Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Delta decline should improve perception of workplace safety

- Declining savings may force some to seek employment

- Technology may be the solution if staffing shortages continue

Jeepers Creepers! It’s hard to believe that Halloween is just days away, and as the month of October comes to a close investors will be anxiously awaiting the release of the jobs report next Friday. There has been some ‘toil and trouble’ in the labor market due to the vast number of jobs available yet an inability to fill the openings. As a result, the cumulative job gains for August and September were substantially below consensus expectations (~430K actual versus ~1.2M expected). But the good news is that the ‘spell’ cast on weak labor force growth should be lifted soon, and the labor market should start giving the economy more ‘treats’ than ‘tricks’ in the months ahead. Below is a list of the developments that should support the labor market improvements and help the economy create at least 300 to 400 thousand jobs, on average, per month over the next year.

- The Economy Is More Delights Than Frights | It’s hard not to get wrapped up in the headlines, especially with the incessant focus on macroeconomic concerns such as the Delta variant, global chip shortage, supply chain disruptions, and commodity costs. While the 3Q21 GDP figure confirmed a slowing of economic momentum, we’re looking forward not backward as we frame our optimistic above-trend growth outlook for the economy heading into 2022. As COVID cases fall further, the perception that it is safe to return to the work place will grow, and the overall strength of economy, particularly for the services sector, will generate job opportunities for those that are ready and willing.

- Labor Market Shouldn’t Be A Ghost Town Amid Return To School | Childcare responsibilities, whether due to virtual learning or daycare closures, has been a common rationale as to why individuals have delayed reentering the workforce. The timing of the Delta variant didn’t alleviate these matters, as the worst of the surge coincided with students returning to school in person for the first time since March 2020. However, a late-September Consensus Bureau Survey noted a ~2.8 million decline (versus June) in the number of respondents citing the care of children not in school or daycare as their explanation for staying home. With the FDA approving vaccines for children ages 5-11, the spread of COVID-19 in schools will likely be mitigated, providing parents with consistency when it comes to school and daycare scheduling, allowing them to start their job search.

- No Longer Bewitched By Federal Benefits | The debate over whether or not federal unemployment benefits (and supplements) disincentivized people from searching for work has become political in nature. While we will leave the validity of this debate to the political pundits, we acknowledge that the excess savings as a result of unprecedented levels of fiscal aid and constrained consumer spending (because of lockdowns) has begun to fade. At its recent peak, the savings rate (as a % of disposable income) reached a record 34%. Since then, with normal activities resuming, it has declined back below 10%. Even though there was not a drastic rush to return to work after the benefits expired on September 6, it is possible that in the months ahead, as savings dwindle further, some individuals may seek employment.

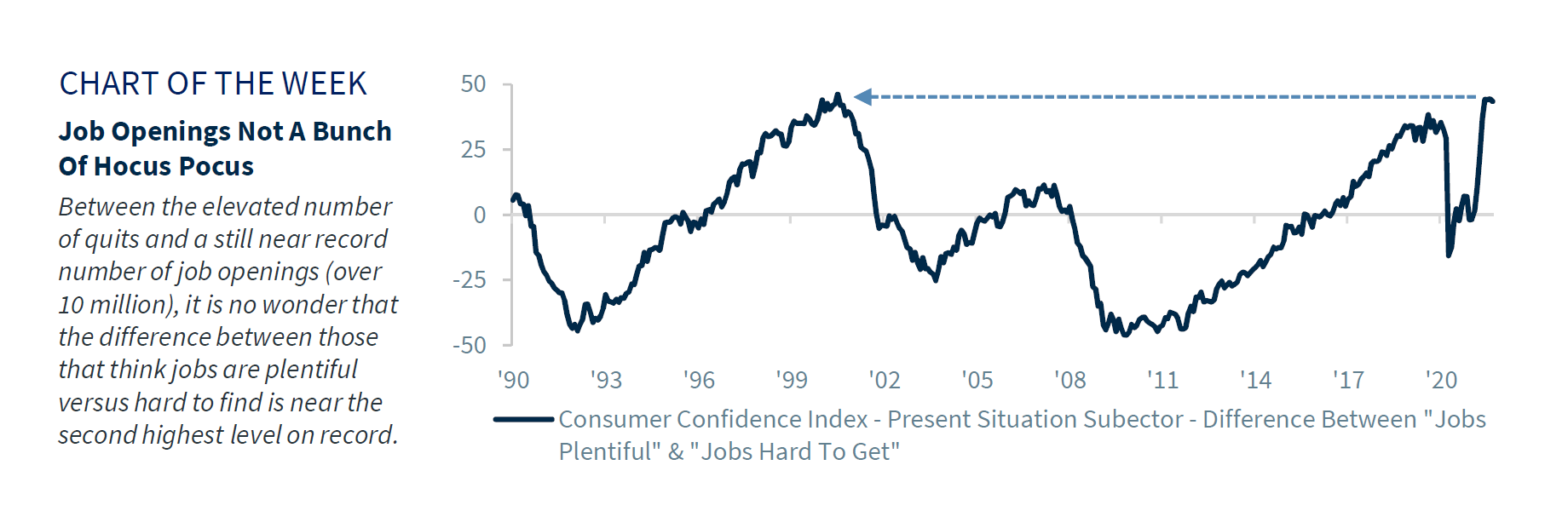

- Job Openings Not A Bunch Of Hocus Pocus | It’s no secret that the labor market shortage has temporarily shifted leverage to employees. Between the elevated number of quits and a still near record number of job openings (over 10 million), it is no wonder that the difference between those that think jobs are plentiful versus hard to find is near the second highest level on record. However, we caution that this could be an inflection point, as companies will not allow operational deficiencies to weigh on their top and bottom line. In fact, many have already noted additional investments in automation and artificial intelligence, particularly in warehouses (e.g., automated forklifts), to resolve the staffing shortages for the long term. So while the level of optimism surrounding the availability of jobs is elevated for now, technological solutions could begin to limit opportunities (think self-checkout, ATMs, and ordering kiosks).

- Recruiting Is Driving Companies Batty | Companies have realized that the competition for labor is fierce and are taking the steps necessary to not only secure their current workforce (e.g., wage increases), but to quickly and successfully recruit new talent. For example, FedEx has offered targeted pay premiums for weekend shifts, increased tuition reimbursement, and sponsored a hiring day; Darden Restaurants allows applicants to apply and schedule an interview in five minutes or less; and Facebook is building its global technical capabilities by hiring people to work remotely. While the solutions are specific to each company, those that are facing a shortage of workers are taking action to attract the help they need.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.