Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Tailwinds from fiscal stimulus will fade in months ahead

- Central banks dialing back accommodative commentary

- Returns may be challenged as the bull market ages

The unprecedented emergence of the COVID-19 virus brought a whole lot of cooks to the policymaker kitchen, as the Federal Reserve and Congress whipped up a plan from scratch (as there was no existing recipe!) to help the US economy avoid the worst-case scenario and to provide stability for the markets. But even after the emergency rush ended, the all hands on deck approach remained as policymakers crafted a course of monetary and fiscal stimulus to further aid the economy’s recovery. The collective response was anything but a flash in the pan, as the US economy was within reach of pre-COVID GDP levels by the end of the first quarter, the equity market reached record highs and credit spreads returned to pre-outbreak levels. With the economy now cooking with gas, the continuance of unprecedented fiscal spending and quantitative easing has led to concerns that the economy may overheat.

- All Boils Down To Bipartisan Efforts | Over the course of 2020, Congress swiftly passed a sizable series of fiscal stimulus bills that provided funding to bridge key industries, small businesses, local governments and households to more normal times. At the start of this year, the Biden administration quickly passed a $1.9 trillion Rescue package, which supplemented and extended many of the same objectives at the core of last year’s bills. Now, as the economy transitions into the recovery stage, the speed and scope of further stimulus deals may be challenged. The Republican and Democratic parties are currently far from agreeing on the size of the infrastructure bill (~$800 billion versus $2.25 trillion) and the pay-fors (e.g., deficit spending vs. taxes vs. user fees). Given the ongoing debate, there are growing expectations that the Biden administration will most likely have to go down the reconciliation path to pass a deal. However, it is likely to be smaller in dollar terms with lower tax hikes than originally proposed. From an economic perspective, given that the funds will be allocated evenly over the next eight years and that there will be offsets in the form of taxes, it should not have a major impact on our economic forecasts. For the equity markets, history suggests that as long as the economy remains strong (as we expect), small to modest increases in taxes should not end the bull market run.

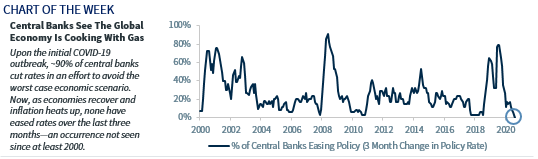

- Central Bank Commentary Simmering Down | At the onset of the pandemic, central banks cut interest rates in a coordinated fashion to buttress the global economy and most followed suit with substantial quantitative easing to prevent the doomsday scenario. In fact, within the first three months, ~90% of global central banks cut rates—nearly a record high. Fast forward to today, as economies recover and inflation heats up, no central banks have eased rates over the last three months—an occurrence not seen since at least 2000. While central banks will likely maintain historic levels of accommodation in the near term, the rhetoric and actions from global central banks is slowly shifting—a change that is expected as they have effectively built the bridge from shutdown to reopening. That is why it is not surprising that the May FOMC minutes suggested that further rapid progress toward their stated inflation and labor market goals may spark the committee to discuss a “plan for adjusting the pace of asset purchases.” This is a good sign that the economy is healing. But regardless, we remain confident the Fed will not prematurely taper (before late this year at the earliest) or raise rates before 2023. Interestingly, central banks are keeping their eyes on the financial markets and their potential negative spillover effects. In their respective Financial Stability Reports, both the Fed and ECB highlighted that accommodative polices have led asset prices to be vulnerable to significant declines should risk appetite fall as there is growing “market exuberance.” We agree that there are some parts of the market that are expensive and that is why we preach selectivity and our preference for our favored sectors such as Technology, Communication Services, and Financials.

- Bottom Line—Investors Still Have A Low Appetite For Volatility | Between COVID-variant strains, inflation fears and elevated geopolitical risk, there is no shortage of catalysts that could lead to upticks in volatility. With these risks in mind, the overt levels of optimism are starting to retrench, which is reflected in the recent sell off of some of the top performers coming out of the pandemic (e.g., Information Technology, small-cap growth). While it is common for investors to focus on the short-term changing dynamics of the market, long-term investors should evaluate the long-term tailwinds that support equities. While historic accommodative monetary and fiscal support will dissipate slowly over the next year or so and likely initiate increased volatility, it does not alter our optimistic equity outlook. Our expectation of strong economic growth driving healthy earnings growth should provide support for additional upside. However, more muted gains at this juncture are not uncommon, as positive equity market returns have historically slowed in both the second year of a bull market and after the 100-day mark of a president’s first term.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.