When You Come to the Fork in the Road, Take It

As expected, the Federal Open Market Committee left short-term interest rates unchanged and indicated that it “will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2% objective.” Senior Fed officials were divided on whether it will be appropriate to lower short-term interest rates by the end of the year, although even those expecting no change felt that the case for easier policy had strengthened. The Fed “will look at everything” in deciding its next move, according to Chair Powell, but the key issue is whether cross- currents, including trade developments and concerns about global growth, will “continue to weigh on the outlook and thus call for additional monetary policy accommodation.” While Powell signaled that the Fed’s July 31 rate decision will be conditional on the information received between now and then, financial market participants heard a different message and are fully factoring in a rate cut.

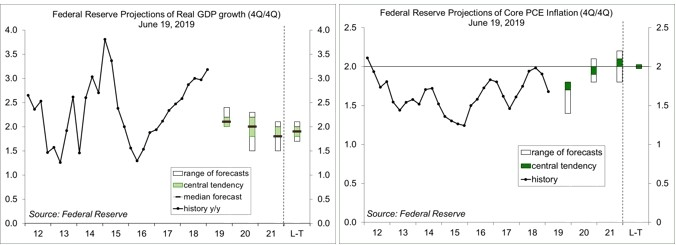

At every other FOMC meeting, senior Fed officials revise their projections of growth, unemployment, and inflation. The median forecast for GDP growth in 2019 remained at 2.1% (4Q19/4Q18), boosted by “a surprisingly strong” 1Q19. However, Powell noted that “the unexpected strength was largely in net exports and inventories – components that are not generally reliable indicators of ongoing momentum.” Consumer spending and business investment are “the more reliable drivers of growth.” Consumption was weak in 1Q19, but appears to have bounced back. However, the available data suggests that “growth in business investment has slowed in 2Q19,” while “manufacturing production has posted declines this year.” While the baseline outlook remains favorable, according to Powell, “many FOMC members cited the investment picture, weaker business sentiment, and cross currents as supporting their judgement that the risk of less favorable outcomes has risen.”

Inflation, as measured by the PCE Price Index, had been close to the Fed’s 2% objective last year, but has decreased this year. Wages are rising, “but not at a pace that would provide much upward impetus to inflation,” according to Powell. Moreover, “weaker global growth may continue to hold down inflation around the world.” The Fed remains firmly committed to its symmetric 2% inflation objective, and officials “are well aware that inflation weakness that persists even in a healthy economy could precipitate a difficult-to-arrest downward drift in longer-run inflation expectations.” Combined with concerns about the downside risks to growth, FOMC meeting participants “expressed concerns about a more sustained shortfall in inflation.”

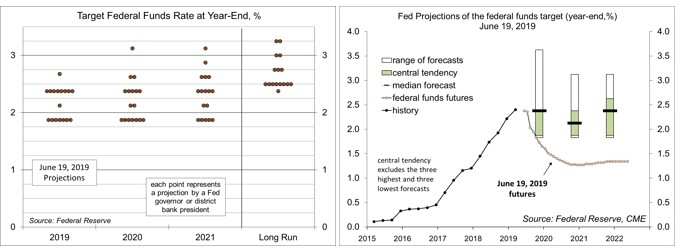

The revised dot plot showed an unusual split among senior Fed officials. Some thought it would be appropriate to leave rates steady through the end of the year, while others anticipate a 50-basis-point reduction. According to Powell:

“Overall, our policy discussions focused on the appropriate response to the uncertain environment. The projections of appropriate policy show that many participants believe that some cut in the federal funds rate will be appropriate in the scenario that they see as most likely. Though some participants wrote down policy cuts and others did not, our deliberations made clear that a number of those who wrote down a flat rate path agree that the case for additional accommodation has strengthened since our May meeting. This added accommodation would support economic activity and inflation’s return to our objective.”

So, while officials are leaning toward a cut, why not move sooner rather than later? Why hold back? Powell answers:

“Uncertainties surrounding the baseline outlook have clearly risen since our last meeting. It is important, however, that monetary policy not overreact to any individual data point or short-term swing in sentiment. Doing so would risk adding even more uncertainty to the outlook. Thus, my colleagues and I will be looking to see whether these uncertainties will continue to weigh on the outlook sustain the expansion.”

