Weekly Investment Strategy

Review the latest Weekly Headings from CIO Larry Adam.

Key Takeaways

- US Economic Recovery Has ‘Many Miles To Go’

- Not All Sectors Of Spending Are On The ‘Right Route’ Just Yet

- Specific Counties May Need To ‘Hit The Breaks’ On Reopening

Tomorrow is the summer solstice, the longest day of the year and the official start to summer! For those who are still fortunate enough to travel with friends and family this year, the trip may look a little different than usual given ongoing restrictions and social distancing guidelines still in effect. Many travelers are planning to replace their flights with road trips, and I bet most are bound to hear the infamous words “Are We There Yet?” from their travel companions. Oddly enough, these are the same words we have been asked regarding when the US economy will fully recover the recent economic contraction. Given the recent rally in the equity market that temporarily got the S&P 500 back into positive territory last week, it is hard not to hope for the same sharp rebound in the economy. But the economy is not the equity market and we believe there are still ‘many miles to go,’ likely not until after next summer, for the economy to return to its pre-COVID-19 growth levels.

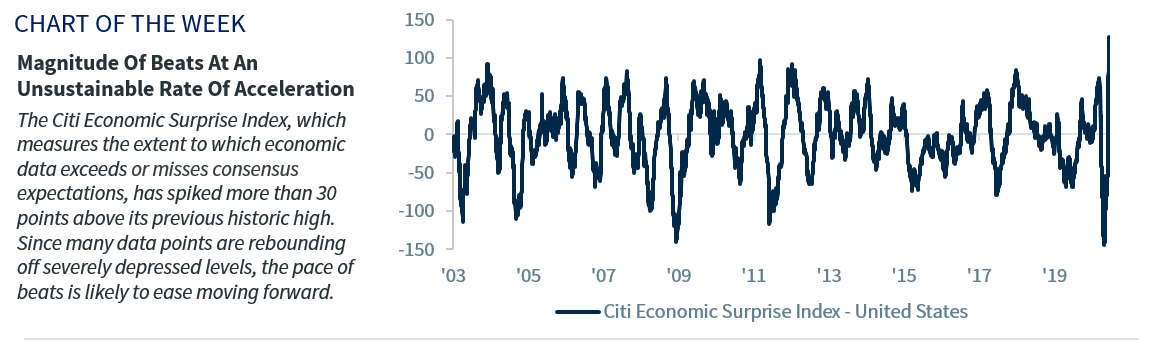

- US Economy Turns The Corner | Optimism surrounding the eventual US economic rebound has led to the recent market rally. As we’ve mentioned in prior publications, real-time activity metrics signaled that the ‘bottom’ likely occurred in April and that the recovery process started in May. Since then, economic data points have not only confirmed but have significantly exceeded the consensus expectations of the bounce back in activity. In fact, the Citi Economic Surprise Index, which measures the extent to which data is coming in versus expectations, spiked ~30 points above its previous record high in 2011. However, it is important to realize that this rate of acceleration from the bottom and the magnitude of beats is likely not sustainable, it is more of a reflection of a quicker than expected bounce off of severely depressed levels. Due to the suddenness and rigidness of the shutdowns, the full recovery from the significant virus-induced decline in economic activity (~12%) is not likely to arrive until the end of 2021.

- Labor Market – Some May Need Roadside Assistance | The recent jobs report (June 5) delivered a shock to the financial markets as it reported the US economy gained just over 2.5 million jobs rather than losing the expected 8 million. However, this single jobs report needs to be put in perspective, as it alone does not erase the 45.7 million unemployment claims that have been filed since mid-March. With the gradual reopening of the economy, we hope these workers will be rehired once their employers reopen their doors, but some may still need assistance over the near term. The additional unemployment benefit is set to expire at the end of July, and all eyes are on Congress as it continues to negotiate an extension of these benefits or a possible return to work bonus. While employment conditions are expected to slowly improve, the unemployment rate will likely not return to the pre-COVID levels for years, ending this year near 9%, more than double the beginning of the year.

- Consumer Spending – Coming Round The Mountain | This week, May retail sales more than doubled the consensus estimate of 8.1%, growing 17.7% MoM. However, on a YOY basis they remain down 6.1%. While spending is likely to rebound (especially on-line sales), it will probably take us well into next year to fully recover consumer spending. Consumer confidence, a harbinger of future spending, remains near multi-year lows and the percentage of people who expect to see an increase in income over the next six months declined to the lowest level since 2013. This uncertainty is evident in ‘big ticket items’ such as motor vehicles as sales are down 30% YoY and unlikely to rebound to pre-COVID levels until the unemployment rate meaningfully falls.

- States Hoping No Closures Or Detours Are Ahead | It has officially been 100 days since the World Health Organization declared COVID-19 a global pandemic, and its remarkable how far the US has come during this time. After weeks of prolonged shutdowns to cautiously planning and implementing phased reopening plans, it is hoped our nation is on the ‘right route.’ However, over the last week or so, more than a dozen states reported significant upticks in cases and a select few experienced an increase in their positivity rate that was not a direct result of more testing. Our Healthcare Policy Analyst Chris Meekins** believes this is a swell of the first wave rather than a second wave, and that the probability of the US truly turning a corner on the outbreak by July 4 remains at 65%. Overall, the US continues to exceed our testing goals (3 million tests conducted per week with a 5% or less positivity rate), and while specific counties or cities may need to ‘hit the breaks’ on easing restrictions, nationwide or statewide shutdowns seem unlikely. The discoveries made on the therapeutic front, such as the seemingly successful dexamethasone study results, provide us with more hope (but we still need more robust evidence) that the US can combat the outbreak while keeping the economy open. Nevertheless, a second wave continues to be the singular biggest downside risk to the economy and markets.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.