Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Elevated growth expectations an equity market positive

- Fed’s taper timeline won’t be delayed much longer

- Earnings estimates still have further upside potential

The pressure is on for Team USA Basketball as the men hope to capture their fourth consecutive gold medal and the women seek to extend their 50-consecutive Olympic game winning streak! Both teams have faced challenges early in their Olympic journey, but fans remain confident that the all-star rosters will find the cohesion and consistency needed to excel. The biggest lesson for Team USA and investors: You can’t rest on your the laurels (i.e., the past), you need to look to the future. Taking it back to basketball basics, this week investors were faced with their own ‘Triple Threat’—major economic data releases, the biggest week of 2Q earnings season, and the Fed’s July FOMC Meeting. Each had the potential to either steal from the S&P 500’s recent rally or help it score additional points. Our view remains that these three catalysts will be market positives over the long-term:

- US Economy Dribbles Past Pre-COVID GDP Levels | While the 2Q GDP was weaker than consensus estimates (+6.5% versus +8.5% estimate), it was still the second best quarter of economic growth since 2003 and worthy of a celebration. The good news: the US has officially recovered all of the lost economic activity incurred during the COVID-induced recession at a record pace! More important, growth is likely to continue for two reasons. First, 2Q GDP was strong from a demand and spending perspective. What was weak was supply-oriented as the reduction in inventories subtracted over 1.1% alone from GDP. Rebuilding these inventories during the second half of this year will be a tailwind for growth. Second, GDP is backward-looking data, measuring growth from April (a long time ago) through June. Moving forward, our real-time, high frequency data (i.e., withholding taxes, mobility indicators, credit card activity, confidence, etc.) support above-trend growth for the remainder of the year. While Delta COVID variant concerns persist, the fact that ~57% of the population has some level of protection against the virus means that widespread economic lockdowns are unlikely. For these reasons, it is no surprise that the US was one of only a few countries with upward revisions to both 2021 (up 0.6% to +7.0%) and 2022 (up 1.4% to +4.9%) GDP forecasts in the IMF’s updated outlook released this week. While a positive macroeconomic backdrop is favorable for the equity market, expectations for elevated annual economic growth is particularly reassuring. Historically, annualized GDP growth in the 4-8% range has coincided with ~11% annual price return for the S&P 500, with the index posting a positive return ~80% of the time.

- The Fed Passes The Taper Discussion To The Next Meeting | Chairman Powell has tactfully navigated the economy through these unprecedented times and that is why we believe he will be nominated for a second term when the current one expires next February. One of his recent feats has been dialing back the building rhetoric on ‘runaway’ inflation. Since the last Fed meeting in June, the 10-year Treasury yield fell ~30 basis points, inflation breakevens stabilized, and equities rallied ~4%. At this week’s FOMC meeting, he continued to effectively ‘tread water’ without committing the Fed to a timetable in regards to tapering its purchases. While he noted that the economy has made “progress” it was not the “substantial progress” that would have been the code word that the Fed was ready to commit. Remaining in a ‘holding pattern’ allows the Fed to get another round of data that includes ISM reports (next week), an employment report (next Friday) and inflation reports (two weeks). Assuming the data remains robust, this is our base case for monetary policy moving forward: the Fed will lay the foundation for bond tapering at the Jackson Hole Symposium (late August) and formally announce its prerequisites and timetable at the September FOMC meeting. The Fed will then begin tapering its purchases at the end of the year/early next year and finish by the end of 2022. Only when tapering is done do we think the Fed will raise interest rates, which will be in 2023.

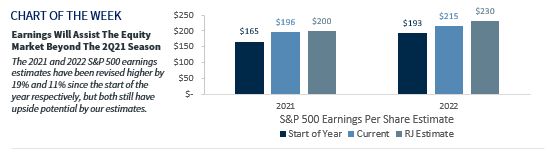

- Earnings Shooting For Their Best Quarter On Record | With 2Q21 earnings season ~73% complete, it is poised to become the best on record, with earnings growth likely to end at ~85%. While the magnitude of beats (18.4%) and percentage of companies beating estimates (88%) is near record levels, few companies have referenced the uptick in the Delta variant negatively impacting their businesses in their forward guidance. While we are reaching ‘peak earnings’ per share growth this quarter, it does not mean that earnings will decline going forward. In fact, forward earnings estimates have been continually revised higher, which is unusual given the historical precedent of a 4-5% downward revision through the first half of the year. So far, 2022 earnings per share estimates have been revised up to $215 from $193 at the start of the year (an 11% increase), yet this figure is still well below our 2022 target of $230. From a full year perspective, S&P 500 earnings per share growth of 45% in 2021 and 15% in 2022 will likely provide the equity market with enough momentum to continue this historic bull market run.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.