induce volatility. It remains our base case that the virus will peak late Q1/early Q2 and that an economic and earnings rebound will ensue. As a result, we reiterate our year-end 3,400 S&P 500 target but suggest patience in committing new capital to the equity market.

- Bond Prices Move ‘Leaps And Bounds’ | The market impact of the coronavirus has led to a ‘flight to safety,’ with Treasuries rallying and once again exhibiting the benefits of having a diversified portfolio. The 30-year and 10-year Treasury bonds have surged over 12% and 5%, respectively, since the outbreak began as yields plummeted to record lows (10-year Treasury yield: 1.16% & 30-year Treasury yield: 1.68%). However, if and when virus fears fade, this sharp rally is likely to reverse itself.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.