Weekly Investment Strategy

January 15, 2021

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Democratic sweep may ‘preserve’ tax policy shifts

- Biden administration vows to ‘protect’ against cyber threats

- The Fed may have to ‘defend’ against inflation spikes

Next Wednesday, January 20, Joe Biden will be sworn in as the 46th President of the United States, and we are hopeful that Inauguration Day will serve as a platform for a more united country. However, before this transition of power occurs, we evaluate the economic and market performance that has occurred over the last four years under President Trump and provide some context as to how the results compare to those of prior presidents. Overall, the performance has been mixed with healthy equity gains and tepid economic growth despite record increases in the size of both the national debt and the Federal Reserve’s (Fed) balance sheet. In addition, given that we ‘inaugurated’ our Ten Themes for 2021 this week, we address a few macro risks that could unsettle our optimistic outlook for the equity market. These include the likelihood and timing of tax policy changes, the potential for premature Fed quantitative easing (QE) tapering, and growing geopolitical risks.

- GDP Growth | During Trump’s first three year’s in office, the US economy had annualized GDP growth of 2.5%, but due to the COVID-19 pandemic, the average fell to an estimated 1.02%—the slowest pace of growth in the post-World War II era. Because of the pandemic, the economy saw the best (3Q20: +33.4%) and worst (2Q20: -31.4%) quarters of growth over this same time period.

- Unemployment Rate | Prior to the COVID-19 pandemic, the unemployment rate fell to 3.5%, the lowest level over the last 50 years. Despite the unemployment rate spiking to a historic high of 14.7% during the prolonged lockdowns, it has only increased 2.0% during Trump’s presidency. While this makes him the sixth president out of the twelve presidents in the post-World War II era to record an increase in the unemployment rate, it is the smallest unemployment increase amongst the six.

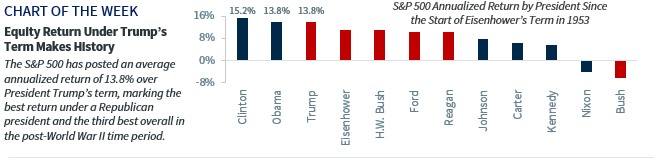

- Equity Market Performance | Since his inauguration in 2017, the S&P 500 has posted an average annualized return of 13.8%, marking the best return under a Republican president and the third best overall in the post-World War II time period. President Clinton still holds the record for the best equity market performance with an average annualized return of 15.2%.

- National Debt & Fed Balance Sheet | National debt increased ~$7.7 trillion, the second largest increase as a percentage of real GDP levels since President Kennedy took office in 1961. The Fed’s balance sheet increased by $2.9 trillion during Trump’s term, by far the largest increase during any presidency. However on a percentage basis, the 66% increase in the size of the balance sheet is well below that of President George W. Bush (260%) and President Obama (99%).

While we foresee that volatility will be lower in 2021 versus 2020, primarily as the world recovers from one of the most severe ‘Black Swan’ events in history—COVID-19—there are still a few dynamics that could unsettle our favorable outlook for the upcoming year.

- Democratic Sweep May ‘Preserve’ Tax Policy Shifts | With the Democratic Party having a slim Congressional majority, we expect budget reconciliation to be utilized to implement aspects of Biden’s campaign platform, including his proposed tax policy changes. However, the timing of when these changes take effect (2022 versus 2021 retroactive) remains an unknown. Given our projections for a strong earnings rebound and robust pent-up consumer spending once our nation can sustainably reopen, accelerated tax increases could serve as a drag on corporate earnings and dampen the potential strength of consumer spending.

- May Have To ‘Protect’ Against More Aggressive Adversaries | Between the China trade negotiations started by President Trump and the massive cyberattack that occurred against US government systems prior to his being confirmed by the Electoral College, Biden is likely to face some geopolitical challenges. History suggests that our nation’s adversaries often test a new administration, but Biden’s initial comments regarding specific foreign affairs suggest that he will take a strong position. For example, the President-elect has voiced that he will “not stand idly by” when it comes to cyber threats against our country. As these relationships evolve in the months ahead, geopolitical frictions have a greater chance of inducing market volatility.

- The Fed May Have To ‘Defend’ Against Inflation Spikes | Recovering economic growth, a surging money supply, prospects for additional fiscal stimulus, and COVID-19-related supply chain disruptions have led to inflation concerns. While a large increase in inflation is not our base case, a modest increase is likely as a result of the aforementioned catalysts. However, if inflation does surprise sustainably to the upside, the Fed may have to taper its current $120 billion/month QE purchases to ‘cool’ the inflationary pressures. In 2013 and 2018, a reduction in QE bond purchases spurred so-called ‘taper tantrums’ that caused a rise in interest rates (bond yields rose ~140 basis points on average) and equity market volatility (the S&P 500 had at least one 5% pullback during those time periods). This week, Fed leaders reiterated they would remain flexible, allowing inflation to move above the stated 2% target for a period of time before tapering purchases; however, it remains a risk worth monitoring.

Video recorded November 13, 2020. All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.