Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The Fed exercises patience in policy adjustments yet again

- Government shutdowns have not led to dramatic declines

- Delta variant has not hindered consumer spending

A September Slowdown? The US economy has had its foot on the gas pedal since its sustainable reopening that began this past spring, with economic growth forecasts consistently revised higher amid elevated consumer confidence and improving activity metrics. Given the resilient macroeconomic backdrop, the equity market was full speed ahead as the S&P 500 notched its seventh consecutive month of positive returns in August. With the recovery seemingly on autopilot, investors had become accustomed to living in the fast lane. However, our GPS signaled that congestion may be ahead given the multitude of critical economic, political, and monetary policy events this month. This near-term gridlock should not lead to a premature exit; rather, strong fundamentals suggest that patience will see the economy and equity market regain their speed as we go into 2022.

- Bottom Line—Not Taking The Exit Ramp | Macroeconomic headlines weighed on the equity market earlier this week, but the fundamental factors supporting the continuation of the bull market far outweigh these short-term risks. First, the Federal Reserve (Fed) confirmed our expectation for above-trend economic growth for the year ahead as it raised its 2022 GDP forecast from 3.3% to 3.8%. Second, the streak of above-average earnings growth should continue through next year, with the projection of 15% earnings growth nearly double the average over the last 15 years. Third, equity valuations, albeit high from a historical perspective, remain attractive relative to bonds. And fourth, companies continue to engage in shareholder-friendly actions.

- Fears Fed Would Reroute QE Early | At the Jackson Hole Symposium, Chairman Powell continued to be transparent as he announced that economic conditions warranted the tapering of asset purchases, likely before year end. Investors immediately looked to this week’s September Federal Open Market Committee (FOMC) Meeting for additional guidance and clarity. As expected, the Fed continued to exercise caution due to the Delta variant, and reiterated the delineation between tapering and tightening (e.g., raising interest rates), an incredibly important distinction for markets to embrace. Regardless of whether or not the official tapering announcement comes in November as we have been anticipating (with the first reduction in December), it is important to remember that the current pace of purchases is for emergency-use only, and that the accommodative Fed will continue to be a tailwind even as quantitative easing is dialed back.

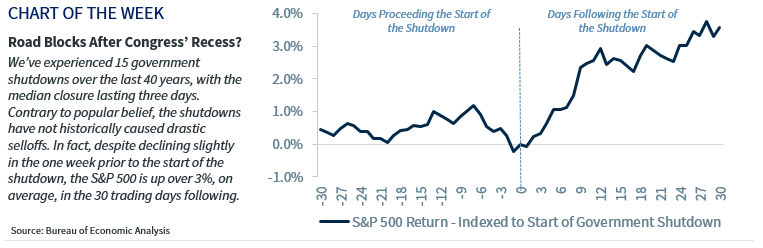

- Road Blocks After Congress’ Recess? | Senate Republicans strongly oppose the Democrats’ proposed legislation that would tie the debt ceiling increase with emergency funding for natural disasters and Afghan refugees. But as partisan as politics have become, we expect cooler heads to prevail and avoid a government shutdown and the first ever debt default. Even still, it is important to dispel the myth that an acrimonious government shutdown would result in a dramatic decline in equities. Since 1980, there have been 15 shutdowns, with the median shutdown lasting a mere three days, and while the S&P 500 declines in the week preceding the closure, the index has rallied over 3%, on average, in the 30 trading days following.

- Delta Variant Detour, Not Dead End | The Delta variant temporarily slowed economic momentum, but limited, if any, shutdowns prevented a repeat of the catastrophic decline experienced last year. While the Fed lowered its 2021 GDP projection for the first time in a year, the economy is still on pace for the best year of growth since 1984 as mobility indicators remain elevated even in the midst of this surge. Pent-up demand throughout the summer and a record back-to-school shopping season should carry into record Halloween and holiday shopping sales—highlighting the power of the US consumer.

- Pullbacks Have Been In The Rearview Mirror | The S&P 500 flirted with its first 5% pullback in more than 10 months earlier this week, which would have ended the second longest stretch over the last 25 years. While the equity market rebounded and quickly erased Monday’s decline, we continue to exercise caution in the near term, especially as we enter the seasonally weakest part of the year (late September – mid October). However, given continued robust economic growth (e.g., no signs of a recession), our bias is to hold existing equity exposure or add opportunistically on weakness. In particular, it is important to avoid panic selling for two key reasons: 1) the seasonally weak period we are currently in is followed by what is seasonally the strongest time of year (mid-October through year end) and 2) it historically takes ~2 months to recover from a 5-10% pullback and ill-timed decisions can be detrimental to a portfolio.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.