Weekly Investment Strategy

Key Takeaways

- Misconceptions with ‘sell in May go away’ expression

- The S&P 500’s history of a summer slowdown

- Keeping an eye on a multitude of events this summer

As we prepare to celebrate the long Memorial Day Weekend, the Investment Strategy Group would like to remember, honor, and thank all of the members of our armed forces who bravely lost their lives in service of our country. Given the improving state of our nation’s battle versus the COVID-19 pandemic, we hope everyone is able to spend quality time with loved ones and we wish you and your family a healthy and restful holiday. Memorial Day serves as the ‘unofficial’ start to summer as the temperature heats up, school ends, and vacation season begins. While the volume of miles driven has historically spiked between now and Labor Day (the ‘unofficial’ end of summer), the easing of restrictions and inability to travel last year will likely turn our country into Resort USA! But with more people vacationing, do not lose focus on the markets as there are significant market moving events in the offing.

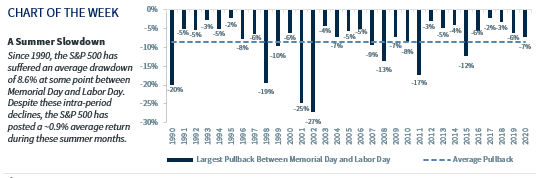

- Sell In May And Go Away? | As many investors prepare to take a long overdue vacation, some are questioning if their equity portfolios should do the same given the bull market’s 85%+ rally from the March 2020 lows, and due to the historically weak seasonal summer equity performance. The old adage of ‘sell in May and go away’ (defined as the S&P 500’s performance between Memorial Day and Labor Day) has held some truth over longer time periods, with the S&P 500 posting a paltry, below-average return of ~0.9% since 1990; but it has shown to be less prescient in recent years as it has posted an average return of ~2.2% over the last ten years. While the returns have been predominantly positive, volatility has tended to heat up as the S&P 500 has suffered an average 8.6% drawdown since 1990 and at least a 5% pullback ~70% of the time at some point during the summer. Pullbacks should be expected this summer as the index sits less than 1% below its record high and has yet to experience a 5% decline so far this year. However, we would not panic with this uptick in volatility because longer term, our positive view of the equity market remains intact. Six developments that could dictate market direction over the summer include:

- Hope Our Head Is Not In The Clouds With Vaccination Target | Despite the decline in daily vaccinations since mid-April, the US is still on track to achieve its goal of 70% fully inoculated by the end of July—which assumes 1.5 million vaccinations/day. With the economy reopening, the biggest risk remains any vaccine evading variants and the potential need for booster shots.

- Fed May Make Waves With Policy Shifts | Between the Federal Open Market Committee (FOMC) Meetings in June and July, and the Jackson Hole Summit slated for August, the Fed has many opportunities to discuss plans for adjusting policy in light of the recovery. The Fed will have to simultaneously keep inflation fears at bay while beginning the tapering discussion (tapering likely to begin in Q4) to maintain its credibility. We continue to agree with the Fed that inflation is transitory, not persistent.

- Sun May Not Set On Inflation Fears Just Yet | Low inventories and supply chain bottlenecks should ease in the upcoming months to allow inflationary pressures to peak in 3Q and subside by year end. However, near-term inflation increases may further fuel investor fears that it will be prolonged, not transitory. Gasoline prices persistently above $3/gallon pose a risk.

- A Bipartisan Path To Infrastructure Stimulus May Be Scorched | While other measures such as repurposing stimulus funds are being discussed, the lack of a bipartisan agreement may force President Biden to take the route of budget reconciliation to accomplish his infrastructure agenda. From a tax perspective, among other things, we believe the market is pricing in a 25% corporate tax rate and 28% capital gains rate. If it comes in lower, equities should see a short-term rally and vice versa.

- Job Reports Will Feel The Heat | With over 8 million workers still unemployed as a result of the pandemic, the labor market has substantial ground to recover to its pre-virus state. Job report releases, one of which occurs just before the July 4 weekend, may weigh heavily on overall investor sentiment and economic prospects, especially following the disappointing April results. While there are some nuances such as unemployment benefits, child care issues, and a mismatch of skills and available jobs, our economist Scott Brown expects the trend in nonfarm payrolls to be relatively strong, averaging 500k+ in the months ahead.

- 2Q21 Earnings Results Should Shine | The S&P 500’s year-over-year earnings growth is estimated to reach 59% in the 2Q—the best since at least 2002. As was the case during 1Q21 earnings season, elevated expectations are priced into the market, so it will take the continuation of above-average earnings and sales beats (both expected) for further equity upside potential.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.