Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

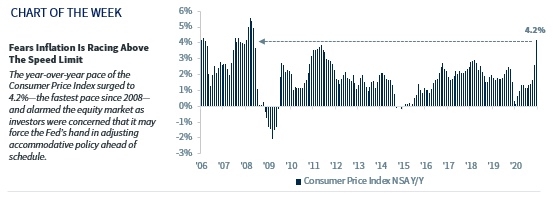

- Investors fearing inflation is going into overdrive

- Providing context to the surge in consumer prices

- The disconnect between job openings & job gains

This past Wednesday was National Odometer Day, a day set aside to appreciate the technological development that has been in existence since the 1600s! With vehicles now having self-driving features, it is easy to forget the more mundane devices on the dashboard, but odometers provide important information such as the distance traveled over a specific time and insights into fuel efficiency. The word odometer is derived from two Greek words meaning path and measure, and since the virus-induced lockdowns last year, we’ve been continually assessing the path of the US economic recovery and measuring the distance needed to return to pre-pandemic GDP levels. Needless to say, as the economy has traveled many miles from the depressed lows seen during this point last year, investors are eyeing any potential speed bumps and unexpected detours that may derail the progress made.

- Bottom Line—Keeping Our Eyes On The Road Ahead | Between improving COVID-19 trends, surging economic activity, record earnings ‘beats,’ and accommodative fiscal and monetary policy, it is not surprising that the S&P 500 has rallied ~10% year-to date (the third best start to a year since 2000—21 years) and surpassed the 4,200 milestone for the first time in history. In short, a lot of good news has been priced into the equity market as reflected by the elevated valuations (S&P 500 NTM P/E: 21.2x). However, this week served as a reminder that the equity market is not impervious to increased downside volatility. The equity market declined on fears that the higher-than-expected inflation readings could force the Fed to adjust its policy ahead of schedule, with the S&P 500 posting its worst trading day (-2.14%) since February 25. Volatility is likely to remain elevated in the near term as market participants potentially overreact to singular data points. However, taking a longer view, we remain constructive on the equity market and would continue to use any headline–induced volatility as a potential buying opportunity.

- Fears Inflation Is Racing Above The Speed Limit | With this week’s year-over-year CPI figure surging to 4.2%—the fastest pace since 2008—and core CPI (excludes food and energy) prices posting their largest monthly gain since 1981, concerns intensified that that this inflationary spike may be more than what the Federal Reserve has telegraphed as ‘transitory.’ However, we disagree and firmly believe that this spike will likely peak during the third quarter at the latest, and settle down by year end. It is important to understand that we are in the midst of the most critical part of the ‘base effect’ as prices today are being compared to the severely depressed levels at this time last year—a time where demand was non-existent as the economy was in the middle of a lockdown. So while some of these increases are eye-popping as consumers are simultaneously coming out of spending hibernation, they need to be put into perspective. For example, while airline fares and hotel prices posted near record month-over-month increases, these two industries remain 18% and 6% below pre-pandemic levels. As we progress through the summer, pent-up demand, supply-chain bottlenecks and shortages should subside and inflation should normalize. Our economist, Scott Brown, believes that core inflation will trend to 2.9% and 2.2% by the end of 2021 and 2022 respectively.

- Labor Market Traffic Jam May Complicate Stimulus Agenda | There is a disconnect in the US labor market between job openings rising to a record high 8.1 million and the April job report (only 266k jobs created). Our sense is that the US economy is strong and that job growth will accelerate, so one disappointing number does not deter our optimistic outlook. However, this disconnect is forcing a deeper political divide in Washington and likely reduces the probability of a bipartisan infrastructure stimulus deal. The debate: Democrats suggest that the weak job numbers support additional, immediate stimulus so the economy does not stumble. Republicans argue that the extension of supplemental unemployment benefits (e.g., $300/week) disincentives some workers from taking a job. As a result, more than a dozen Republican-governed states have announced the termination of these benefits in June or July, well before the September 6 expiration, in the hopes of increasing job growth. As a result, it appears the passing of any or all of the additional ~$4 trillion in proposed stimulus will likely be a partisan Democratic effort through reconciliation. With stimulus having a major effect on spending and taxes (corporate, individual, estate, etc.), uncertainty over the final bill given the slim Democrat majority could lead to increased market volatility.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.