Yield Curve Positioning

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

We are in a low interest rate environment. Does this mean you don’t need fixed income? You don’t only if your portfolio’s sole purpose is growth and you have no desire or necessity to conservatively protect any of your accumulated wealth. Investors interested in how to best position their fixed income allocation investments given the current interest rate environment may consider the following:

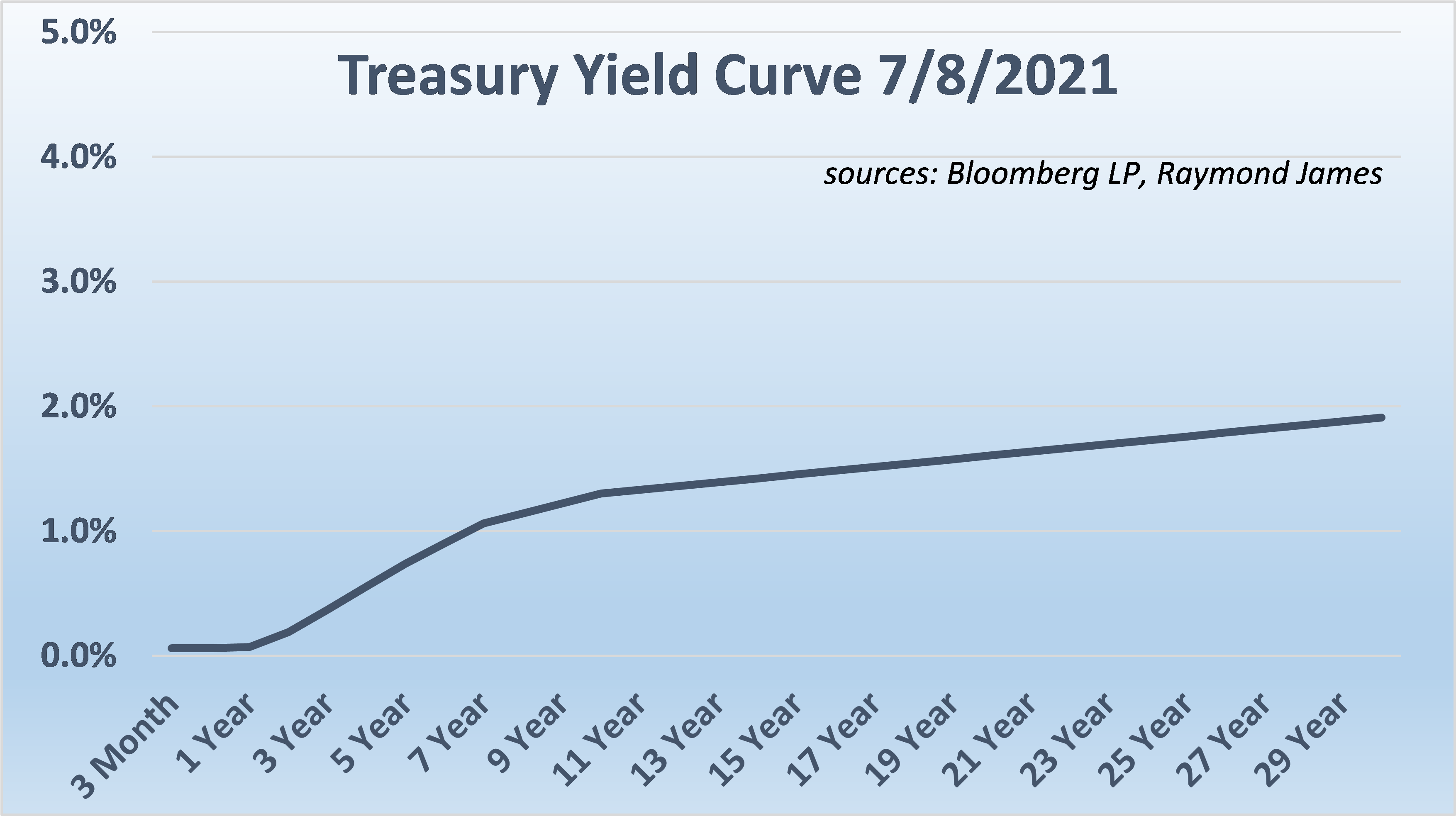

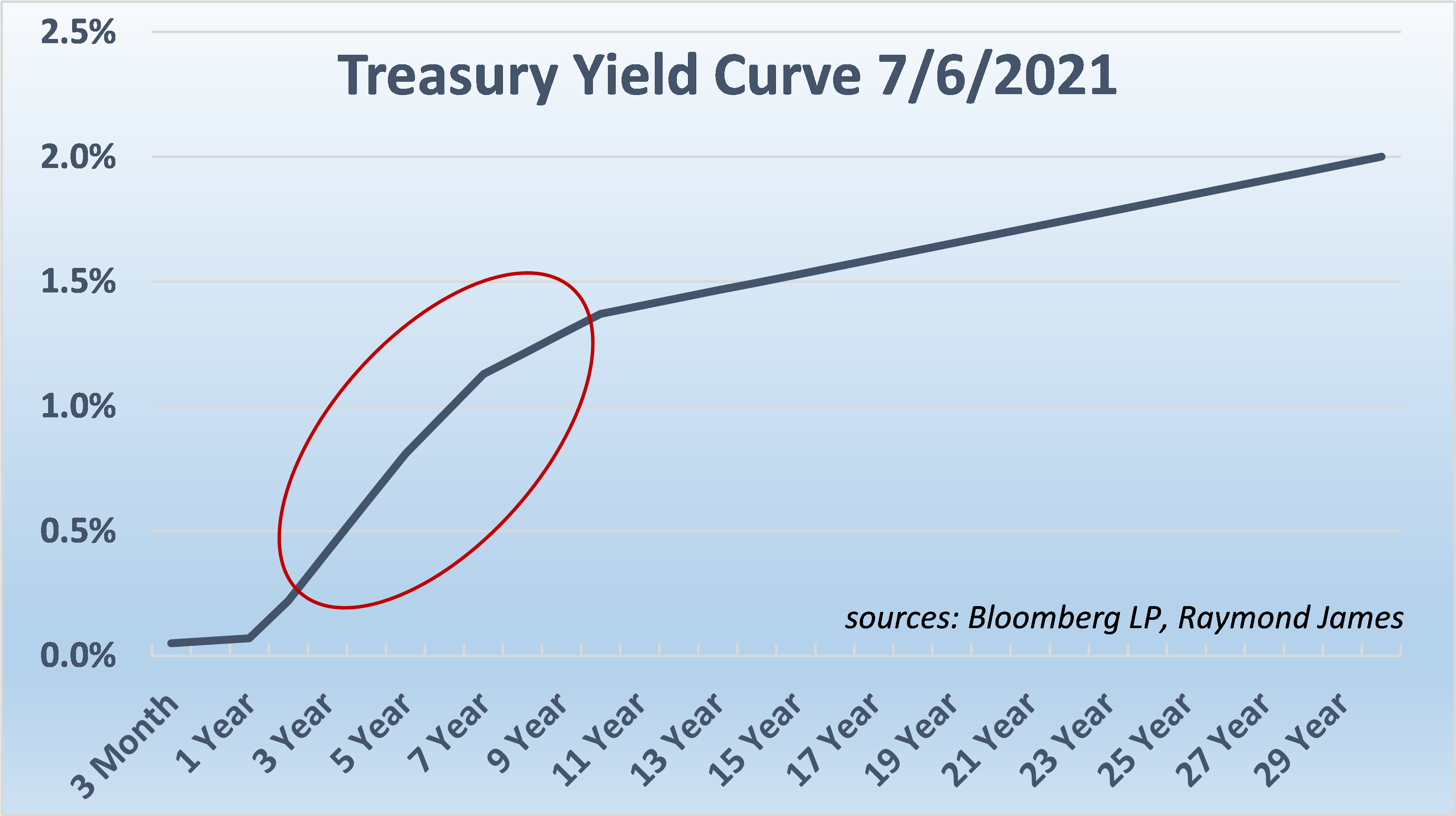

We are not getting paid to take on interest rate risk. The yield curve is very flat ten years and out. The yield pick up for adding duration risk is insignificant as you extend farther out on the curve (see above graph).

