Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- COVID-19 trends in the US anything but ‘amusing’

- Headlines have caused ‘thrills & chills’ for equity investors

- Congress needs to ‘log’ a big fiscal stimulus ‘splash’

Today is the 65th Anniversary of the first Disneyland Park, built in Anaheim, CA. Amusement parks are usually at the top of the summer to-do list for most families, but the COVID-19 pandemic has drastically changed the experience with plexiglass barriers, masked staff, and staggered ride operations to accommodate cleanings. Due to the psychological and physical concerns of the virus, Disneyland remains closed and is expected to keep attendance at only 10% of full capacity when it opens. Staying home this summer, I will miss enjoying the Ferris wheel and its slow and steady ride to the top that provides the perfect aerial view to get your bearings and map your plans for navigating the park. Ironically, this is the same view we seek when framing our investment insights. We distance ourselves from the chaos and panic of the crowd during pullbacks and from the ‘amusement’ and euphoria of rebounds and instead focus on providing a steady, reliable outlook that remains focused on risks on the horizon.

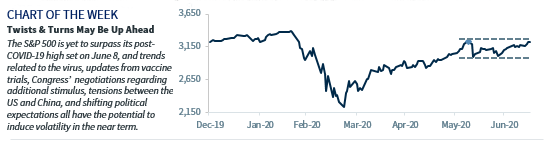

- Bottom Line: Equity Market Riding A Rollercoaster | Investors entered the year with a justifiable level of confidence. US equities had just posted their best year since 2013, and the record US economic expansion was buoyed by a healthy labor market and resilient consumer spending. With the overall outlook remaining positive, the S&P 500 began its ascent, reaching a new ‘peak’ of 3,386 in February. But then, the COVID-19 outbreak led to an unexpected drop that was the steepest, quickest decline from a record high in history! Since then, the financial markets have experienced their fair share of ‘thrills and chills’ as investors react to the daily headlines surrounding the health crisis and the highly anticipated economic recovery. The S&P 500 reached a post-COVID-19 high on June 8, and despite climbing above this level intra-day this week, it has yet to notch a new peak. We are confident in equities over the long term, but a few potential ‘twists and turns’ up ahead may make this ‘wild ride’ far from over.

- COVID-19 Carousel Still Going Around | Our nation is still grappling with the COVID-19 outbreak, and recent trends have been anything but ‘merry.’ Over the last few days, the US notched record daily increases in cases and the death count surpassed 142,000, with states like California forced to rollback reopening guidelines. While this recent surge is a swell of the first wave, it is no less impactful as it poses risks to our expectation for an economic rebound. An ongoing deterioration in data threatens the consensus estimate of 18% and 7% GDP growth in the 3Q and 4Q, respectively, and the recent flatline in real-time activity metrics (e.g., airline travel, restaurant bookings, credit card spending) reveals that the health crisis remains a viable threat.

- Track To A Vaccine Still Under Construction | This week’s positive performance was driven by promising data releases from vaccine clinical trials (e.g., Pfizer, Moderna, & Oxford). These developments are steps in the right direction, and we cannot underestimate the tremendous amount of resources dedicated to finding a vaccine that has helped reach these stages quickly. We are optimistic that an emergency use vaccine will be available by year end, but this still leaves ~5 months of constrained economic activity. Mass production levels do not seem viable until next year, and more important, the effectiveness of the vaccine is yet to be determined—as it could be like the flu vaccine (~50% efficacy) or like the hepatitis B vaccine (95% efficacy). Side effects and the length of time for protection (e.g., the need for boosters) are also important factors to monitor. Ultimately, the markets may be too quick to correlate promising data with a widespread, readily available solution for COVID-19.

- Fiscal Stimulus Benefits Need To Make A Splash | Unemployed workers, small businesses, and state and local governments are anxiously awaiting the details of the next fiscal stimulus package as the negotiations in Congress are still underway. From the size of the bill, to the manner in which aid is provided (unemployment benefit vs. return to work bonus), much of the deal is up for debate. If Congress is unable to ‘log’ a ‘big splash’ in a timely fashion (by month end), the markets will likely be disappointed.

- US & China Bumper Cars Collide | Tensions between the US and China are escalating, with intellectual property rights, technology supply chains, and human right violations appearing to be the greatest points of contention. Last year, the main disagreement was trade, but now the two are ‘colliding’ on several issues that may derail the trade progress made thus far. Tariffs or sanctions may compound the pressure felt by certain industries that are still coping with the aftermath of COVID-19.

- Election Swings In Favor Of Democratic Party | With only 109 days to Election Day, the probability of a Democratic sweep remains elevated. While it is still early, ongoing momentum could result in interim volatility. The reason: Former Vice President Biden’s proposed tax policy increases the corporate tax rate from 21% to 28%. Strictly focusing on his tax policies from an equity market perspective, this action could result in an annualized ~10% drag on 2021 earnings if enacted. In addition, any reinstated regulations for the Financial, Health Care, or Energy industries could pose additional short-term headwinds for these sectors.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.