Weekly Investment Strategy

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Economic momentum will carry into 2022

- Low interest rate environment a positive for equities

- All 11 S&P 500 sectors positive year-to-date

Happy Turkey Day! For many, this will be their first holiday celebration in-person since the pandemic began—something to be thankful for! Thanksgiving is the time to reflect on all we are grateful for, and given the strides the economy and markets have made over the last year, we have a cornucopia of blessings to count! Between the economic expansion and the S&P 500 up ~27% year-to-date, there is quite a long list. Below are our top ten:

- #1: Vaccines & Therapeutics Brought To The Table | While COVID has not been eradicated (yet!), we are grateful for the scientists who developed vaccines and life-saving therapeutics at warp speed and the medical professionals who have administered over 444 million vaccine doses to help achieve a sustainable reopening and transition from the pandemic to the endemic state of the virus.

- #2: Economic Growth Trotting At The Best Pace Since 1984 | A sustainable reopening allowed the US economy to recover all of the economic activity lost during the COVID-induced recession. Our forecast for ~5-6% GDP growth in 2021—which is up sharply from our estimates at the beginning of the year—would mark the best year of growth since 1984. While the Delta variant caused a short-term setback, consumer spending—which represents ~71% of GDP—should accelerate in the months ahead as reflected by real-time activity metrics nearing or at pre-pandemic levels.

- #3: Labor Market Feasting On Job Gains | With a record number of workers ‘quitting’ their jobs, the ‘Great Resignation’ headlines signify the confidence of workers. Overall, the job market remains healthy with an impressive ~6 million jobs added year-to-date and a still record number of job openings (~10.4 million) remaining.

- #4: Harvesting The Best Wage Growth Since 1982 | With the competition for labor growing fierce, companies have rolled out incentives in order to attract workers, which has led to the best wage growth since 1982.

- #5: Record Net Worth Levels The Gravy On Top | Between the current record-breaking equity market rally and substantial home price appreciation (housing prices up ~20% year-over-year), US household net worth has reached peak levels.

- #6: Low Rates The Right Stuff(ing) | While some of the ultra-accommodative policy of the Fed is being removed by the start of tapering its asset purchases, the Fed remains dovish and patient in regard to its rhetoric around raising interest rates. While the economic rebound has caused sovereign yields to rise from historic lows, they remain at historically low levels, especially with real (inflation-adjusted) rates negative. Mortgage rates near 3% remain supportive of the housing market.

- #7: Multi-Year Lows For Spreads As Sweet As Apple Pie | Credit spreads remain near multi-year lows, which has benefitted some sectors, such as high yield (up 4.4% year-to-date). With overall corporate bond yields at historic lows, corporations continue to repair their balance sheets with lower cost debt.

- #8: Doesn’t Get Any Butter Than This Bull Market | Up more than 110% since the March lows of last year, it is no surprise that the current equity market rally is the best start to a bull market on record. In fact, it is outpacing the next best run by ~35%. Historically low volatility, a paltry 5% intra-year decline year-to-date (third lowest in last 40 years) is the cherry on top!

- #9: Earnings Growth Helps Equities Gobble Up New Record Highs | As Q3 earnings season comes to an unofficial end, quarterly earnings growth is up ~40% on a year-over-year basis. While this is below the 92% peak reached in the second quarter, it is still far outpacing the historical average and will help contribute to the best year of earnings growth in at least 20 years. The resiliency of corporate earnings has helped the S&P 500 notch 66 record highs YTD—the most since 1995!

- #10: All Sectors Floating Higher As Energy Leads The Parade | All eleven S&P 500 sectors are in positive territory year-to-date, led by Energy (~56%). While this is only the fifth time that all sectors have been positive at this juncture over the last 15 years, it is the strongest from a magnitude perspective—with the sectors up, on average, ~27%.

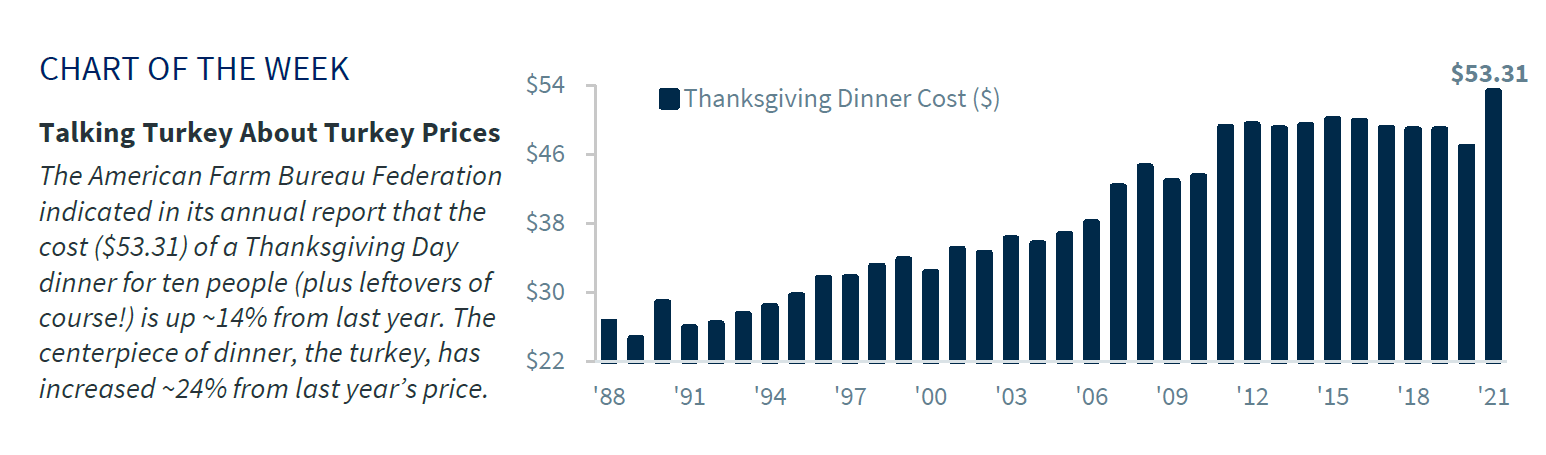

The American Farm Bureau Federation indicated in its annual report that the cost ($53.31) of a Thanksgiving Day dinner for ten people (plus leftovers of course!) is up ~14% from last year.** While our budgets may not be thankful for this pricier feast, I think we are all willing to pay a price to be surrounded by our nearest and dearest for the holiday once again! We wish you and your families a very Happy Thanksgiving, and we hope you have many reasons to be thankful this year and all the years to come.

Due to the Thanksgiving holiday, Weekly Headings will not be published next week, November 26. Have a safe and happy holiday!

** Source: Bloomberg.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.