Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Global economy poised for best growth in 80 years

- Pace of U.S. economic growth will steady into year end

- Quality bonds diminish overall portfolio volatility

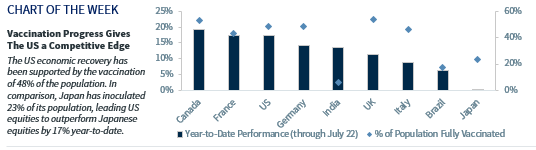

Let the Games begin! The Tokyo Olympics Opening Ceremony was held early this morning, but luckily for those who weren’t out of bed quite yet, the festivities will be re-aired later today! At the beginning of the year, we chose the Olympic Games as the backdrop for our Ten Themes for 2021, titled Seeking the Thrill of Victory, because they symbolized the problems with COVID (e.g., cancellations and/or delays last year) with the hope of a return to normal (i.e., re-opening) this year. While there has been significant progress in the fight against COVID, the current delta-induced rise in COVID-19 cases is casting a shadow on the athletic events as the ceremonies will not be quite as grandiose as ceremonies past, especially with no spectators. With the Games of the XXXII Olympiad underway, we assess the performance of some of our key 2021 themes and give an outlook for the remainder of 2021.

- Global Synchronized Recovery–Rowing In The Same Direction | The combination of unprecedented accommodative monetary and fiscal stimulus and the expectation of the availability of multiple, effective vaccines drove our belief that the global economy, led by the US, would recover in a synchronized fashion. Across the globe, growth has rebounded as most countries are no longer in recession. In fact, with the World Bank’s 5.6% 2021 global GDP estimate, the global economy is poised for its best post-recession annual growth rate in 80 years. While every region is expected to notch positive growth in 2021, there is some dispersion. The best areas of growth are expected to be in the US, UK, and China whereas the rebound in Germany, Italy, and Japan is expected to be less robust. Overall, we expect the global economy to remain robust, with the assumption that new variants of COVID do not cause widespread shutdowns again.

- US Economic Recovery Taking On A Triathlon | We anticipated that the US economic recovery would mirror the stages of a triathlon, defined by transitional periods with varying paces of growth throughout the year. As expected, the first few months of the year were at a ‘swimmers’ pace as the economic data was choppy as new COVID cases surged to almost 300k/day. However, the combination of additional fiscal stimulus, an improving vaccination process, and momentum in companies re-opening led to the US economy pushing the ‘pedal’ to top speed during the spring and early summer (2Q consensus GDP estimate: +9.0%). In the months ahead, pent-up demand for services, a rebuild of depleted inventories, and an improving labor market should help the economy maintain a slower, albeit steadier stride heading into the end of the year (2H consensus GDP estimate: +6.0%) and 2022 (consensus GDP estimate: +4.0%). Admittedly, the rebound in economic growth has been faster than expected as our economist and the consensus have significantly raised their forecasts for 2021 GDP. The consensus GDP forecast, for example, has been raised 2.6% (to +6.6%) since the beginning of the year. With heightened levels of transmission (i.e., delta nearly ~230% more transmissible than the original strains), COVID variants still pose the greatest risk to this outlook. However, given that the most at-risk age brackets have exceeded the 70% vaccination threshold, a dire surge in COVID-deaths is likely to be avoided.

- Fixed Income–Keeping Portfolios En Garde Despite Low Yields | Given our assumption of the strength of the US economic recovery and a modest uptick in inflation, we expected yields to increase from depressed levels but remain below 2% as a result of the Fed’s bond purchasing program and strong foreign demand. While longer-duration bond yields are off of their recent highs, the upward trend in interest rates since the start of the year has hampered fixed income performance. For example, since the beginning of the year, the 10-year Treasury yield and 30-year Treasury yield have risen 36 and 26 basis points, respectively. As a result, they have both seen negative performance YTD (the 10-year Treasury bond down 2.5% and the 30-year Treasury bond down 6.5%). While further upside in yields from current levels will weigh on bond returns going forward, quality bonds help dampen overall portfolio volatility in times of equity market disruptions (e.g., during the depths of the pandemic declines).

- Equity Market–Earnings Will Do The Heavy Lifting | The S&P 500’s positive performance over the prior two years (2019 & 2020) was driven by record-setting P/E expansion, where the price appreciation of the index far outpaced the growth in earnings. As a result, we expected the reverse to occur this year where the price appreciation of the S&P 500 would lag the increase in earnings. As expected, with the S&P 500 up ~17% YTD, its performance has lagged the spectacular earnings growth seen in Q1 (~+50%) and Q2 (~+72%). Accordingly, the S&P 500 P/E (NTM) has receded from 24x late last year to 21.4x currently. Similar to the consensus’ 2021 earnings growth estimates being revised 16% higher YTD, our equity team has raised their estimates and now expect the S&P 500 to have $200 in earnings. Higher earnings estimates lifted our year-end target for the S&P 500 to 4,400.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.