Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Not all industries ‘reaping the benefits’ of the recovery

- 3Q20 earnings season may ‘plant the seeds’ for 2021

- ‘Don’t bet the farm’ on yields moving substantially higher

This week we celebrated National Farmer’s Day, a holiday that goes back more than 200 years despite the profession existing for more than 12,000 years! Our nation’s farmers work tirelessly to ensure there is food available for our tables, and the industry is responsible not only for countless jobs but for the livelihood of many of our communities. As it further relates to the economy, we believe the initial seeds for recovery have been planted, and we hope that positive catalysts such as the highly awaited Phase 4 fiscal stimulus package and the successful development of a vaccine come to fruition so that a full return to pre-pandemic GDP levels can be reaped. In fact, as we cultivated our outlook for the remainder of the year and for the next 12 months, our long-term positive view for the equity market was rooted in an overall improving macroeconomic backdrop. However, our rationale is supported by several historical and fundamental factors too.

- Taking The Bull Market By The Horns | The S&P 500’s 57% rally from the March lows is the strongest bull market at this juncture from a historical perspective, and as remarkable as this run has been we have reason to believe the equity market will move higher. Just as we are still in the early stages of the economic recovery, we are in the beginning phase of a bull market, which on average have a magnitude of 200% and last ~6 years. The economy’s ‘K-shaped’ recovery path has translated directly to the equity market, with certain businesses such as Internet and direct marketing retail benefiting from the outbreak (69% year-to-date) while others such as airlines (-46% year-to-date) are struggling due to the psychological impacts of the virus. Therefore it is of little surprise that the 81% dispersion between the S&P 500’s best and worst performing sectors so far this year (Information Technology 34% versus Energy -47%) is more than double the average over the last 15 years. With specific aspects of our economy experiencing a lagging recovery, positive catalysts such as successful therapeutics or a widely available vaccine could help restore the health of these industries and allow the bull market to experience a more broadly based rally.

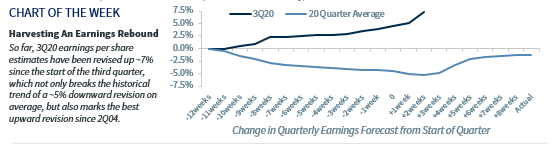

- Harvesting An Earnings Rebound | The COVID-19 outbreak and the subsequent prolonged shutdowns were detrimental to earnings growth this year, with consensus S&P 500 earnings growth expected to be down -18% YoY—the worst decline over the last decade. However, consensus 2021 estimates are expecting a 25% rebound, the best annual growth rate since 2010 (+40%). While we look forward to the anticipated bounce back next year, we believe the ongoing 3Q20 earnings season will provide early insights into companies’ guidance for the remainder of this year as well as into next year. So far, 3Q20 earnings per share estimates have been revised up ~7% since the start of the third quarter, which not only breaks the historical trend of a ~5% downward revision on average, but also marks the best upward revision since 2Q04. Over the next two weeks, 282 companies representing 69% of the S&P 500’s market capitalization are set to report, and we hope that better than expected results (companies typically beat by ~5-6%) and more positive forward guidance spur optimism heading into year-end and 2021.

- Search For Yield Like Looking For A Needle In A Haystack | While valuations remain elevated from a historical perspective (22.0x NTM versus 15.6x 20-year average), lower for longer yields have led the equity market to remain attractive on a relative basis. In fact, 73% of companies currently have a dividend yield higher than the 10-year Treasury yield. Improving economic data has already led yields to modestly rebound from the historic lows reached in March, but the promised accommodative stance by the Federal Reserve, heightened foreign demand due to still negative interest rates abroad, and aging demographics will likely keep the 10-year Treasury yield at or below the 1% threshold through year end.

- Cash On Hand To Make Hay When The Sun Shines | Despite the strong equity rebound off the COVID-19 lows, over optimism has not engulfed investor sentiment. In fact, there is ~$4.4 trillion held in money market mutual funds, not far from the recent May peak of $4.8 trillion, and domestic equity flows (both mutual funds and ETFs) have seen a record ~$300 billion in outflows in the past 12 months. Investors may be awaiting a pullback or for the COVID-19 crisis to be ‘put out to pasture’ before getting into the market, but in either case, the rebound has not been driven by excessive optimism and investors still have cash to put to work.

- Bottom Line: Selecting The Cream Of The Crop | We’ll always caution against ‘putting all your eggs in one basket,’ but the COVID-19 outbreak has created a ‘pecking order’ with more-tech oriented industries inherently favored throughout the recovery process. These trends will likely continue until the virus is vanquished so while we remain positive on the equity market overall, we believe selectivity will be critical in the months ahead and maintain our bias toward large-cap, growth-oriented companies particularly within the Info Tech, Communication Services, Consumer Discretionary, and Health Care sectors.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.