What Is Your Fixed Income Perspective?

Drew O’neil discusses fixed income market conditions and offers insight for bond investors.

Which fixed income market have you experienced so far in 2022? Or rather, from which perspective have you experienced 2022’s fixed income market? Many characteristics of packaged products and individual bonds differ, meaning that an investor in one might have a different experience than an investor in the other in the same market. If your fixed income allocation consists of total return focused packaged products with no maturity date, it has likely been a rough ride so far this year. As yields have surged higher, prices have fallen sharply, leading to poor total return performance across most of the fixed income landscape. Without a stated maturity date and price, returns are dependent on price movement. When prices fall, performance suffers. Yet, from the perspective of an investor with individual bonds, interim price movement does not have to affect performance. No matter how far the price of bonds that you own fall, if you are holding the bond until maturity: the coupon cash flow doesn’t change, the maturity date doesn’t change, the maturity value doesn’t change, and the income earned doesn’t change.

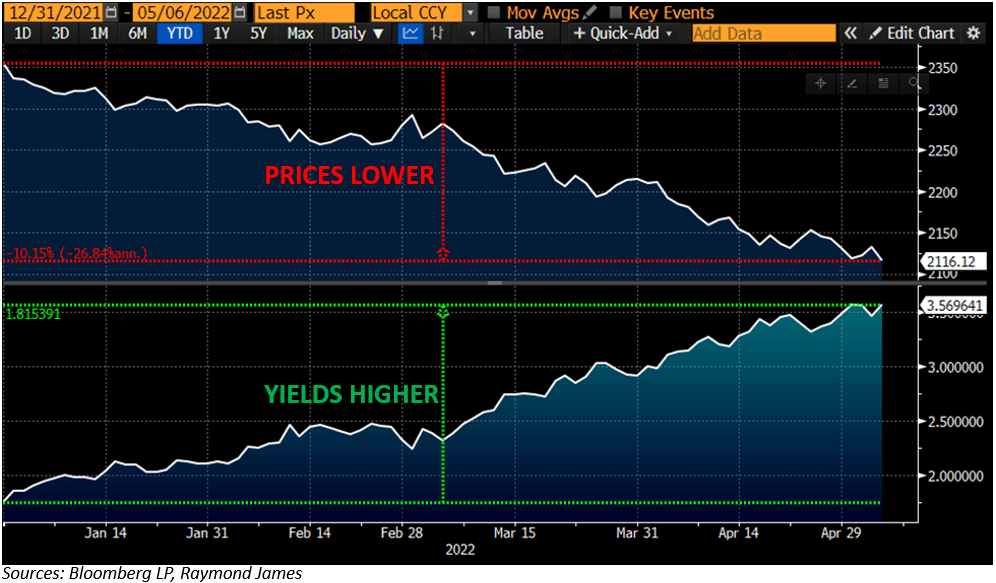

To put a visual on the two very different points of view of the bond market so far this year, the graph above shows the path of two different fixed income data points year-to-date. The index displayed is the Bloomberg US Aggregate Bond Index, which is a broad representation of the fixed income market. The top portion shows price movement. The trend has been steadily lower and shows a year-to-date drop of 10.15%. If your fixed income allocation is focused on total return, this is the bond market you have experienced. The bottom portion of the graph displays the yield-to-worst of the index, which shows the mirror opposite of the top of the graph, as the index yield has increased by 182 basis points so far this year.

The bottom of the graph represents a huge opportunity for fixed income investors. The increase in yields (using the index as a representation) means that an investor is now able to purchase a portfolio of bonds that will earn them ~3.57%, whereas at the beginning of the year, that same portfolio would have only yielded 1.75%. The opportunity has doubled. Across nearly all fixed income products, yields are available that we haven’t seen in years. 3-year brokered CDs are yielding over 3.00%, there are 5-year investment grade corporates are yielding over 4.00%, 10-year investment-grade corporate bonds are inching towards 5.00%, and intermediate maturity municipal bonds are offering tax-exempt yields north of 3.00%. Opportunities, opportunities, and more opportunities. Yes, yields are higher which means that prices are lower and total return has suffered in 2022. Yet, for investors who have money to invest in individual bonds, now could be an opportune time to lock in yields that we haven’t seen in years. Ask your financial advisor for a proposal that illustrates this today.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.