Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Consumer behavior resilient through the Delta surge

- Hiring competition has led lower-end wages to grow

- Depleted inventory levels will gradually be rebuilt

Tomorrow is National Dance Day, a day for dancers of all ages to celebrate movement as both a form of exercise and artistic expression. Whether you prefer the two-step or tango, samba or rumba, ballroom or ballet, turn up the music and participate! Looking ahead to the Federal Open Market Committee Meeting next week (September 21-22), we expect Chairman Powell to divulge more details on the Fed’s heavily choreographed plans to ease ultra-accommodative policy. The topic of tapering its quantitative easing bond purchases has taken center stage since the Jackson Hole Symposium last month, but the Fed will likely stick to the same song and dance and defer the official announcement of its plans to the November meeting. Instead, the more important dynamic to observe will be the rhythm of the revisions to the Fed’s own economic growth, unemployment rate, and inflation forecasts.

- Bottom Line—Interpreting The Fed’s Forecast Moves | With this year almost three-quarters over, the market is likely to have a laser focus on the Fed’s quarterly update to its 2022 economic forecasts. If these projections remain consistent with the June estimates, the backdrop for the economy and equity markets will remain very favorable. Why? Assuming the Fed maintains its economic growth of 3.3% for 2022, growth expected next year would be nearly double the growth level generally deemed as a ‘good’ or ‘average’ year of economic growth. If the 2022 unemployment rate (June estimate: 3.8%) and core inflation (June estimate: 2.1%) are relatively unchanged, it would signal that the labor market is expected to edge closer to its pre-COVID levels and that the recent spike in inflation was truly transitory. While there are questions surrounding the above-average growth rate for 2022, multiple undercurrents support this optimistic outlook.

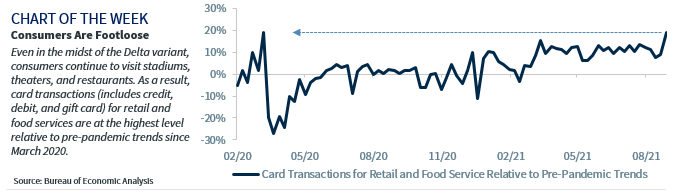

- Real Time Activity Metrics Still Got Their Groove | The peak of the Delta surge has seemingly been reached, and with more than 75% of American adults having received at least one dose of the vaccine, case counts, and hospitalizations are slowly retreating. While variants may emerge as this pandemic transitions to an endemic, real-time activity metrics are no longer being hindered. Just look at the news headlines! The top ten college football stadiums hosted more than 900k fans in a single weekend, Labor Day weekend movie theatre attendance surpassed pre-pandemic figures for the first time, New York’s Broadway reopened, and hotel bookings and restaurant reservations are not nearly as impacted by the virus in comparison to the second and third waves. As a result, card transactions for retail and food services are at the highest level relative to pre-pandemic trends since March 2020. With consumers ‘out and about,’ spending will remain supportive of the economy.

- Labor Market Putting On Its Dancing Shoes | US consumer health is the best it has been in decades, with debt serviceability (e.g., the amount of interest paid on debt) at record lows while net worth is at record highs. Although Federal stimulus checks are starting to dwindle, job creation and the accompanying income should keep disposable income steady. And between the expiration of the federal unemployment benefit (on September 6) and the return to school (which resolves some childcare issues), the record 10+ million job openings that are available should start to be filled. Incidentally, increased hiring competition has led lower-end wages to grow at the fastest pace since 2002 and given that this income bracket has the highest marginal propensity to consume, a gradual, consistent stream of job gains will further support consumer spending.

- Inventories Will Waltz Once Again | For anyone who has shopped lately, it is not uncommon to see barren shelves and limited supply. In recent earnings calls, many CEOs acknowledged that disrupted supply chains and elevated demand levels have hampered inventory levels. In fact, the aggregate inventory to sales ratio is at the lowest level on record, and ~45% of businesses have claimed inventories are too low—nearly the highest percentage on record. But as supply chains normalize as we enter 2022, the essential rebuilding of depleted inventories will be additive to GDP within the next 12 months.

- Capex Dancing On Air | With confidence growing on the economic outlook, businesses are looking ahead to the future. We’ve previously discussed that companies have options when deploying the excess cash on their balance sheets, and according to the NFIB**, capital expenditure plans are at the highest level in two years. Many of these plans include tech-oriented upgrades, with a focus on the digitization of inventories, which seem necessary given the current environment; but the decision to invest in their businesses may also be encouraged by the current tax proposals that might disincentivize buybacks and dividends. Either way, increased business spending should supplement and support above-trend economic growth.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.