Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- ‘Keep Your Seatbelt Fastened’ for near-term volatility

- Congress needs to ‘safely land’ a stimulus package

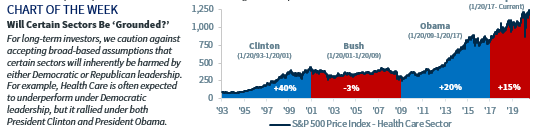

- Sector positioning not a ‘one way ticket’ based on winner

This upcoming Wednesday is National Aviation Day, a holiday established by President Franklin Delano Roosevelt in order to honor the birthday of Orville Wright—inventor of the first airplane. While it’s hard to believe we’ve had the ability to fly for more than 115 years, it is even harder to comprehend the havoc that the COVID-19 pandemic has wreaked on the airline industry. At first, stay-at-home mandates prohibited any travel not deemed necessary, and now, the psychological impact has deterred Americans from entering airports despite increased sanitization methods and drastically reduced fares. In fact, our most recent Investment Strategy Sentiment Survey revealed that only 20% of respondents would feel comfortable boarding a plane by year end. Even though most of us will not be preparing for take-off anytime soon, there are many ‘connections’ between the flight process and the current state of the economy and financial markets.

- Bottom Line: The Importance Of A Flight Plan | Before an aircraft departs, a pilot must have a flight plan in hand. While the plan rightfully contains some rather basic information, such as the destination and the number of passengers on board, it also contains some critical information should a problem, such as an equipment malfunction or adverse weather conditions, occur. We believe this overall level of preparedness should be mirrored by investors, especially now as the S&P 500 has ‘ascended’ to just below its all-time high. While we wish investors could just ‘sit back, relax, and enjoy the rest of the flight,’ a number of viable risks are still on the horizon for the near term. So instead, we urge investors to ‘keep their seatbelts fastened’ and rely on their financial advisor as a co-pilot in discussing not only the basics (e.g., investment goals, risk tolerance) but the critical asset allocation details in order to prevent emotionally-driven poorly timed decisions that could lead to sub-optimal performance.

- Second Wave Of Covid-19 Could Cause Crosswinds | The US has made apparent progress on the COVID-19 outbreak, with the total identified cases, the testing positivity rate, hospitalizations, and the rate of increase in deaths all now hopefully making their ‘final descent.’ While we wish the efficacy and ‘estimated time of arrival’ of the potential vaccine were known, the US economy has been able to regain some of the momentum lost as ‘hot spots’ emerged throughout the nation. This has been evidenced by the improvement in a few of our real-time economic activity metrics, such as TSA screenings. This week, the TSA exceeded a daily screening count of 800,000 for the first time since March. While this is still well below the daily average seen during this time last year (~2.5 million), it is still more than 9x the lowest levels seen in April and a positive sign that the economy is proceeding on the right route. But in the months ahead, the threat of a second wave of COVID-19 may become more daunting. Upcoming large gatherings (e.g., schools, in-person voting) combined with colder temperatures could cause some ‘crosswinds’ for the recovery progress made thus far, and social distancing practices will be even more critical to mitigating the virus’ spread.

- Stimulus Still Needs To Make A Smooth Landing | Congress needs to ‘safely land’ a phase 4 fiscal stimulus package so that the runway is clear for the economic recovery to takeoff. With ‘miles’ still separating the two parties on key issues, President Trump signed executive orders to continue unemployment benefits at $400 per week, implement a payroll tax deferral, establish eviction limitations, and freeze student loan interest for the remainder of the year. Ultimately, a number of operational logistics have this action ‘up in the air,’ and the more highly debated issues (e.g., a second round of stimulus checks, augmentation to the Payroll Protection Plan for businesses, critical aid to state and local governments) were excluded. Therefore, it is still up to the ‘crew’ in Congress to ensure that aid is available to support the economy during such a fragile time.

- Navigating The Election-Induced Turbulence | If the election were held today, the outcome would be in favor of Democratic nominee Joe Biden and his newly announced Vice Presidential candidate Kamala Harris. However, the election is still 80 days away and previous elections have taught us that this three month window is an eternity in politics. For example, in the 1988 presidential election, Massachusetts Governor Michael Dukakis was defeated by George W. Bush despite having an early 17 point lead in the polls. The 2016 election taught us the same, that the ‘turbulence’ occurring just weeks let alone days before voting day can impact the outcome. We exercise caution over using broad-based assumptions or generalizations when it comes to intertwining politics with investment decisions. For example, under President Obama and President Clinton, the Health Care sector was expected to widely underperform. However, it was the third best and second best performer under the respective administrations. Under Republican leadership, the Energy sector is touted to perform well, however under President Trump it has drastically underperformed the broader market. Overall, we encourage investors to focus on the conventions this month and the specific policies that are discussed versus using historical precedence as the basis for sector allocation.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.