Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- CEOs share insights regarding the strength of the recovery

- Heightened expectations impacting stock price moves

- Cyclical sectors expecting positive earnings growth

Today marks the start of a three day celebration in honor of what would have been John Glenn’s 100th birthday. Between making the first supersonic transcontinental flight, becoming the first American to orbit Earth and the eldest to fly in space at the age of 77, and serving four terms as a US Senator for the state of Ohio, he has a seemingly endless, impressive list of accomplishments. While it may not garner quite as many accolades as the renowned astronaut and politician, this 2Q21 earnings season is set to earn its own long list of records, which should include the best quarter of earnings growth since at least 2002, record revenues, and record earnings growth for some sectors. The results may be worthy of a celebration, but as the economy and earnings complete their launch from the COVID-induced lows, it’s important to realize that results such as these may come once in a blue moon.

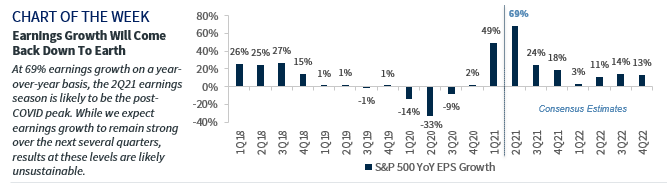

- Bottom Line—Earnings Expectations Will Come Back Down To Earth | Since the start of the year, 2021 consensus earnings estimates have already been revised 16% higher and could be revised up another 5% (for a total of ~21%) if our estimate of $200 shows prescient. These figures are substantial on a standalone basis, but even more when considering that earnings are historically revised down ~4% through mid-year. This untraditional earnings revision path has been supported by a record number of companies beating both their sales and earnings estimates. More important, the magnitude of the earnings ‘beats’ has smashed previous regards consistently over the last year. In fact, the average aggregate beat rate over the last four quarters—~20%—is more than 3x larger than the previous 40-quarter average of ~6.0%. These better than expected results are attributable to the surprising resiliency of the US economy; however, as the reopening is fully realized, much of the uncertainty clouding analysts’ estimates will subside and so will the magnitude of the earnings beats. While we expect this earnings quarter will be the post-COVID peak (+69% YOY), there are still some developments to monitor in the upcoming weeks:

- CEO Commentary Will Be Our Telescope | While we still rely upon key indicators and real-time activity metrics to take the pulse of the economy, earnings seasons provide a quarterly opportunity to analyze the perspectives of CEOs, who are truly on the frontlines of the recovery. This earnings season specifically, post-earnings conference calls give insights regarding the strength of the economy, lingering supply chain disruptions (e.g., shortage of materials, low inventories, delivery days), trends in technological innovation and investment, and the tactics firms are employing to attract workers in an increasingly competitive labor market. Some of the specific statistics shared should offer more clarity and assurance on the macroeconomic backdrop, such as JPMorgan Chase CEO Jamie Dimon sharing that combined credit and debt card spending rose 22% compared to the second quarter of 2019—a time when consumer spending patterns were ‘normal.’ Nike’s earnings were also headline grabbing as the company recorded record revenue in North America, largely driven by online sales, which were up 41% compared to 2Q20 and nearly 150% compared to 2Q19. Even so, it upgraded its sales outlook for the year ahead!

- Investors Won’t Be Over The Moon For Earnings Beats | Investors are becoming accustomed to above-average earnings and sales beats, and we expect the ‘reward’ or upward stock price momentum for a company exceeding estimates will be less pronounced than the ‘punishment’ or magnitude of the stock price decline for a company missing either or both. While only 12% of the S&P 500’s market capitalization has reported thus far, we’ve already witnessed this disparity. For example, while many of the Big Banks (e.g., JPMorgan Chase, Bank of America, CitiGroup, Goldman Sachs, Wells Fargo, & Morgan Stanley) beat earnings estimates, the average price movement in the trading session following the release was -0.2%, largely driven by the realization that these banks can’t release reserves in perpetuity and that net interest margins disappointed.

- Cyclical Sectors Will Shoot For The Stars | The strength of the second quarter earnings season is expected to be broad based, with nine of the eleven S&P 500 sectors experiencing positive earnings growth on a year-over-year basis. However, in the aggregate, the cyclical sectors are positioned to post the best results as the economy surges from the depths of the pandemic-induced shutdowns. The Industrials and Consumer Discretionary sectors, for example, are anticipating quarterly earnings growth of 363% (best on record) and 220% (best since 4Q09) on a YoY basis respectively. While this is favorable extraordinary growth, keep in mind that these two sectors are among the most expensive sectors relative to the S&P 500 (on NTM basis). As a result, this is an example of valuations pricing in elevated expectations and as these earnings grow, valuations will become more reasonable. With confidence of continued healthy earnings growth, we continue to favor both of these sectors.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.