The difference in officials’ policy expectations reflects a difference in economic expectations and perceived risks to the growth outlook. Concerns about cross-currents – trade policy and global growth – have risen (at the start of the year) and ebbed (at the May FOMC policy meeting) and risen again (following Trump’s May 10 escalation in trade tariffs against China) – but could just as easily ebb again with possible trade policy developments over the next few weeks. Powell noted in the Q&A that “we want to see and we want to react to developments and trends that are sustained, that are genuine and not react just to data points just to changes in sentiment, which can be volatile.” At the same time, “we’re quite mindful of the risks to the outlook and are prepared to move and use our tools as needed to sustain the expansion.”

Still, trade policy isn’t the Fed’s only consideration. Officials are also concerned about the low trend in inflation and recognize the proximity to the zero-lower-bound on interest rates requires the Fed to be more aggressive in cutting rates if needed (although, in his press conference, Powell noted that officials have not begun a debate about whether to move by 25 or 50 basis points). While the consumer spending outlook remains positive, the softness in business fixed investment might reflect more than concerns about trade policy and global growth – and if business expectations continues to weaken, jobs and the consumer outlook would eventually suffer.

In his press conference, Powell indicated that the Fed’s July 31 policy decision is conditional on the incoming economic information. To their credit, financial market participants did not overly focus on the median of the dots in the dot plat (the median was for no change in rates this year). However, the market is far ahead of the Fed in terms of its policy expectations. Moreover, investors never seem to ask themselves why the Fed would be cutting rates.

Data Recap – The FOMC left rates steady, but signaled a willingness to cut if needed. The federal fund has fully factored in a July 31 rate cut – although Powell indicated that the policy decision will depend on the information received between now and then.

As expected, the Federal Open Market Committee left short-term interest rates unchanged following its two-day policy meeting. In its policy statement, the FOMC removed the language indicating that it would be “patient” in deciding its next policy move. Instead, the FOMC “will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion.” The FOMC recognized that “although growth of household spending appears to have picked up from earlier in the year, indicators of business fixed investment have been soft.” St. Louis Fed President Bullard dissented in favor of a 25-bp cut.

In the Summary of Economic Projections (SEP), senior Fed officials were nearly split evenly in the revised dot plot (seven expected the federal funds rate to be 50 basis points lower at the end of this year, eight expected no change, one saw a 25-bp cut, one saw a 25-bp increase). Projections of growth and unemployment were little changed from March, but the inflation outlook was revised lower.

In his post-meeting press conference, Fed Chair Powell noted that “since our last meeting, the crosscurrents (trade developments and concerns about global growth) have reemerged.” FOMC participants “expressed concerns about a more sustained shortfall of inflation.” He emphasized that “my colleagues and I will be looking to see whether these uncertainties will continue to weigh on the outlook, and we will use our tools as appropriate to sustain the expansion.”

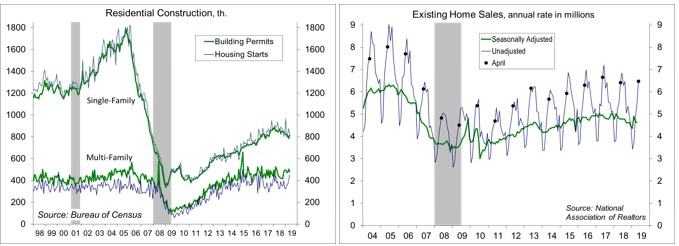

Building Permits edged up 0.3% (±1.3%) in May, to a 1.294 million seasonally adjusted annual rate (-0.5% y/y). Single-family permits rebounded 3.7% (after falling 3.7% in April), down 3.3% from a year ago. Unadjusted single-family permits for March-May fell 5.6% y/y (-7.6% in the Northeast,

-8.2% in the Midwest, -2.5% in the South, and -9.8% in the West). Housing Starts fell 0.9% to a 1.269 million pace (-4.7% y/y), with single-family starts down 6.4% (-12.5% y/y).

Existing Home Sales rose 2.5% to a 5.34 million seasonally adjusted annual rate in May (-1.1% y/y). Unadjusted sales for March to May fell 2.3% from the same three months in 2018.

The Current Account Deficit narrowed to $130.4 billion in 1Q19 (2.5% of GDP), vs. $143.9 billion (2.8% of GDP) in 4Q18. The current account deficit had widened to more than 6% of GDP in 2005, a significant imbalance (in comparison, the current deficit is moderate).

Homebuilder Sentiment slipped to 64 in June, down from 66 in May.

The Index of Leading Economic Indicators was unchanged in May, up just 0.3% since September – a weak trend. Positive contributions for May were led by consumer expectations and the leading credit index. The stock market and the drop in ISM new orders made negative contributions.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.