Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Must differentiate between the price level and rate of change

- Spending should soon shift from goods to services

- Many advancements made to the supply chain system

Its National Young Readers Week! Whether your favorite childhood author was C.S. Lewis or Judy Blume, you likely remember the joy of reading your favorite book and turning through the pages of witty rhymes and colorful illustrations. I know for me, the times spent reading with my three daughters will always be some of my fondest memories. As we grow older, we tend to read less for pleasure and more for purpose, and this week’s ‘read’ on inflation was on the ‘reading list’ for policymakers and investors alike. Given the supply chain issues reported by companies across nearly every industry, it is no wonder headline inflation rose to the fastest annual pace since 1990. However, we encourage investors to ‘read between the lines,’ and understand that the meaning of ‘transitory’ should not be left to the imagination.

- Bottom Line: Inflation Will Be A Wrinkle In Time | With conflicting headlines circulating over whether inflation will linger, dissipate, or abate, we’re finding that the time period associated with the word ‘transitory’ is quite relative. We’ve said all along that we expect the inflation surge to peak at some point during the fourth quarter if not early next year, which we define as ‘transitory,’ and then trend lower as we progress further into 2022. We’ve also differentiated between the price level and the rate of change. As far as the price level, we do not think that prices are going to fall; rather the pace of prices moving higher will slow. While the inflationary pressures are arguably more prolonged than any of us would’ve liked, it is unlikely to manifest into a long-term problem. In fact, a long-term hyperinflation environment would have to overcome these disinflationary factors:

- Goodnight Goods | From the depth of the economic decline in 2020, the annualized pace of ‘goods’ spending has increased ~$1.7 trillion—that is larger than the cumulative increase over the last 10 years! With consumers simultaneously buying the same things, at the same time, with supplies limited, prices were naturally expected to move higher. But with spending likely to shift from ‘goods’ to ‘services’ as the economy reopens, pressure on ‘goods’ (e.g., cars, furniture, etc.) should moderate.

- The Chronicles Of Supply Chain Capacity | The West Coast ports have received a lot of negative press, but in reality many advancements have been made to the entire supply chain system. There has been a 20% increase in the container volumes processed at US ports this year, a 20%+ increase in air cargo freight since 2019, and warehouse storage space has increased by the equivalent of 6,000 football fields. Increased productivity and capacity should eventually drive down supply chain costs in the future. In addition, companies are taking matters into their own hands to overcome bottlenecks. Watch for updates on the supply chain and holiday shopping season as Wal-Mart and Target report their respective earnings next week.

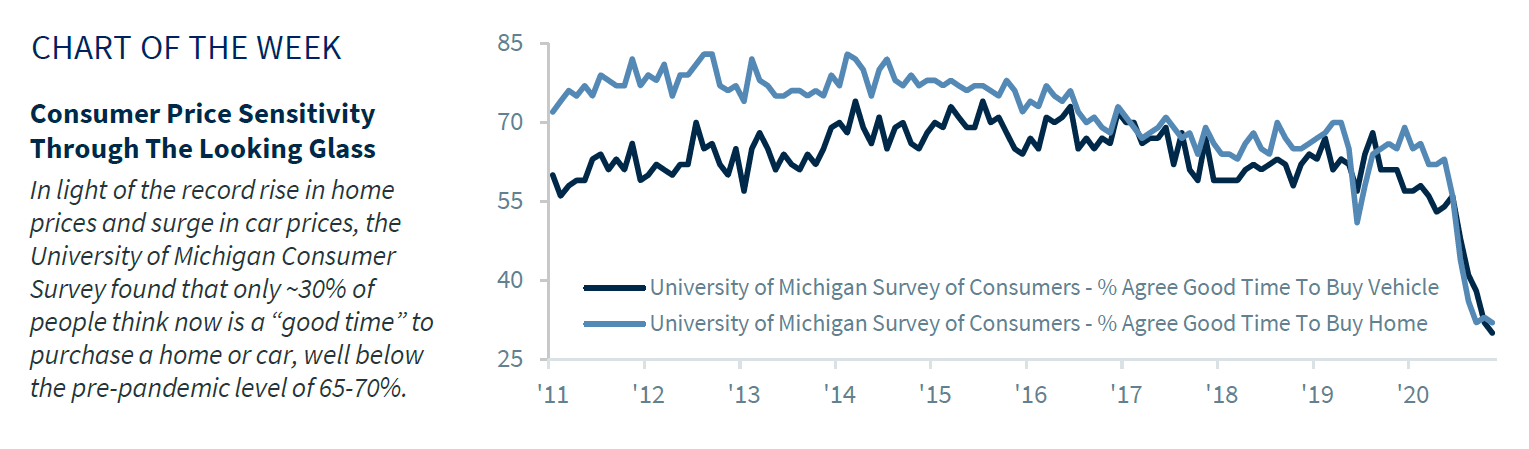

- Consumer Price Sensitivity Through The Looking Glass | The notion of the frugal consumer is real, as consumers are placing a premium on getting a good deal or value. It is why companies market ‘everyday low prices’ and why we have seen a dramatic shift to discount chains and online shopping. This ‘cost consciousness’ is a mentality that will not just fade. In fact, with the recent rise in prices, consumers are starting to balk at the increases. For example, in light of the record rise in home prices and surge in car prices, the University of Michigan Consumer Survey found that only ~30% of people think now is a “good time” to purchase a home or car. This percentage has remained near record lows, and is well below the pre-pandemic level of 65-70%. This cautiousness and frugality is not the psychology that leads to runaway inflation.

- The Globalization Giving Tree | The pandemic will not cease globalization. Even in the midst of the 2019 tariff war, trade volumes increased modestly, and are expected to sequentially rise to a record high in the fourth quarter and in 2022. Increased trade has forced countries and companies to find their competitive advantage, benefitting the lowest cost-producers. While supply chain disruptions and the pandemic may have caused some companies to shift where they conduct business, the priority remains to establish facilities in places that maintain inexpensive labor.

- The Technology Engine That Could | Technological advancement is a price container, and its impact on productivity is unlikely to change. Just compare the 1972 price of the HP 3000 computer to today’s HP 8200: $95,000 versus $290 – a cost reduction of 99% for a machine that is 30 million times more powerful! Not to mention, it is also more portable than the original unit that weighed ~300 pounds! Today’s technology has allowed for the faster processing of transactions, fostered a shift of data storage to the cloud, and permitted more efficient communication between people all over the world! Companies are also turning to technology for cost savings, particularly when it comes to automating certain processes.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.