Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Fed shifted near-term rather than long-term forecasts

- Deadline for bipartisan deal quickly approaching

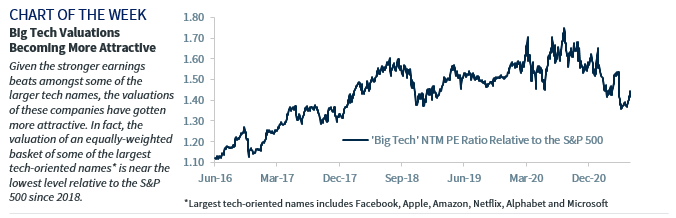

- Strong earnings have made valuations more attractive

Sunday is the summer solstice, the longest day of the year and the beginning of the astronomical summer. The day is thought of as the perfect time of year as Americans get as many as eight additional hours of sunlight relative to the shortest day of the year in December and temperatures are mild relative to the heat and humidity of July and August. However, that perfection does not last long and dissipates as we go through the summer. Similarly, the equity markets are seemingly priced to perfection with both the S&P 500 and NASDAQ hitting record highs this week, and still remaining within reach of all-time highs despite increased volatility surrounding the Fed’s Wednesday meeting. While fundamentals supporting equities are still intact (e.g., low interest rates, solid earnings growth), there are some catalysts that could turn up the volatility heat in the upcoming weeks.

- Fed Commentary Hot Off The Press | At this week’s June Federal Open Market Committee Meeting, the Fed upgraded their 2021 economic growth forecast (to 7.0% from 6.5%), lifted its core inflation target (from 2.2% to 3.0%) and saw the new ‘dot plot’ imply potentially two interest rate hikes in 2023 (versus zero previously). More importantly, the Fed only minimally adjusted its 2022 and 2023 economic projections and kept its longer-run forecasts unchanged. Our interpretation: the Fed right-sized their expectations for this year given the favorable data over the last few months but remains resolute that future economic growth will moderate with the recent inflation surge being viewed as transitory. From a market perspective, better economic growth is a positive for earnings and the commentary by Chairman Powell suggesting that the economy still needs “substantial further progress” before tapering begins should comfort the bond market. As the Chairman acknowledges that the Fed will discuss tapering its bond purchases, there is no set timetable. Potential near-term data points that could alter market expectations include the next jobs report (July 2), CPI (July 13) and the minutes of this meeting (July 7). Our view is that the Fed will begin to taper its bond purchases late this year or early next year and that there will be no change to short-term interest rates until 2023.

- Too Many Hot Buttons For Bipartisan Path | This week, the $1 trillion bipartisan infrastructure proposal was endorsed by 21 Democratic and Republican senators. While the plan purposefully accounts for two of the major sticking points between both parties – no tax increase on either corporations or the top income bracket and the exclusion of clean energy funding to reduce the size of the bill – it will have difficulty capturing enough support from Senators at the polar ends of the political spectrum. With the White House’s deadline for a broadly accepted bipartisan deal quickly approaching next week, the anticipated failure will lead to the Democrats employing the reconciliation process. While increased tax rhetoric headlines may lead to interim volatility, especially with tax increases for corporations and wealthy individuals, the final result will likely be less onerous than the initial proposals. For example, the corporate tax rate, if increased, is likely to be raised to 25%, not 28%, from the current 21% level. And remember, historically, as long as the economy remains strong, modest tax increases do not end the equity bull market.

- Temperatures Rising Between The US & China | Many thought President Biden’s stance toward China would be less aggressive, but his administration is standing firm in protecting US interests. In recent weeks, Biden met with political leaders throughout Europe to ensure our allies will consider a coordinated effort in resolving grievances with China. Add in the potential for the delisting of Chinese companies which fail to comply with auditing standards, the possibility of a pro-Taiwan bill, and the reemerging allegations against the Wuhan lab as the source of COVID-19, and there is reason to assume that China may soon retaliate – a déjà vu scenario for equity investors who experienced the volatility related to the 2019 trade tensions.

- Companies May Catch Heat For Missing Earnings Estimates | The bar for earnings expectations has continually moved higher, with earnings estimates for the S&P 500 rising 14% and 9% for 2021 and 2022 since the start of the year alone. The results from the second quarter are anticipated to be among the best yet given the stage of reopening that most developed countries were able to reach during this quarter, with year-over-year quarterly earnings growth possibly exceeding 60% for the first time since at least 2002. In addition, the continuation of above-average earnings growth has made valuations much more attractive. In fact, the collective price-to-earnings ratio for the largest tech-oriented names (Facebook, Amazon, Apple, Netflix, Alphabet, & Microsoft) is trading at the lowest multiple relative to the S&P 500 since 2018 due to its consistently strong earnings and sales beats.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.