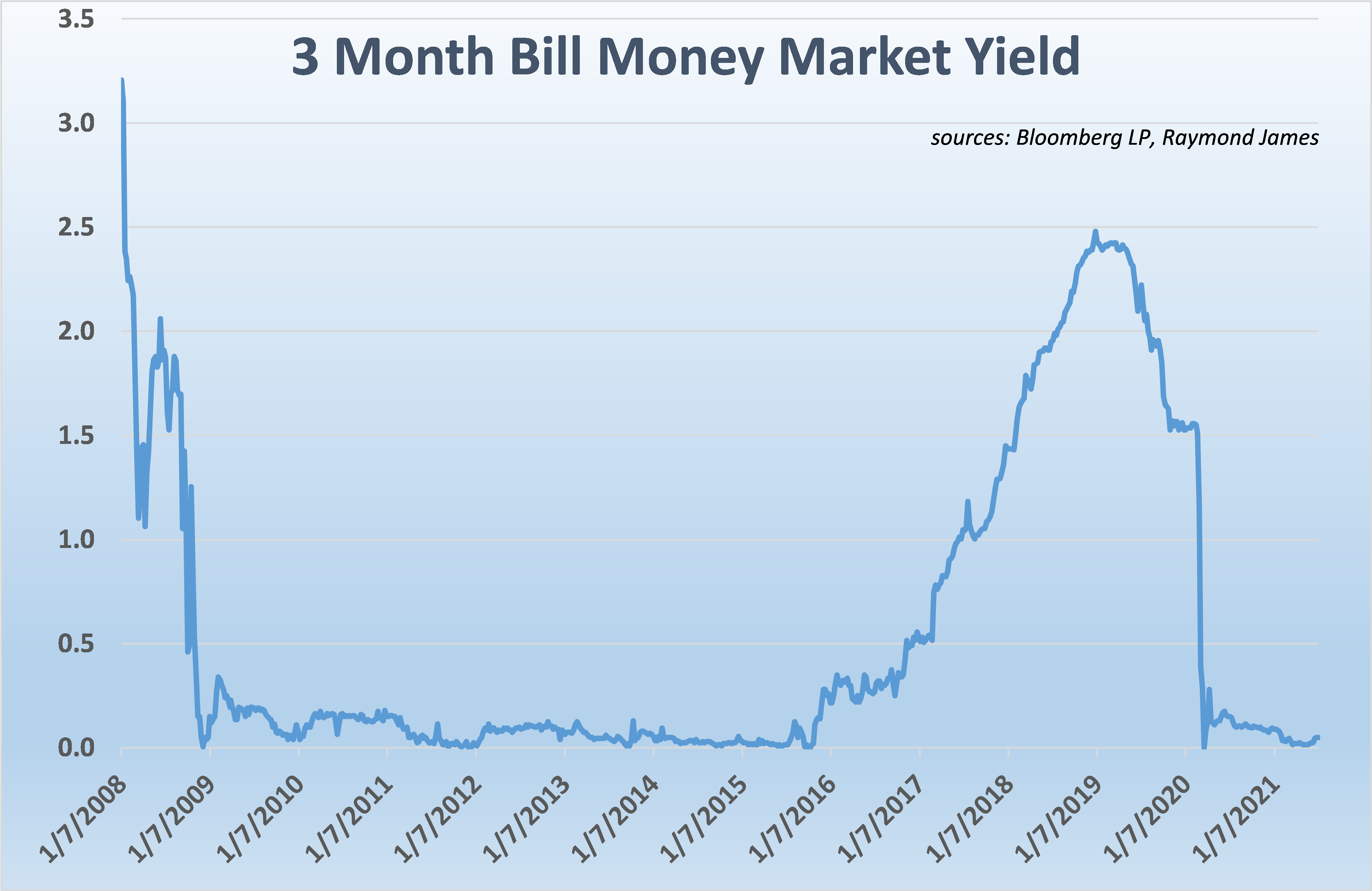

The very short end of the curve is completely flat, idling near a zero interest rate. Having large amounts of cash can cheat earnings and attempting to out-wait the market hoping for higher interest rates may take much longer than anticipated. After the Great Recession, short money market rates settled near zero percent interest for around seven years. In other words, waiting for interest rates to rise can take a very long time while inflicting a huge loss of opportunity. The following graph illustrates how money market rates have remained low for long.

In addition, we also are not getting paid to take on credit risk. Note the following U.S. corporate high yield spread versus the ten year Treasury rate:

Since 2000, ten year high yield spreads have averaged 516bp over Treasuries. During that period, the tightest spread over Treasuries is the 217bp we are currently experiencing. High yield bonds are not offering higher yields (higher reward) that is historically typical of this asset class.

A quick recap:

- We are not getting paid to take extended interest rate risk.

- Money markets and cash are paying virtually zero interest.

- We are not getting paid for credit risk.

Almost by default, the three year to ten year part of the investment-grade curve exhibits the greatest opportunity for return.

Regardless of interest rates, the portfolio’s fixed income will continue to perform its primary goal of protecting hard earned principal. By laddering maturities within the favored yield curve range, you allow your money to be reinvested or at least reevaluated in a very moderate time frame. In essence, it is positioning one self to be ready to take advantage of when the interest rate cycle flips and interest rates do begin to rise. In the interim, the portfolio benefits from what steepness the curve is offering.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.