Weekly Investment Strategy

Review the latest Weekly Headings from CIO Larry Adam.

Key Takeaways

- Policymakers tried to ‘remedy’ economic fallout

- Questioning if state budgets are in ‘stable condition’

- ‘Follow-up’ on forward guidance will be critical

In a world filled with challenges there is no truer phrase than “Save one life, you’re a hero. Save a hundred lives, you’re a nurse.” And if we need any more reasons to celebrate and honor our nurses, this past Wednesday was National Nurses Day and next Tuesday will be 200 years since the birth of Florence Nightingale—the originator of modern nursing. The “Lady with the Lamp” was a dutiful caregiver and relentless advocate for improved sanitary conditions and proper medical supplies in hospitals. There is no doubt that Nightingale’s principles and the tireless work of nurses have helped to combat COVID-19 and save the lives of tens of thousands. And for that, we say thank you! While the trend of new COVID-19 cases appears to be flattening (and hopefully begins to decline soon) in the US, ~43 states will be at least partially re-opening their economies by this Sunday. As we enter this next phase of re-opening, it is important to take the ‘pulse’ of where the economy and markets stand.

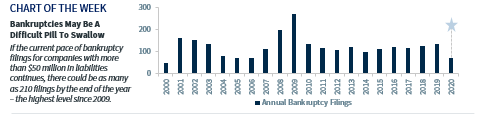

- Nursing The US Economy Back To Health | The US economy was in ‘good shape’ prior to the COVID-19 outbreak, experiencing the longest economic expansion in US history—129 months. But the virus has caused the economy to ‘flat line’ with both consumer spending and the labor market suffering. Prolonged shutdowns have forced 33.5 million people to file unemployment claims (~21% of the total US workforce) and caused the unemployment rate to spike from its 50-year low of 3.5% to 14.7%. However, ‘critical care’ has been administered by both the Federal Reserve and Congress. Between interest rate cuts, record levels of lending, stimulus checks, and more, policymakers have hopefully set the foundation for an eventual economic recovery by year end. Despite these efforts, not all patients of the economy will recover at the same pace and magnitude and we reiterate our belief that the US economy will experience a “K” shaped recovery. While most industries will eventually recover, there are some companies—small/mid sized companies that are over-leveraged and ill prepared for an extended shutdown—that will likely have a ‘difficult pill to swallow’ and not recover. For example, year-to-date, 71 companies with more than $50 million in liabilities have filed for bankruptcy. If this trend continues, the total could sadly rise to ~210 or more by the end of the year, which would mark the highest level since 2009. While there may not be a ‘remedy’ that provides relief for all industries, we maintain hope that further Fed action and additional aid packages will soothe the negative economic impacts until the recovery gains momentum.

- Just What The Doctor Ordered—State Stimulus | The reduction in economic activity and consumer spending has hampered state revenues as sales taxes have shrunk. The financial distress faced by states suffering the worst of the outbreak has called into question whether state budgets are in ‘stable condition.’ Fixed income investors are particularly concerned, as state bankruptcies would surely have negative ‘side effects’ on the municipal bond market. We do not believe any state will declare bankruptcy. The reasons: laws and the long standing interpretation of the US Constitution currently prohibit states from filing for bankruptcy, the credit profiles of states are remarkably strong (94% rated Aa1 or better), and states, if needed, have the ability to increase taxes or raise capital through the municipal bond market. However, the reports released by the Congressional Budget Office indicating that states will experience $110 billion and $350 billion shortfalls in 2020 and 2021, respectively, cannot be ignored. In order to prevent states, let alone particular counties or cities, from ‘feeling under the weather,’ we expect Congress will mitigate the situation with a Phase 4 stimulus package within the next few weeks. While the proposed amount of aid is still under discussion (potentially $1 trillion+), it is highly likely that bipartisan negotiations will lead to substantial relief that will appease the needs of state and local officials as they seek to suppress the virus and ensure the health and safety of their states’ residents.

- Examining Earnings & Future Guidance | Heading into 2020, earnings growth was expected to be positive for all four quarters. However, the escalation of COVID-19 to a global pandemic has since reversed this trend, leading earnings growth expectations to be negative in each quarter, with the first and second quarters falling 13% and 41%, respectively. For the most part, no sector, overall, has been ‘immune’ to the detrimental impacts of the virus. ‘Vital’ signs have been weak with only 64% of companies beating earnings estimates (versus the 20-quarter average of 73%), more than 100 companies pulling their forward guidance, and almost 50 companies cutting or suspending their dividends. With the equity market trading near the highest valuations in twenty years, investors appear to be ignoring the substantial reduction in earnings growth this year because of expectations for a ‘healthy’ bounce back in earnings growth (current consensus 20%+) in 2021. ‘Follow-up’ on forward-looking guidance once companies return to standard operations and production (hopefully during the summer as the economy re-opens more fully) will be the ‘prescription’ that gives more visibility into 2021. From our vantage point, earnings visibility remains the ‘fittest’ for Technology, Communication Services and Health Care—our favorite sectors.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.