Weekly Investment Strategy

Key Takeaways

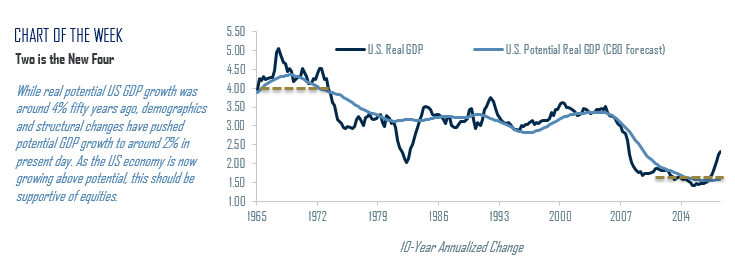

- GDP and Interest Rates Have Fallen Over the Last 50 Years

- People Living Longer is a Positive for Health Care Sector

- Tech Revolution Supportive of Tech and Communication Services Sectors

I made it! I am fortunate to be celebrating my fiftieth birthday this week, joining Jennifer Lopez, Jennifer Aniston, Jack Black, Jay-Z, and Matthew McConaughey who were also born in 1969. As I reflect upon my life thus far, not only have I changed (just a little bit of gray hair!), but there have been demographic, economic and financial market modifications that need to be appreciated and applied to investment strategy.

- Fifty is the New Forty | Back in 1969, the average life expectancy was ~70 years; today it is approaching ~79 years. The added years of life expectancy are a result of enhanced preventive and life sustaining medicines, two long-term reasons why we continue to like the Health Care sector. Other supportive factors include attractive valuations and strong growth prospects for the rest of 2019 and 2020. However, living longer is not without its drawbacks as the longer people ‘tap’ into social security and Medicare, the more fiscally challenged these programs will become.

- Two is the New Four | In the late 1960s and early 1970s, US GDP growth in excess of 4.0% was not an anomaly and was considered a ‘healthy’ growth rate. Today, because of demographics and structural changes to the economy, 2% GDP is considered healthy as the economy grows above its potential (estimated to be +1.9%). Slower growth has been offset somewhat by the increased longevity of economic expansions as the current expansion is the longest (123 months) in US history. We forecast that the US economy will grow by 2.2% in 2019 and 1.7% in 2020. With a low probability of a recession over the next 12 months, risky assets such as equities should continue their ascent (S&P 500 2019 year-end target = 3,071).

- One is the New Seven | The 10-year Treasury yield was ~7% when I was born and peaked around 15% as I became a teenager. However, after that, interest rates and my age have gone in completely opposite directions. Today, the 10-year Treasury yield struggles to shake the 1%-handle to the upside. Weak global growth, trillions of dollars of negative yielding debt, tepid inflation, and aging global demographics will keep interest rates lower for longer. In addition, as global debt from governments, businesses and consumers has increased to record levels, the global economy will have a tough time absorbing higher interest rates (as interest payments increase). Our 2019 year-end 10-year Treasury yield forecast is 1.60%. With rates remaining low and the yield curve relatively flat, we have a neutral view on the Financial sector.

- The Tech Revolution | The industrial revolution has been replaced by a technology revolution. In 1970, manufacturing accounted for ~24% of US economic output, more than double the 2018 contribution of ~11%. During that time, General Electric and General Motors were considered the bellwethers of the US economy while now they collectively only make up 0.5% of the S&P 500 market cap. It was not as if technology was non-existent in 1969 as the first iteration of the internet (called the Advanced Research Projects Agency Network or ARPANET) was created and connected four computers together. However, today, it is estimated that there are ~7 billion internet-connected devices! As the number of users continues to reach record levels and as companies continue to adopt new technologies and replace ‘outdated’ processes, it is no surprise that Technology and Communication Services are two of our favorite sectors. The visibility of the earnings in these two sectors remains healthy and in a world where growth is slowing, strong earnings growth should be valued at a premium.

- Lifting the Shopping ‘Blues’ | The Blue Laws, which restricted shopping on Sundays, were generally in effect in the 60s, 70s and 80s. In addition to most states repealing and relaxing the rules surrounding Blue Laws, e-commerce and expedited delivery essentially allow US consumers to shop anywhere at anytime with just a few clicks! Fifty years ago, department stores were the dominant source of shopping and the leaders of the sector. Today, department stores represent less than 1% of the market cap of the Consumer Discretionary sector whereas internet retailers make up ~35% (up from 5% just 15 years ago.) The US Department of Commerce estimates that consumers spent $514 billion online last year, up 14.2% from the year prior! While brick and mortar stores without an internet presence will likely continue to struggle, we expect companies with strong e-commerce ties to continue to excel.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.