Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

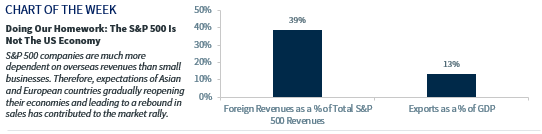

- The S&P 500 is not a ‘copycat’ of the U.S. economy

- The Federal Reserve ‘gets an “A” for effort’ & execution

- Vaccine developer will win ‘valedictorian’

Today is National School Principal’s Day! We are always grateful for our nation’s educators, but with more than 50 million children out of school due to COVID-19, we are especially thankful for their efforts to provide students with distance learning. The unprecedented nature of the virus has challenged the school of economic and investment thought, and the unknown magnitude and duration has posed obstacles in formulating a concrete outlook. We rely upon the ‘history’ of the market and the ‘science’ of evaluating economic indicators, but this period of uncertainty has pushed us to ‘think outside the box,’ and add an element of creativity to our investment views. As any teacher knows, great students ask great questions, but the same could be said of any thoughtful investor. When it comes to the equity market, investors are questioning if the recent rally is inconsistent with the economic downturn and wondering what catalysts have the potential to propel it further in the long term.

- Knowledge Is Power: The Stock Market Is Not The Economy | Simply put: a robust economy drives earnings growth, and earnings growth propels equity prices and vice versa. But in understanding the recent market rally, it is important to recall that the equity market is a forward-looking indicator. In fact, history suggests the market bottoms ~4 months before a recession ends. So this rally is looking at the prospects for the economy four months hence in August—a time period that could experience steady improvement. Taking this a step further, there are several other factors that articulate how the S&P 500 is not the US economy.

- Size | S&P 500 companies only represent 500 of the more than 28 million companies in the US economy. In addition, small businesses make up 48% of people employed and the industries where small business employment dominates—agriculture, construction, real estate and entertainment— have been hampered by the lockdown.

- International Sales | Approximately 40% of S&P 500 revenues come from overseas whereas small businesses get little, if any revenues from overseas. As a result, if China is coming back to full strength, followed by Europe, than the large multi-national companies in the S&P 500 will have a head-start in seeing their businesses turnaround.

- Sector Composition | The three largest sectors of the S&P 500—Information Technology, Health Care, and Communication Services—represent 52% of the index’s market capitalization and have been more resilient to the lockdown. In comparison, the US economy has only a 17% weighting to those sectors and more exposure to more sensitive areas like business services, real estate, and manufacturing that have all been hit hard by the shutdown.

- The New Consumer | When you hear the negative headlines about the shutdowns of department stores, leisure, home furnishings, casinos, auto manufacturers, hotels, and homebuilders, remember that they make up ~1% of the S&P 500. So while these are a big part of our daily lives, they are a very small portion of the S&P 500. In the Consumer Discretionary sector, e-commerce and home improvement companies, which have been more resilient, make up over half (~57%) of the sector.

- Favorable Financing | Due to the size and quality of the average constituent in the index—~90% of the S&P 500 is rated investment grade—these companies have more favorable financing dynamics than small businesses.

- Catalysts To Help The Market ‘Make The Grade’ | When market volatility was at record highs and the S&P 500 was down ~34%, we compiled a list of four market catalysts that we believed could help the S&P 500 rally and move back toward the 3,000 level. With favorable developments in three of the four catalysts already driving the market higher, the upward ascent is likely to slow.

1. Fed At The ‘Top Of Its Class’ | From quantitative easing to substantial lending, the Federal Reserve’s accomplishments are well known. In an effort to further ease the markets this week, Chair Powell stated that current interest rate levels will be maintained until the economy is better positioned to reach the employment and inflation goals set forth by the Fed. He also signaled that the Fed will likely take more action as needed when additional concerns come to light.

2. Wheels In Congress ‘Go Round & Round’ | Congress has passed ~$2.7 trillion in fiscal stimulus, which has helped to mitigate the downside risk to the economy. Although the budget deficit is expected to widen to 15%+, current discussions surrounding the need for additional state aid lead us to believe that this won’t prohibit our elected officials from taking further action.

3. Biotech & Big Pharma ‘Put Their Thinking Caps On’ | A reliable therapeutic or vaccine would accelerate the return to economic and social normalcy. This week’s favorable data from the Remdesivir trials helped fuel equity gains as investors were optimistic that this and other medical advancements will become a reality to help combat the virus.

4. Nightly News ‘Needs A Recess’ | News outlets are still captivated by the COVID-19 outbreak—still comprising ~90% of the news coverage. Further declines in the coverage would likely be a sign we are returning to normalcy with an opened economy.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.