Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Case surges could have the recovery “all shook up”

- Need “a little less fight a little more spark” in Congress

- The sectors that have ‘Rock N’ Rolled’ through the pandemic

Tomorrow, the Elvis Week celebration will begin at the Graceland Mansion in Memphis, Tennessee. Due to COVID-19, the schedule has been adjusted to include both virtual and limited attendance, socially distanced in-person events so that all fans wishing to commemorate the life, legacy, and music of the King of Rock & Roll can feel safe doing so. To borrow lyrics from arguably one of the greatest cultural icons of the 20th century, “someone said that the world is a stage and we must each play a part.” While he surely filled the role of entertainer, we hope to fulfill the part of a trustworthy source of investment insights. The pandemic has undoubtedly brought about a number of challenges for investors, but constructing a well-founded economic outlook and identifying opportunities in the midst of this unprecedented time are “always on my mind.” Until we can announce that COVID-19 ‘has left the building,’ our team will strive to do exactly that.

- It’s Now Or Never For The US Economic Recovery | Surges in COVID-19 cases throughout the Sun Belt and now the Midwest caused investors to question whether the economic recovery progress made thus far would be “all shook up.” While at no point did we believe the rise would translate to a decline back to the severely depressed levels of economic activity experienced during the shutdowns, real-time indicators did suggest that the trajectory of the recovery lost momentum. As key regions were forced to reinstate restrictions and as the public alarm regarding the spread of the virus heightened, improvement in mobility metrics (e.g., airline travel, restaurant bookings), consumer spending oriented trends (e.g., initial claims, Redbook Index), and business livelihood statistics (e.g., small-business hours worked, total temporarily and permanently closed businesses) all appeared to plateau. Due to the nature of the virus, we all must continue to do our part in order to prevent such case spikes as they clearly are capable of delaying the recovery process. Elected officials in areas experiencing a deterioration in COVID-19 trends must act diligently to mitigate the spread, and further intervention by the Federal Reserve and Congress are needed to get the US economy back on the right track. To echo Chairman Powell, “we ought to do what we can” to avoid a prolonged economic downturn.

- One For The Money, Two For The Show, Three To Get Ready, Now Go Congress Go | Unemployed individuals, small businesses, and state and local governments are all hoping for “a little less fight a little more spark” in the Congressional negotiations regarding the Phase 4 stimulus bill. The broad-based need for additional aid will hopefully bring the debates to a conclusion soon, and provide belated if not retroactive aid during a critical time in the economic recovery process. While the two parties are relatively in agreement on issues such as a second round of stimulus checks, it is evident concessions will need to be made on matters such as the size and duration of the unemployment benefit extension impacting nearly 31 million Americans in order for a deal to be reached. Although stimulus has been widely anticipated for some time, the actual passing of the deal would remove a level of uncertainty from the market and would provide consumers with a level of security in the months ahead.

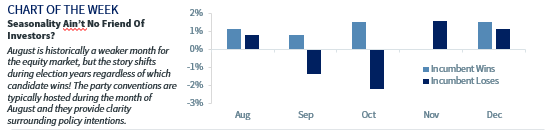

- Seasonality Ain’t No Friend Of Investors? | In the post-World War II era, as well as over the last thirty years, August and September have been the weakest two month period of the year for the S&P 500. Both months typically incur negative performance, but focusing solely on election years, August is predominantly positive – regardless of which candidate wins! The party conventions typically occur during this month, providing the nominees the opportunity to formalize their visions and policies for the next four years. However in September and October, the election intensifies and equity returns tend to be more differentiated. For example, in October, the market tends to rally and is positive 78% of the time if the incumbent wins, but posts a modest decline and is negative 66% of the time when a challenger wins, likely due to uncertainties surrounding potential policy changes. In addition, the three months prior to the election historically hold a strong correlation with the eventual winner. In fact, the three month return ahead of Election Day has accurately predicted whether an incumbent will be victorious (positive performance) or defeated (negative performance) 83% of the time since 1928 and 100% of the time beginning in 1984.

- Can’t Help Falling In Love With Our Favorite Sectors | “Wise men say only fools rush in,” but our bias toward the Info Tech, Health Care, Communication Services, and Consumer Discretionary sectors has been based in fact, not emotion. These sectors are currently the top four performing sectors year-to-date and they remain supported not only by our anticipation for a robust economic rebound but by their own unique long-term growth catalysts as well. Even in the midst of what is forecasted to be one of the worst earnings seasons in history, results in the aggregate have provided additional reassurance that our bias is well-founded. For example, Info Tech has the largest percentage of companies beating estimates (92%), and in a year in which most sectors are expected to see negative year-over-year earnings per share growth, Health Care is among the more resilient, up 6.1%.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.