Will the bond market cooling trend persist?

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Policymakers pour ‘cold water’ on early rate cuts

- Economic data is still likely to ‘chill’

- Watch the quarterly refunding announcement

Hope you are staying warm! This week brought record low temperatures and wind chill advisories across the nation – causing school closures, airport delays, and dangerous travel conditions for millions of Americans. While this should not be surprising given January is traditionally the coldest time of the year, the deep freeze is wreaking havoc for many. The bad news: another artic blast is expected to roll in over the weekend, with temperatures expected to remain below average for much of the U.S. The good news: the cold snap will eventually come to an end. And just like the weather, the bond market is going through its own version of a cold snap, with yields 10-30 basis points higher since the start of the year. Fortunately, like the weather, we do not expect this cooling trend to last. Here’s why:

- Policymakers pour ‘cold water’ on excessive rate cuts | Treasury yields have steadily climbed since the start of the year, with the 10-year Treasury yield rising back to 4.16% after reaching a low of 3.79% in late December. A retracement after the spectacular rally in the final months of the year was expected. If you recall, we flagged in our December 15 Weekly Headings report that Treasury yields were vulnerable to a mild reversal as we were concerned that the market had gotten ahead of itself pricing in six 25 basis point rate cuts in 2024 according to fed funds futures (nearly double the Federal Reserve’s and our projections). We also worried that any signs of economic resilience could weigh on sentiment. Right on cue, the stronger than expected retail sales report and Fed speakers (Waller, in particular) walking back expectations for a near-term rate cut have dented sentiment and pushed yields higher. However, with Fed rate cuts still on the horizon, we doubt yields will move sustainably higher.

- Economic data likely to ‘chill’ | The probability of a recession has eased considerably as economic growth remains more resilient than expected. And, while consensus now expects a soft, non-recessionary landing in 2024, our economist still has the ‘mildest ever’ recession penciled in this year. Why? We expect higher borrowing costs, rising credit card debt and a weaker job market to dampen, but not derail consumer spending. This should drive the economy’s growth rate from a 2.3% pace in 2023 to a below-trend rate of ~1.0% in 2024. It should also drive inflation lower, building a case for less restrictive Fed policy in the coming months. A continuation of this favorable macro backdrop of moderating growth (slowing, but still at a level to avoid a deep recession) and cooling inflation should provide support for the bond market and lead to lower yields in the months ahead.

- Will the quarterly refunding announcement ‘ice’ bond yields? | The U.S. Treasury Quarterly Refunding Announcements (QRA) have garnered a lot of attention in recent months. Given huge deficits, soaring interest servicing costs, and key buyers stepping out of the market, the amount of Treasury issuance has become a concern for markets. Rightfully so, as the Treasury Department issued an enormous amount of supply last year – to the tune of $2.5 trillion. This was one of the key factors that drove 10-year Treasury yields above 5.0% over the summer. Fortunately, the Fed pivot and the Treasury Department’s tilt in issuance toward shorter maturities in the November refunding announcement sparked an everything rally in the final months of 2023. But, with yields nearly 100 basis points lower and government funding needs still significant, the next QRA coming at the end of this month could be a pivotal event for the markets. While the upcoming QRA may not provide the same tailwind to Treasurys that we saw last quarter, we are also not expecting any major surprises and expect issuance to remain weighted to shorter maturities.

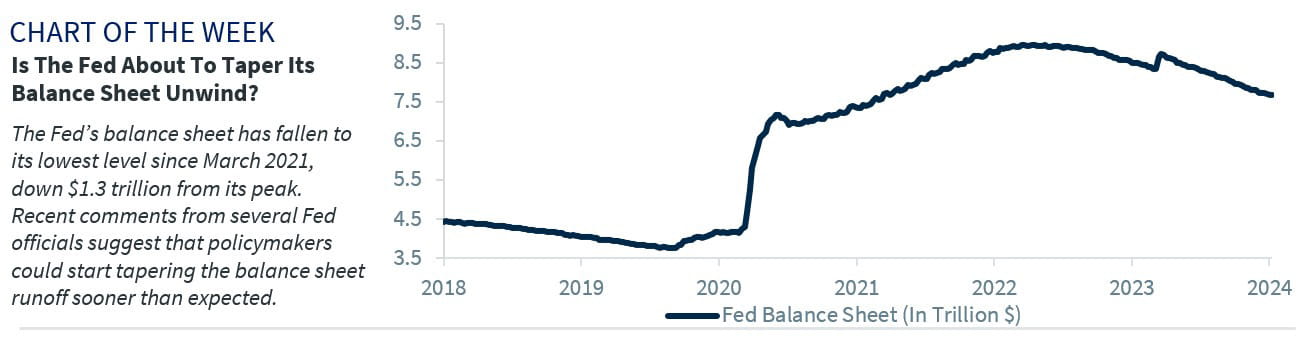

- Is the Fed getting ready to ‘defrost’ the balance sheet? | Treasury issuance is likely to remain elevated for the foreseeable future, however Fed officials (i.e., Logan, Waller) have started discussing when it may be appropriate to slow down the pace of the Fed’s balance sheet runoff. Since quantitative tightening began in June 2022, the Fed’s balance sheet has declined from ~$9T to ~$7.7T. Although no official announcements have been made and the timing remains uncertain, the signaling from officials suggests that a tapering of the Fed’s balance sheet is on the horizon. If the Treasury’s QRA continues to lean toward more short-term issuance, then an earlier than expected taper could be in the cards. This would be welcome news for the bond market. Why? Because it would reduce the amount the Treasury Department needs to borrow from other investors. With the Fed currently reducing its Treasury holdings by $60B/month ($720B/year), any reduction in the Fed’s QT program should alleviate upward pressure on bond yields from increased Treasury supply. This, plus the prospect of Fed rate cuts, should give Treasurys a boost.

Bottom Line | While rates have moved higher to begin the year, it is likely a consolidation period and interest rates should move lower over the next 12 months. From a positioning standpoint, the risk-return framework on the longer end of the curve is better as the 10-year Treasury yield is expected to fall to 3.50% by year end. This should support investment grade bonds, as they benefit from their longer-duration characteristics. Any move above 4.25% represents a good opportunity to lock in attractive yields.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.