Weekly Investment Strategy

February 5, 2021

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- US Economy ‘Running The Route’ To Recovery

- Equity Market ‘Rooting For The Home Team’

- Big Tech Stars ‘Shine’ In 4Q20 Earnings Season

Raymond James Stadium is ready to be the host site for the Big Game, with at least 100 million fans expected to tune in to see which city—Tampa Bay or Kansas City—has the will to win. Even before kickoff, Sunday’s match-up is one for the record books! First, Tampa Bay is the first team to play in the championship game at their home stadium. Second, the 18 year, 45 day age difference is the largest ever between the two starting quarterbacks. And third, either Tom Brady will become the first quarterback to win the championship in three different decades, or Patrick Mahomes will become the youngest quarterback with multiple victories. No matter the outcome, you can count on elite perseverance, discipline, and team work being on display—the same qualities needed for a successful investment strategy! Ahead of the showdown on Sunday, we draw a few additional parallels between the game’s terminology and the state of the economy and financial markets.

- Economic Growth Still Under Further Review | This week, the release of several data points supports the notion that the economy is ‘running the route’ toward normality. For example, the ISM Services Index rose to the highest level since November 2018 and the services employment subsector finally rose back to pre-pandemic levels, suggesting that services’ hiring is set to accelerate. While this is a positive for the labor market, improving economic activity may lead investors to question whether accommodative fiscal and monetary policy remains necessary. Ultimately, we expect policy officials to wait for ‘clear and irrefutable evidence’ of a sustainable improvement in economic activity before reversing accommodative policy calls. As a result, we expect the Fed to leave interest rates unchanged through at least 2023 (with no tapering to the pace of QE purchases this year) and Congress to pass an ~ $1.5 trillion rescue package in the coming weeks before turning its sights to a recovery package. Continued accommodative fiscal and monetary policy should remain supportive of overall economic growth and risk assets.

- Scientists Still The Most Valuable Players | Over the last several weeks, mutations in the virus’s sequence have appeared, some of which have reduced the efficacy rates of the vaccines presently in use. Currently, scientists remain confident that existing vaccines and technologies remain poised to combat these new strains that have proven to be more transmissible (United Kingdom strain) and/or able to pierce prior immunity (South Africa & Brazil strains). While risks such as a more deadly strain that forces consumers to ‘sit on the sidelines’ remain viable, we have confidence that the scientists who have worked under insurmountable pressure over the last year will be able to alter inoculation (e.g., boosters, time between doses) so that the level of protection against infection is as elevated as possible as to not negatively impact the recovery in economic activity.

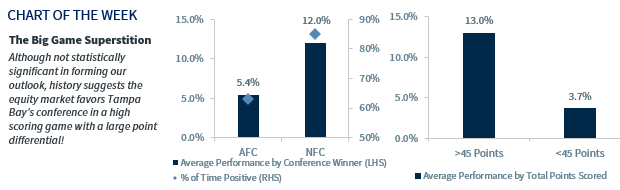

- Fantasy Football Perspective | Unquestionably, our positive outlook for the US equity market is based on improving economic fundamentals, a substantial rebound in earnings growth, an accommodative Federal Reserve, and lower for longer interest rates. While not statistically significant, sometimes investors want to ‘ride the wave’ of interesting historical trends. So if you have not decided which team to root for, history suggests that the best equity market performance has occurred when Tampa Bay’s conference defeats Kansas City’s conference in a high scoring game (more than 45 total points scored) with a point differential of more than seven points. Furthermore, while Tampa Bay and Kansas City have won the Vince Lombardi Trophy only once and twice before respectively, the S&P 500’s average performance in the year following the game is in Tampa Bay’s favor (34.1% versus 9.1%). So no offence to our friends and followers in Kansas City, but we will be cheering for the ‘home team’.

- Big Stars Showed Up To Play This Earnings Season | The 4Q20 earnings season is well past ‘halftime,’ with more than 80% of the S&P 500 market capitalization having reported. Some of the ‘big time players’ on the S&P 500’s ‘roster’ (e.g., Alphabet, Apple, Amazon, Microsoft, Facebook) made some ‘big time plays’ to move the earnings growth ‘chains’ for this ‘underdog’ season. If other ‘players’ (e.g., Walmart, Home Depot) are able to ‘shine’ in the final minutes, earnings growth may turn positive and put some more ‘points on the board’ ahead of the 2021 earnings seasons. Sectors such as Technology have put earnings growth at the ‘edge of the goal line,’ with the ‘early season’ consensus expectation of a -8% year-over-year decline in earnings growth already revised higher to -1.3%. So far, 94% of tech companies are beating earnings expectations (the highest of any sector) with an average upside surprise of ~18%, far outpacing the sector’s 20-quarter average of 7.2% and the current S&P 500 ‘score’ of 15.1%.

Video recorded November 13, 2020. All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.