Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Economic rebound to ‘assist’ growth-oriented sectors

- A pullback may bring investors off the ‘sidelines’

- Positive future guidance may ‘score’ points with investors

This Monday will mark the 90th Anniversary of the first FIFA World Cup. Luckily for fans, the next tournament is not slated until 2022, and by then the COVID-19 outbreak should hopefully be far behind us so that fans can actually be in the stands in Qatar! For those who are not soccer enthusiasts, the sport appears to be a simple game of kicking the ball up and down the field until either team scores. But those more familiar with the sport know there is much more nuance than meets the eye. Soccer is a game of hustle and heart but it is also a game of angles, whether it be the direction a player intentionally runs to be well-positioned for the next pass or the way a shooter perfectly curves the ball into the upper corner of the goal. Given the historic levels of volatility the financial markets have seen this year, investing has required some hustle and heart too! And when it comes to constructing a portfolio in the midst of so much uncertainty, decision making has undoubtedly felt like a ‘game of angles.’

- Bottom Line: The Angles Of Our Equity Allocation | Heading into halftime with our equity allocation selections (domestic over international, large cap over small cap, growth over value, and our favorite sectors) all in the lead, our mid-year outlook centered on whether any second-half adjustments to our game plan were needed. The short answer is ‘no’ except for a small tweak with the addition of Consumer Discretionary to our sector ‘lineup’ that already included Technology, Communication Services, and Health Care. We knew full well that we’d have to ‘defend’ our preference for the top four performing sectors year-to-date, therefore we critiqued and analyzed our position from all angles. Ultimately, with selectivity remaining critical, we believe our equity positioning will get an ‘assist’ from our expectation of a robust US economic rebound while having the ‘defensive skills’ necessary to combat the potential second-wave of COVID-19. Although we expect some near-term volatility given overall elevated valuations, any near-term pullback should serve as an opportune ‘counterattack’ to buy for long term investors.

- Performance: Go Big Or Go Home | Since the start of the year, the top 2% (top 10 names) of the S&P 500 index has outperformed the next 48% of holdings and the bottom 50% of holdings by 46% (38% versus -8%) and 48% (38% versus -10%) respectively. The top 2%’s outperformance is not a surprise given they are the biggest, healthiest companies (from a balance sheet and cash flow standpoint) and are growth–oriented (80% of the top 2%’s market cap are in the growth index). In addition, the outperformance is attributable to sector composition, with our four favorite sectors accounting for 87% of the top 10 names. In transitioning to the composition of the next 48% and bottom 50% of holdings, the weighting of our preferred sectors with the exception of Health Care begins to diminish. For example, from a market-cap perspective, the Technology sector accounts for 44% of the top 2%, 22% of the next 48%, and only 12% of the bottom 50%. Given that these top 10 companies have a larger composition to our overweight sectors, we expect them to continue to ‘captain’ the leadership of the market going forward.

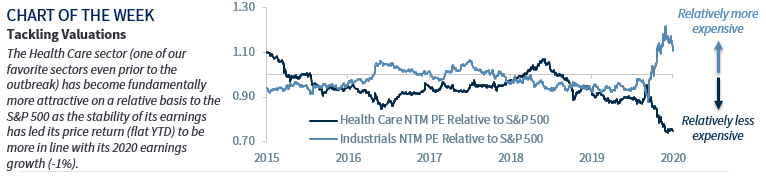

- Tackling Valuations | On a stand alone basis, the valuations for the S&P 500 and a few of our favorite sectors are elevated—the highest since 2001. However, observing sector multiples in relation to the broader index reveals that sometimes the premium is reasonable, and arguably attractive. For example, on a relative basis, the P/E multiple for the Communication Services sector is currently 5% higher than that of the S&P 500, but it is well below its 15-year average premium of ~14%. It is also prudent to evaluate these multiples in light of earnings growth expectations given the significant downward revisions seen year-to-date (YTD). For example, the Industrials sector has become more expensive on a price-to-earnings basis as YTD, the sector has declined ~17% while its earnings growth for 2020 is expected to fall a much greater 50%. In comparison, the Health Care sector—one of our favorite sectors even prior to the outbreak—has become fundamentally more attractive. The sector’s return is nearly flat YTD, but its earnings are only expected to decline 1%. So although Health Care has been one of the top performing sectors, it has become more attractive on a relative basis versus Industrials because of the stability in its earnings.

- Shutdowns ‘Shut Out’ Earnings Growth | 2Q20 earnings season begins next week in earnest with the big banks taking center stage. While S&P 500 earnings growth is likely to be ‘out of bounds’—down ~45% because of the temporary lockdown of US economy—we expect earnings to improve the rest of this year and into 2021. Due to the depressed level and backward-looking nature of these earnings reports, most companies will earn a ‘free kick’ as more emphasis will be placed on forward guidance rather than the reported metrics. Hopefully, the more than 34% of companies that withdrew guidance last quarter will begin to gain some visibility in their earnings moving forward as the economy has started to rebound. With valuations overall reflecting more optimism than fear, investors do not want to get caught ‘offsides’ with certain industries or sectors that lack earnings visibility, and a failure to provide a more positive future outlook may be perceived as committing a ‘foul in the penalty box.’

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.